While trawling the blogosphere, we unexpectedly ran across one of our Gonzo-tribe fulfilling his gossip and advice fetish.

Some exchanges were not age-appropriate to reprint, and we’re not sure all of it is sound advice, but here is a sampling. Enjoy.

————————————

Dear Croal Dude, for decades Wall Street and 401Ks have been skimming my deposits. Now that the baby boomers are retiring, how can my bank get our fair share of these rollovers and boost our core deposits? -Jerry Locust, Kansas

Dear Croal Dude, for decades Wall Street and 401Ks have been skimming my deposits. Now that the baby boomers are retiring, how can my bank get our fair share of these rollovers and boost our core deposits? -Jerry Locust, Kansas

CD: Aaah gashoppa….fee-ah monga issa ansa now. As the markets tumble and baby boomers lose billions in their nest eggs, little calculators in their heads are computing how much less per month they have to spend or how much quicker they need to die and still enjoy retirement. Scaring them into your bank can work. Try a tag line like, “Don’t roll your retirement into a subprime IRA,” or “Why let your lump-sum distribution rot before you do,” or “Your bones should turn to dust, not your retirement payout.” Forget about having trained financial advisors in the branches profiling customers, performing needs assessments and becoming trusted financial advisors. You’ve had years to master that, and you ain’t got nowhere, brother. It’s too late now to earn that trust. Buy a chain, lock the doors, pull down the shingle and start selling mattresses and mason jars. Word on the street is that boomers have $1.75 trillion tied up in 401Ks and $301 billion is rolling over in 2008 with an average payout of $334,176. Have you seen BofA’s three page IRA ads? If you are not already executing a plan, call in the dogs and put out the fire, game over.

Dr. Croal Dude, I’m proud to say we have over 200 servers and 1,500 PCs but my users are screaming for Vista and my desktop jocks are cringing. Can you give me some advice on whether we should upgrade from XP now? -Bev Gates (no relation), Florida

Dr. Croal Dude, I’m proud to say we have over 200 servers and 1,500 PCs but my users are screaming for Vista and my desktop jocks are cringing. Can you give me some advice on whether we should upgrade from XP now? -Bev Gates (no relation), Florida

CD: Somebody please tell me why we are even having this conversation! Sure. Being able to hold the Windows key down and press “M” to minimize all applications and then Shift+M to maximize them all is way cool. Plus you get to blow your infrastructure budget on more memory, faster processors and upgrades on those 1,500 PCs for currently working but now incompatible applications. No way, BG. Try these new things called thin client, VM, Citrix, Web applications, SANs. Yeah, it’s cutting edge like an end of season lawn-mower blade. But I’ve heard that at least three shops have been successful in lowering TCO. Better yet, dump Billy-boy for some iMacs. Your marketing department will love you and probably even pony up some of their corporate donation money to fund the swap.

Hey Croal Dude, I needs some s’poat. I bin maken loans fer 25 years. Wit’ nearly fiteen hunert customers and a 20 million dolla book, me and my loan gal stay busier’n all get out. Now dey got dis new fangle automation thing that don’t know nuttin ’bout lending no money. I have to override them there declines just about ever day. Why come dem bidness anlist make me put in da income? And why don’t dat machine know the differnz tween a good 540 and a bad 540? I knowd a bunch a good 540s. Like rat dare. Lookum dem legs. Dat’s a good 540 if’n I ner see one. -Don Trumpt, Mizura

Hey Croal Dude, I needs some s’poat. I bin maken loans fer 25 years. Wit’ nearly fiteen hunert customers and a 20 million dolla book, me and my loan gal stay busier’n all get out. Now dey got dis new fangle automation thing that don’t know nuttin ’bout lending no money. I have to override them there declines just about ever day. Why come dem bidness anlist make me put in da income? And why don’t dat machine know the differnz tween a good 540 and a bad 540? I knowd a bunch a good 540s. Like rat dare. Lookum dem legs. Dat’s a good 540 if’n I ner see one. -Don Trumpt, Mizura

CD: Hey Donald! You are fired!!!! I sympathize with you man. I was once in the same boat. Like when they replaced the window crank with an electric switch. Man did I lose some left shoulder mass when that happened. I know it’s hard on you bro’. Being able to recall an application you did a year ago with the click of a mouse. Having to read a credit bureau report and calculate a debt-to-income online. But process efficiency isn’t the only thing you are struggling with, is it now? Having that credit quality watchdog holding you accountable for all those overrides as your delinquencies rise has got to be a heavy weight on your shoulders. And with your “loan gal” handling the apps and closings for most of the deals, you’ve actually got to get out from behind the desk and earn that high dollar salary drumming up small business and middle market deals. Wait until they spring that CRM tool on you and then cut your base and incent you on portfolio growth. It might be time to oil up the thirty ought six, wake up the blue tick, cash in those options and head for the camp. I don’t see you making it, cousin.

Dear Croal Dude, I love my job. Or at least I used to. In the good old days, I would come in early to sort the mail and have a few cups of coffee with those nice 3rd shift sorter boys on their way out. But they are gone now because of that Check 21 law. Then I’d pick out all the easy maintenance … but lots of it. I’d spend the rest of the day working down that stack. No matter how much or how little work there was, it always kept me busy the whole day. And I only had just a little bit of overtime. Except around the holidays when it always took longer to get the same work done. They don’t run the heat much in the winter and it is always so cold and I don’t work so fast with my sweater on. Now the mail is all gone and it shows up on my computer screen in a thing called a cute. I never know what maintenance is coming next. And my boss (his name is Dave) has all these “productivity” reports that come out of the cutes. It is very stressful now. That new girl, Kamryn with a “K”, thinks she is so smart and so fast because Dave tells her that she gets more done in half a day than I used to in a whole day. Well I told him, of course she can. You should see how she slings that mice-thing around and pecks on that keyboard. I bet they will have to spend a ton of money to buy her a new one because she is just wearing that one out. There’s no telling how many errors she makes. Kamryn took Maybelle’s place. Me and Maybelle used to check each other’s work – every single piece. More on Mondays and less on Fridays. Now nobody is checking. I’m telling you, Mr. Croal Dude, this bank is simply going the wrong way. -Anna Jean Hornswallow, Kentucky

Dear Croal Dude, I love my job. Or at least I used to. In the good old days, I would come in early to sort the mail and have a few cups of coffee with those nice 3rd shift sorter boys on their way out. But they are gone now because of that Check 21 law. Then I’d pick out all the easy maintenance … but lots of it. I’d spend the rest of the day working down that stack. No matter how much or how little work there was, it always kept me busy the whole day. And I only had just a little bit of overtime. Except around the holidays when it always took longer to get the same work done. They don’t run the heat much in the winter and it is always so cold and I don’t work so fast with my sweater on. Now the mail is all gone and it shows up on my computer screen in a thing called a cute. I never know what maintenance is coming next. And my boss (his name is Dave) has all these “productivity” reports that come out of the cutes. It is very stressful now. That new girl, Kamryn with a “K”, thinks she is so smart and so fast because Dave tells her that she gets more done in half a day than I used to in a whole day. Well I told him, of course she can. You should see how she slings that mice-thing around and pecks on that keyboard. I bet they will have to spend a ton of money to buy her a new one because she is just wearing that one out. There’s no telling how many errors she makes. Kamryn took Maybelle’s place. Me and Maybelle used to check each other’s work – every single piece. More on Mondays and less on Fridays. Now nobody is checking. I’m telling you, Mr. Croal Dude, this bank is simply going the wrong way. -Anna Jean Hornswallow, Kentucky

CD: I see a hookup with Donald in your future, Anna Jean. I can’t believe they would do that to a lovely lady such as you. I understand that the bank is growing with all those new free checking accounts. But they should really just hire more people. What do they expect? I know the bank has to make money but really now. What’s more important? Those shareholders that have so much already or the little folks that just need a job that is not so demanding? If that bank doesn’t watch out, more folks like you will decide that being held to unreasonable expectations is simply too much for so little pay. Then what will they do? Do they really think they can find more Kamryns with a “K”?

Dear Croal Dude, based on some criticisms from our recent BSA exam, we have invested (heavily) in an automated BSA/AML program that is anything but automated. While it does take some of the manual steps out of suspect identification and filing, it seems like it is identifying way more suspects than our old manual review process did. So instead of decreasing staff, we actually need to increase staff not only in our compliance department but also in our technical support staff to maintain the system and databases that support it. What is your opinion of these new BSA systems? -Will B. Skeptic, New York

Dear Croal Dude, based on some criticisms from our recent BSA exam, we have invested (heavily) in an automated BSA/AML program that is anything but automated. While it does take some of the manual steps out of suspect identification and filing, it seems like it is identifying way more suspects than our old manual review process did. So instead of decreasing staff, we actually need to increase staff not only in our compliance department but also in our technical support staff to maintain the system and databases that support it. What is your opinion of these new BSA systems? -Will B. Skeptic, New York

CD: We have a saying in the Carolinas that goes something like this … Regulators are like fleas on a hound dog. A few will keep him from gettin’ lazy. Too many will suck the life-blood out. BSA/AML automation is a good thing when your risk profile warrants it. Unfortunately, the smaller the shop, the heavier the burden. In the 2007 Cornerstone Report, banks with fewer than 50,000 accounts have less than half the efficiency of banks with more than 50,000 accounts. We attribute some of this to the compliance requirements of CIP, OFAC, 314a, AML, BSA, et al. The need for automated systems is believed to be a requirement for smaller banks but the efforts from support and administration are nearly the same as for larger banks. Using this technology, which most banks installed around 2005 and 2006 because of the heavy fines the man was handing down, definitely creates more work.

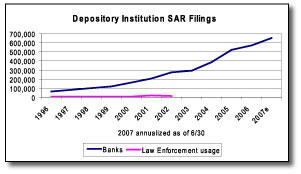

The number of SARs filed by Depository Institutions is steadily climbing while law enforcement usage stayed flat (until Eliot Spitzer increased the number by one). Maybe that’s why FinCen stopped reporting that number. The top category for SAR filings, accounting for 48%, is one that can really only be identified by software, structuring and money laundering. The bottom line is that you can thumb your nose at the feds if you perform a risk assessment and identify yourself as not being in Miami or Los Angeles, and if you have really good procedures on reviewing and following through using existing reports. Skip the automation for now and use a spoon to dig rather than an excavator.

Dear Croal Dude, we are on the tail end of a document imaging project and they won’t let me shred what we have imaged. I still have to organize, box and retain the physical paper. How can I convince the lawyers to get rid of the paper? –Sandy Burglar, D.C.

Dear Croal Dude, we are on the tail end of a document imaging project and they won’t let me shred what we have imaged. I still have to organize, box and retain the physical paper. How can I convince the lawyers to get rid of the paper? –Sandy Burglar, D.C.

CD: Shred fear. The only defense is reverse psychology. Explain to the lawyers that you understand the importance of physical records. Tell them your imaging clerks are low-skilled laborers that you don’t trust making decisions, so synchronizing the destruction schedules of duplicate paper and electronic records will require the legal department to physically review the original paper and printed copies of matching i/wp-content/uploads// and authorize the destruction of both. After about a week, they’ll cave in. Or their desk will. Really now, after the document has been scanned and QA’ed, what possible purpose can keeping the paper serve? It’s bad enough making sure the copies of the i/wp-content/uploads// on the year-end backup tapes are destroyed along with the production image, but adding paper into the mix is just … … … well … … … dumb. Shred it. And when somebody wants the paper, print a copy from the archive at 1200 dpi and give it to them. They’ll never know the difference.

————————————

We hope you have achieved higher levels of insight and awareness from this week’s lofty missive. Direct your Croal Dude questions to Michael Croal here.