“There’s an old story about the person who wished his computer were as easy to use as his telephone. That wish has come true, since I no longer know how to use my telephone.”

–Bjarne Stroustrup

Boy, the whole area of wireless banking – text messaging, alerts, PDA/cell access to Internet banking – is hot. Virtually every bank we talk with is contemplating its strategy in this area, and many have some sort of 2008 investment planned. Bank of America, by recent counts, already has about 1 million customers using its wireless banking services. Everybody is trying to forecast how quickly consumers will adopt this new technology and how it can be used to cement existing relationships and create new ones.

In the middle of all this, though, I’m reminded of what the Wizard of Oz yelled: “Not so fast!” In the middle of all this sexy new technology, the serious heavy lifting of telephone banking is still being done where it has always been done – in the endless (and small) cubicles of the call center and through that somewhat forgotten box called the IVR (or VRU, depending on your age). Looking at some of the numbers recently reported by our Cornerstone Report participants, I was struck by how much of a mainstay IVRs and call centers still are in this virtual day and age. Consider what they reported:

In the middle of all this, though, I’m reminded of what the Wizard of Oz yelled: “Not so fast!” In the middle of all this sexy new technology, the serious heavy lifting of telephone banking is still being done where it has always been done – in the endless (and small) cubicles of the call center and through that somewhat forgotten box called the IVR (or VRU, depending on your age). Looking at some of the numbers recently reported by our Cornerstone Report participants, I was struck by how much of a mainstay IVRs and call centers still are in this virtual day and age. Consider what they reported:

So let’s throw two overall thoughts together. First, Internet and remote (cell phone/PDA) banking will

So let’s throw two overall thoughts together. First, Internet and remote (cell phone/PDA) banking will  continue to grow steadily. Second, our tried-and-true IVR and call center channels will continue to be crucial to delivery and volumes.

continue to grow steadily. Second, our tried-and-true IVR and call center channels will continue to be crucial to delivery and volumes.

The bottom line, citizens of the hamlet of Gonzo, is that we need to pause and think about how these channels will fit together and complement each other in the bank’s overall channel management strategy. I want to look ahead to 2011, three years from now, and suggest six call center and IVR issues/strategies that banks should start talking about in 2008 if they haven’t already.

1. The advent of remote banking could significantly expand, not reduce, the role of the IVR.

The reason? A call from your IVR to a customer with an alert or notification may have several advantages over a text message. First, the call can lead the customer right to the IVR menu for confirmations, transfers and other actions. Second, your IVR tracks every entry made and menu accessed. Third, voice identification could be a very effective tool for customer security. Fourth, voice recognition capabilities can be implemented to allow customers to speak instructions without a massive investment needing to be made – i.e. voice recognition for key phrases can be deployed without the need for full natural language recognition. Fifth, most of the technology is available now.

The implication? At a minimum, banks need to look at overall remote delivery and see where IVR fits. Who knows, that old box in the closet just might become sexy again…

2. The call center will become the “opt out” center.

The reason? At some point, every customer who uses a self-service channel gets in trouble and needs to talk to somebody. And, in most of the customer satisfaction surveys I have read, when online and cell phone/PDA users talk about service, there is one thing they always mention – when they have a problem or want to do something with a live employee, they want the opt-out to be instant and they want to be connected to somebody who knows what they are talking about. No “let me find someone who can answer your question” for them – they are the most impatient bunch we’ll ever see.

The implication? If this is true, banks will need to build the capabilities to provide high-quality support for all self-service channels – Internet, cell, PDA and whatever comes next. This can be an electronic banking group, but in the long run it makes sense that your call center, which gets these types of calls anyway no matter how you plan things, be the dedicated support channel. At a minimum, banks need to determine what role the call center will play in the self-service world and build skills accordingly.

3. Call center employees will need to be “channel experts.”

The reason? If the previous point is true, call centers will need to become more knowledgeable about how these new channels work. They’ll need to understand what customers did on their cell phones prior to a call (screens, steps) and why they did them. They’ll need to know what error messages mean. They’ll need to know how Internet access looks/works on a PDA and a phone. They’ll need to know what people can do and not do through each channel.

The implication? It’s time to expand the knowledge and skill sets of at least some of the call center employees. No cuts to the training budget in 2008-2009. There’s an added bonus, too. Nothing, and I mean nothing, will improve sales, maintain relationships and add “cred” more than a group of employees that are good at this when talking to customers.

4. The call center will have a key role in online loan and deposit opening.

The reason? The call center is a logical place to have people who can do the inevitable follow-up on these transactions – and there will be follow-up needed. There is also a great opportunity to utilize the outbound calling skills many call centers have to cross-sell to customers that might start in a self-service channel. One best practice I have seen lately is having the call center follow up with every online loan applicant to try and cross-sell payment protection/ disability insurance.

The implication? You know that training budget you can’t reduce? Increase it.

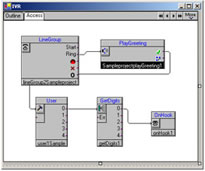

5. To make this happen, improved call routing and will need to have “front and center” status.

The reason? As e-mail, text and chat volumes increase (and they will), there has to be a single enterprise logic to get people to the right call center employee. Most of the call center groups we work with now have one or two employees that handle chat/text, but completely outside of the systems used to route calls. Banks need to build a single routing capability for all channels as part of any future service strategy

The implication? I think, somehow, we just added your PBX into the conversation. Sorry.

6. Enterprise contact management will become crucial.

6. Enterprise contact management will become crucial.

The reason? It’s pretty simple. How will any employee be able to service customers without it? There will be too many points of entry, transactions, messages and problems not to. I always felt that more complex servicing and channel management issues would drive real adoption of enterprise contact management, not sales or PR. This should do it.

The implication? Banks need to get serious about company-wide contact management initiatives and vendors need to get serious about integrating contact management with teller, platform, loan and call center delivery systems so that they are one and the same. And neither group is there yet.

So, to the bottom line. Let’s recognize that our IVR and call center support systems, far from becoming less significant, are in fact integral parts of the new multi-channel world. Everything old is new again. Let’s make sure we know how all the pieces of the multi-channel world fit together.

And, then again, maybe this could happen:

“I rigged my cellular to send a message to my PDA, which is online with my PC, to get it to activate the voicemail, which sends the message to the inbox of my email, which routes it to the PDA, which beams it back to the cellular. Then I realized that my gadgets have a better social life than I do…” –Tom Ostad

-tr