Have you ever owned a jalopy, a hooptie, a money pit, or an otherwise black hole? At some point you realize your investments are having a diminishing rate of return but you are so far into it that backing out is painful. Admitting to a waste of time, money and effort is never pleasant. The same could be said of Check 21. How can you justify investing billions of dollars in capital, time, effort, development, testing, training and implementation for a volume of work that is declining ever more rapidly and is nearing the precipitous edge of the cliff?

The visualization below may help support the premise.

As the years roll by, FIs will have invested in people, gear, systems, networks, processes, controls and myriad other items getting good and smart about Check 21. All the while the volume of those transactions drops to near zero. For years, the industry has tolled the bell on checks, but thanks to the fine folks at NACHA, Visa, MasterCard, Star, Pulse and others, the bell is now in quadraphonic stereo.

We have all felt the effects that PIN and signature POS, ARC and POP have had on check volume. But have we really seen it? Look at these trends and try to come up with a reason why Congress shouldn’t have just sunsetted checks in 2010 and let businesses and consumers figure out how to get there. You know we could have. Other countries have been without cheques for years. Giving some credit to the urgency 9/11 placed on check handling, Congress was still way behind the curve seeing the electronic shredder killing off the check.

Check Volume

According to the FDIC’s Statistics on Depository Institutions Report, the number of transaction accounts has been hovering at the 600 million mark for the past four years. Using check volume data from the Federal Reserve Board Annual Reports-Operations in Principle Departments, a little Excel trendlining, and rudimentary division, the average number of checks per account has declined by 42% since 2002.

Aching for checks

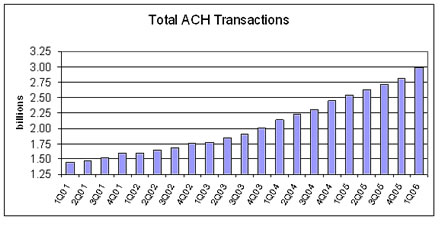

Where have all the good times gone? According to NACHA, the number of ACH transactions processed quarterly has risen 106% in just five years.

This graph is for all ACH transactions. Digging deeper into the numbers really puts the laser dot on the forehead of the check. (Special thanks to NACHA for a fine, free and accessible data repository @ www.nacha.org.)

RCK

RCK transactions are created when a merchant receives a check, tries to deposit it, and it bounces. The merchant can convert the paper check to an RCK entry and try and collect when it thinks there will be money in the account. Something like the Thursday before a Friday and after happy hour but before ladies night.

These RCK transactions leveled off in 2004 and are in a steady decline for a couple of reasons. Consumers aren’t giving merchants as many checks these days. With the explosion of extended overdraft privileges at many FIs, not as many checks are bouncing back to the merchant. And maybe there is even a hint of more consumer fiscal responsibility… … … nah.

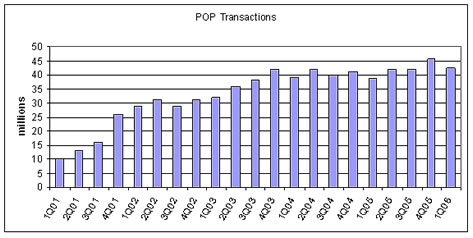

POP

POP transactions occur when you write a check to a merchant, which is then swiped through a MICR reader and popped back in your hand quicker than you can say, “Why’d I waste my time writing that check?”

POP was introduced in September 2000, and merchants were successful in late 2001 and up until the start of 2004 in putting the checks back in the hands of customers. One reason for the increase is that check conversion vendors were successful in signing up new merchants. But for two years now this transaction type has not seen any significant growth. Maybe the vendor sales folks fell asleep, or maybe customers figured out merchants were going to convert their checks anyway so they pulled out their debit cards instead.

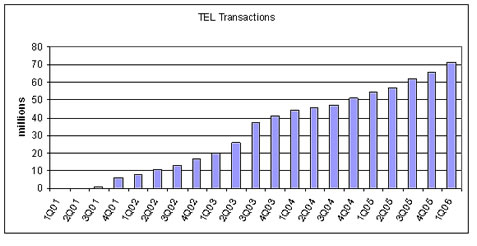

TEL

TEL transactions are initiated when a merchant obtains verbal authorization over the phone from a consumer for a one-time debit to their account. This little gem of an entry hasn’t been around long but has seen an astounding 800% increase in just four years. Immediate gratification is a powerful thing. A TEL transaction enables Jenny to get back to text messaging when she forgets to pay the cell phone bill on time and they shut her lifeline down.

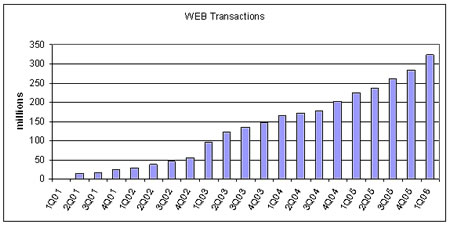

Web entries

We probably don’t even need a chart to show you this. You can probably figure out that anything having to do with the internet is going to show some explosive growth. Think bill pay here. How does a 43,000% increase in five years strike you?

Notice that until now we have been talking about tens of millions of transactions per quarter. Web transactions are into the hundreds of millions per quarter and still climbing. In fact, this quarter’s increase is the largest quarterly increase in three years. Think free bill pay.

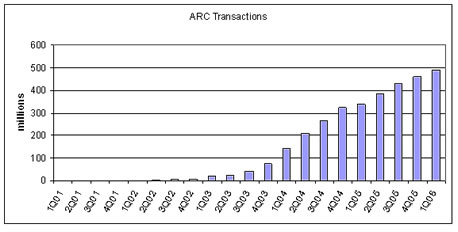

Just in case you need one more piece of data to swing you to the dark side, let’s look at account receivable conversion, otherwise known as ARC. When a credit card payment is mailed off, it’s just about certain it will get converted to an ACH ARC transaction and show up on the statement as another debit instead of a check image. ARC transactions have only been around a short time and have grown 93,000%.

While ARC’s growth rate since its inception in March 2002 is impressive, it is noteworthy that the quarterly growth rate has slowed tremendously in the last year compared to two and three years ago. Several explanations exist for this phenomenon. Consumers are not writing as many checks, consumers are paying bills online and with credit/debit cards, and all of the big merchants/payment processors that are going to get in this game are in.

BOC to the future

Just as with TVs, telephones, VCRs, cell phones and DVDs, as each new ACH entry type is introduced to the market, it is accepted faster and with higher adoption rates than the previous entry type. That is why there is so much excitement buzzing around the latest rules for BOC, or back office conversion. The rules were just recently finalized, and although the ineligible parameters water down the opportunity, expect this new transaction type to take a bite out of your paper inclearing volume. In a nutshell, if a consumer or business (>6”) check is less than $25,000, and if the business check doesn’t have a serial number, and the check is not “special” (HELOC, credit card, FRB, FHLB, etc.), and if the customer hasn’t opted out, THEN the FI’s item processing system can convert it to an ACH transaction and clear it through the ACH network instead of sending it in a physical or image cash letter. Even items received in image cash letters can be converted and processed as ACH transactions if they meet the criteria.

Although the ineligible BOC parameters seriously dilute the potential opportunity, the reasons behind the ineligibility rules are admirable. Turning loan checks into ACH items generally creates exceptions in the back office when it attempts to post to a DDA. Without being able to “see” the item, the research time is increased. Businesses rely on serial numbers to reconcile accounts and take advantage of positive pay systems. But expect the industry to get creative and exploit these new rules.

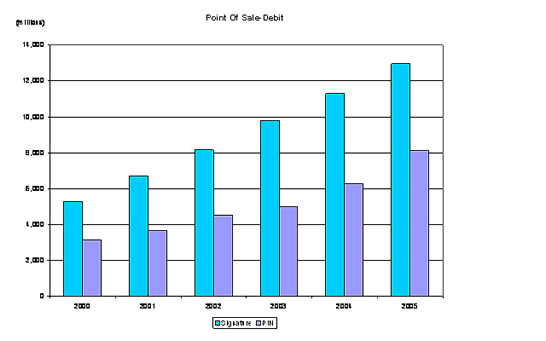

Credit, debit (to-may-to, to-mah-to)

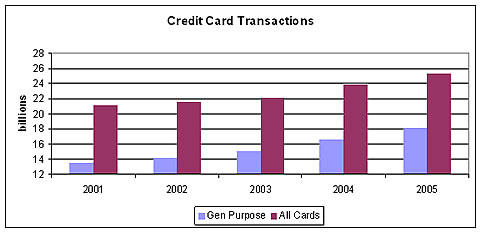

Card transactions continue to have steady increases across the spectrum of transaction types.

As consumers get comfortable reaching into their wallets for a card, it really doesn’t matter what type of card they grab: credit, debit, gift or store. In the old days, you knew when you were putting something on a credit card and that debt-devil on your shoulder whispered bad things in your ear. Nowadays, it’s just a card like any other card. That stigma of “charging it” has been lost in the deck of cards populating most consumers’ wallets. The aggressiveness of card issuers targeting the electronic, willing, Gen-Y market puts credit card use for cheeseburgers in the “no big deal” category. That should come as no surprise as this is the same market for which wearing flip flops to meet the President of the United States is “no big deal.” According to The Nilson Report (Carpenteria, CA), credit card transaction volume growth is outpacing debit card transaction growth.

The average annual growth rate for all credit cards (general purpose, retail, oil, etc.) has more than doubled from 2003 to 2005 as compared to 2001 to 2003.

So what?

All of this has a tremendous impact on your payments strategy, not to mention your income stream. If the thought, “What payments strategy?” just crossed your mind, call Cornerstone, quick! Both sides of your income statement have the potential for serious impact. Declining revenue and increased expenses are painful individually and lethal in tandem. Capital decisions must be made between following the long-term, electronic transaction growth and reaping short-term, item processing efficiencies offered by Check 21. Pricing decisions on paper and electronic transactions must be balanced between customer nickel-and-dime tolerance thresholds. Ancillary products and services like cash management, online bill pay and debit rewards programs must be evaluated for market competitiveness, balance sheet support and income statement ramifications.

With their dying breath, checks are forcing FIs to rethink the most fundamental banking operation—payment processing.

-mc