Hey GonzoBankers – Could things get any worse in the financial industry for big banks?

BofA looked like a shining star at the end of last year. Despite a write down of $5.3 billion in its collateralized debt obligation (CDO) portfolio, BofA managed to earn $.05 per share in Q4, a 96% drop in earnings from Q4 2006.

Not only are earnings ugly at big banks, but the employment prognosis doesn’t look much better. In a report released April 1, 2008, Celent predicts that the U.S. commercial banking industry will lose 200,000 of its 2 million jobs over the next 12–18 months – an unprecedented number, historically – and most of those will be at the big banks.

With all of this front page bad news, I wondered if Cornerstone’s mid-size bank clients were taking advantage of this “big banks on their backs opportunity.” Very few “mid-size” banks or “community” banks (under $1 billion in assets) were stung by the subprime crisis. Mid-size banks weren’t heavily weighted in structured investment vehicles (SIVs), CDOs or a lot of other three-letter investment product acronyms that only quant grads from MIT understand. And, most mid-size banks don’t own investment banks, which had an incredibly bad year in 2007. IMHO, mid-size bank should be attacking this environment like a border collie in weave poles at an agility contest.

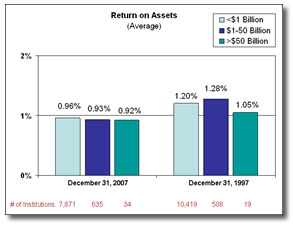

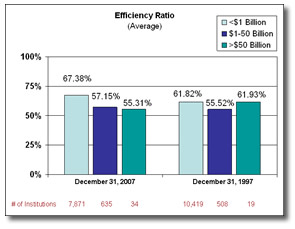

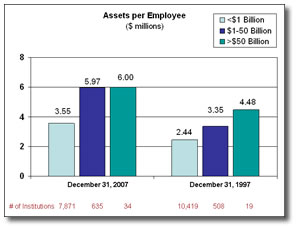

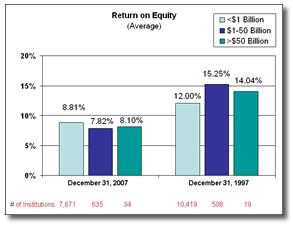

In order to get some perspective on the “is bigger better” question, I took a 10-year snapshot looking at year-end 1997 vs. year-end 2007 for “community” (under $1 billion in assets), “mid-size” ($1–50 billion) and “big” banks ($50 billion+). And to keep this exercise from getting too esoteric, I looked only at some blunt measures – ROA, efficiency ratio, ROE, net interest margin and assets per employee. Below is a summary of the results.

Despite the worst year in a decade for big banks, their ROA remained almost flat from 1997, dropping only 13 basis points from 1.05% to .92%, while mid-size banks had the biggest drop of the three groups dropping 35 basis points from 1.28% in 1997 to .93%. By year end 2007 big banks, mid-size banks and community banks were about equal in their ROA.

The simple fact of the matter is that scale matters when it comes to leveraging people, process, and technology. Over the 10 year period, big banks gained nearly 7% in efficiency falling from 62% to 55%. Hey mid-size banks – what the heck is happening? Over the past 10 years you’ve gotten less efficient, increasing your efficiency ratio from 55% to 57%.

Interestingly, you now match the big banks at $6 million in assets per employee, but you’re not translating a huge gain (in 1997 mid-size banks were at $3.4 million in assets per employee) into bottom line efficiency.

Looking at ROE doesn’t change the picture for mid-size banks either. While you outpaced your big brethren in 1997 by a full 1.2% (15.25% vs. 14.04%) a backbreaking 2007 for big banks seemed to break you even more. The result: big banks finished the year with an 8.1% ROE in comparison to your 7.8%.

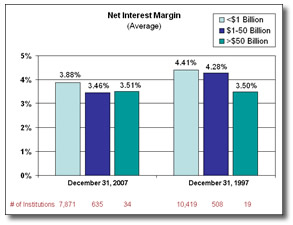

A look at the margin doesn’t improve the mid-size bank picture. Big banks have remained absolutely flat over 10 years enjoying a not so great NIM of 3.5%. Mid-size banks have lost the advantage they used to enjoy dropping from 4.28% in 1997 to 3.46% in 2007.

Source: FDIC

Now I realize this data is just a snapshot that doesn’t trend all relevant information on a quarterly basis for 10 years, but it does raise a fundamental issue: Why are big banks, from a blunt measurement perspective, looking as good as or better than mid-size banks after a horrific 2007?

Lessons for Mid-Size Banks

Are big banks better than mid-size banks? Yes and no. By the numbers, the big banks are kicking tail even in the midst of their worst year in the past decade. But mid-size banks continue to flourish, grow and develop niches in the commercial world big banks can’t touch. As a contrarian, I think now is the perfect time for mid-size banks to look at mortgage, to invest in sales training in the branches to sell consumer loans, and to continue to make smart credit decisions in the commercial/C&I world where the big banks have essentially, in a knee jerk fashion, shut off the credit spigot. Come on, mid-size banks – don’t let those numbers continue to prove me wrong.

All for now.

-SAS