Famous dictators like Mussolini and Castro always felt that a little top-down direction can be just what the swarming, irrational masses need sometimes. Yeah, democratic principles sound great, but sometimes only a leader can break the gridlock. I was forwarded a leaked internal memo from the Gonzo National Bank penned by famed CEO Joe Takesnames. It seems Mr. Takesnames is a bit frustrated by the passivity of his commercial lending team and the corporate staff. As I read through the memo, I think ol’ Joe has a point. See what you think, Gonzomongers.

———————————————————-

INTEROFFICE MEMORANDUM

October 26, 2007

To:

Lou Johnson – Commercial Banking

J. Douglas – Credit Administration

Betsy Marion – Loan Operations

Terry Smith – I.T.

From: Joe Takesnames

Re: Mad as hell and I’m not going to take it anymore

Since becoming CEO eight years ago, I have heard countless conversations about the need to improve and modernize the way we do commercial lending. In the past three strategic planning sessions with our consultant, Zippy Roth, the management team has emphasized ad nauseam that we want to be the premier commercial bank in our market. Our billboards on the freeway say, “We’re in the Business of Helping Business,” and just last week, we were successful in recruiting another team of commercial lenders from the Bank of Monstrosity for our Southern Region.

Since becoming CEO eight years ago, I have heard countless conversations about the need to improve and modernize the way we do commercial lending. In the past three strategic planning sessions with our consultant, Zippy Roth, the management team has emphasized ad nauseam that we want to be the premier commercial bank in our market. Our billboards on the freeway say, “We’re in the Business of Helping Business,” and just last week, we were successful in recruiting another team of commercial lenders from the Bank of Monstrosity for our Southern Region.

What I would like to know from each of you individually and collectively is why our commercial lending processes are so miserable if Commercial Banking is our primary business focus. Our lenders complain that they spend too much of their time dealing with “dippy” administrative hassles just to get a credit memo ready or a renewal processed. Our Credit Administration group harks about the countless list of exceptions that the front line seems unwilling to take seriously. Our Loan Operations group complains of being abused by loan officers and their assistants who “don’t seem to understand the basic rules of compliance with the garbage they send us.” Our I.T. group says the Commercial area has sufficient technology tools to do their job, the Commercial group calls I.T. a bunch of crazy control freaks.

Somehow, your four departments have come to resemble a band of rival chimps instead of a team of professionals who demonstrate that they care about customers and shareholders.

Every attempt to do something about our commercial processes seems to fail. I remember approving a $350,000 document imaging request in 2005. In 2006, our Process Review from those consultants Dewey, Cheatum & Howe identified many key recommendations, but none were implemented. We’ve talked about automating the commercial process more, but this year’s I.T. budget features teller cash counters, a wireless banking pilot and a Windows Vista “refresh.” What in God’s name does any of this have to do with supporting our commercial strategy? (And what the hell is a “refresh”?)

Because I can’t seem to sort fact from fiction with all the finger pointing, I’ve decided the feel good era is over for now. In the name of progress, I have developed the following simple project plan that I want you to address with the highest level of urgency. Starting today, we will undertake an 18-month intense focus on developing the very best commercial banking processes in our industry. I think our priorities are pretty straightforward:

#1 – Sales and Relationship Management

Our bank has struggled with the business development side of commercial banking. While I understand that there’s a lot of fluff behind the sales culture garbage, there is no doubt we should be out in the market more asking for the business. Starting today, our commercial calling program is a non-negotiable, meaning any deal that closes that didn’t initiate in our calling system will not be eligible for incentive pay. I understand some officers struggle with our intranet calling software and say it’s cumbersome. I am instructing our I.T. department to complete a usability review of the software and ensure that an officer call can be entered in the system in less than five minutes. I want any necessary improvements to make the calling system more usable done in the next 60 days. The I.T. department can plan on giving me a demo of the system when I return from Christmas vacation – I want to see for myself how simple it really it is to use.

In have also instructed our Marketing and Finance departments to move forward with our customer and loan officer profitability software, which will be installed in 2008. We are going to have a two-day meeting in the spring to review the setup of this profitability system and buy into the assumptions and profit calculations. From that point on, no manager will be allowed to complain about the “accuracy” of our cost accounting software – it will be real currency in our organization and integrated into our 2009 officer incentive program. Officers will be paid on growth in profits vs. growth in volumes starting in 2009. Watch the pricing and the fee waivers boys… it’s going to hit your own wallet.

#2 – Loan Approval

In addition to the relationship profitability system, I am approving the expense to complete the implementation of our Web-based commercial loan origination system – $500,000 for 2008. I am making this investment so we can finally automate our commercial processes. Because this task will be challenging, I am asking I.T. to dedicate a full-time business analyst to this project for the next 18 months. I have also asked Jenny Michaels, a star credit administrator, to work full-time with the analyst in sorting out our commercial processes and burning them into this new system. With the implementation of this system, all credit write-ups will electronically flow through the origination system and Credit Administration needs to start conducting electronic loan approvals across our regions by September 30 of next year. You have nine months guys, get moving!

#3 – Loan Processing and Document Preparation

First of all, I am instructing the Marketing department to arrange a special customer service training class for our entire Loan Operation staff – this will be a symbol of the fact that this department must be run as an internal service organization. This department is not here strictly to punish folks for compliance. The recent situation when a loan officer was characterized as a “Gravy Sucking Idiot” by Barbara in Loan Ops was totally inappropriate.

I understand that sloppiness from the front-line certainly does occur. One way I plan to combat this is to professionalize our administrative staff on the front line. I have instructed our HR group to develop a formal “Para-lender” certification program for all of our loan administrative assistants. We will work to raise the skills and professionalism of these team members to make loan officers more productive.

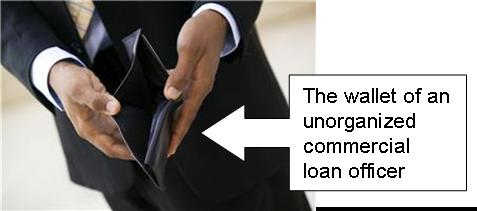

One more thing – 70% of requests for loan documents are coming into the Operations center during the last five days of the month, mostly for renewals. In the spirit of load balancing, I am instructing that $100 be deducted from loan officer quarterly incentive commissions for any loan renewal package requested past the 26th of the month. This should get the team focused on their day planners a bit more.

#4 – Loan Administration

One last investment – I’ve approved the cost to back-file image our commercial loan files – it’s time to pull off this Band-Aid off and move down the road. By the first quarter of next year, all lenders and their assistants will receive training on the imaging system and be given a certification test to ensure they understand how to use the system. I will accompany the I.T. manager to each of our five commercial loan centers in the next month to verify first-hand that the bandwidth and response time for our imaging system is sufficient. After that, mi amigos, no excuses about imaging being slow. We will be completely bar coded and paperless for collateral and credit files by December 2008.

#5 – Service Quality

#5 – Service Quality

We have a lot of work ahead of us and playing nice in the sandbox will be important. Starting in 2008, the HR department will be preparing two internal surveys. One where loan officers rate the level of service from Credit, Operations and I.T., and another where these support groups get to rate the cooperation levels and buy-in to standard procedures from each of our five Commercial Lending regions.

It’s a two-way street here, and 15% of each of your bonuses will now be tied directly to these internal service scores. Koom ba ya, my Lord, koom ba ya… Oh Lord, koom ba ya!

You guys and girls are going to have a great time working together

In this memo, I have agreed to roughly $1.2 million in new capital investments to change the way we do commercial business. This will add almost $300,000 per year to our operating costs. However, our current average loan officer portfolio is only $36 million. I have established a goal of driving this to $55 million in three years. With our strong 12% growth projected in the next five years, we will be able to defer adding 15 commercial loan officers and 6 loan assistants if we hit these productivity targets. These annual savings will eventually total $2.3 million on our original $300,000 expense increase. Not bad, eh?

You see folks, a little determination around process improvement can mean serious dough. I hope now you can see why I got so mad at you all. But shake it off. I will be hosting a party at the club 18 months from now to celebrate our creation of a best practice lending environment.

I personally hope each of you have contributed appropriately to the task at hand and are still employed at Gonzo National Bank to attend one hell of a celebration.

-spw