“The wheel is turning and you can’t slow down

You can’t let go and you can’t hold on

You can’t go back and you can’t stand still

If the thunder don’t get you then the lightning will”

–Robert Hunter, Jerry Garcia, The Wheel

GonzoBankers, it’s time for a multiple choice question! Don’t panic, there are only two choices, so you have a 50/50 chance of being right. My question for you is this:

After your customers visit your Web site, look around your home page briefly searching for your latest news release, log into online banking, slug their way through the multifactor matrix of animal pictures and double dog secret pass phrases, pay a couple of bills, finally log out and go on their merry way…

Which picture do you think best describes the experience they just had?

A.

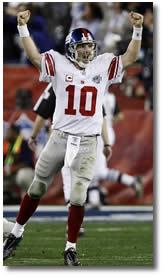

OR

B.

Sorry, Patriot Gonzos, but I just could not resist!

OK, back to the question. How many of you selected “A”? Now be honest!

You May Ask Yourself… How Did We Get Here?

Back in the late ’90s most of our Web sites were created by Marketing or outside agencies staffed with creative types wearing cool spectacles and the latest designer threads. But as online banking took hold, control of banks’ Web sites began to drift into I.T. Now whether Marketing or I.T. is responsible for the Web site makes no difference to me personally; however, it might to an institution’s customers. By nature I.T. folks are just not that creative, and the customer experience is usually not top of mind. Don’t get me wrong here; I.T. is definitely needed to provide much of the behind-the-scenes functionality, but a Web site’s usability and design should never be left to the techies.

As it is now, most bank Web sites need serious makeovers. Don’t believe me? Spend an hour or two looking at financial institution Web sites. What you will see is evidence that over the past 12-18 months, the only activity that took place on many of these sites was the implementation of that industry debacle known as multi-factor authentication. Security departments across the country seem to have commandeered most banking Web sites, and it clearly shows – security and privacy propaganda appear to be what we are selling as products these days.

Is this really the message we’re trying to send?

From Bricks to Cyberspace

Picture for a moment your branch. The “public side” entails all the characteristics that define the physical building – its appearance, its distinction, its accessibility. The branch lobby is also part of the public side. Are product displays prominent? Can customers and potential customers easily locate information about services without having to ask someone? Is the layout of the branch easy to navigate?

While most banks have done a pretty good job of renovating their brick and mortar, the truth is, most customers and/or potential customers don’t go into a branch anymore. (You knew that was coming!) Nope, they type the bank URL into a browser and up pops the home page – the online equivalent of the bank’s “public side.” As someone once said, “You only get one chance to make a first impression.” (I think maybe the Hodgester said that, but then again I might still be hung over from that Super Bowl party.) Does your home page provide the same level of service as your branches?

According to Vox, customer experience can directly affect the bottom line:

What does a bank’s online presence need to evoke this Xanadu-like experience?

This is the point where most of you expect me to begin a lengthy spiel about Web 2.0 functionality and things like wiki’s and blogs; widgets and Active X; .NET frameworks, Ajax programming and Java Beans. Relax, Gonzos, not gonna go techie on you this week.

Usability and Content

Let’s be honest, GonzoBankers. Banks whose online banking home pages don’t wow customers on first experience don’t really need to be concerned with multi-factor stuff and transactional capabilities – because the customers probably won’t make it that far.

Consequently, here is a list of items that should be included on the home page to ensure customers have a good experience and are encouraged to use the online banking capabilities.

Online customers are more demanding than average clientele. Patience is not within their DNA. Fast, informative and easy to use is what they demand of an online banking Web site, and if your site doesn’t provide it, with one click of the mouse they will transfer all their accounts to someone whose site does.

Gonzos, I ask one last time: How do your online customers feel?

Like this?

Or this?

Seriously, folks, I am a Raiders fan and I don’t think we won a game this year.

Until next time,

-tj

A highly competitive landscape demands that financial institutions leverage their IT investments to provide measurable business benefits. Your success relies on infrastructure and systems that align the strategy, people and processes of your organization.

Cornerstone utilizes a six-step approach for Strategic Technology Planning to achieve that alignment.

Visit our Web site or contact us for more information.