“I believe that banking institutions are more dangerous to our liberties than standing armies.”

–Thomas Jefferson

Dear Barney Frank, Ben Bernanke and Henry “Hank” Paulson:

I know you all are quite busy with this financial meltdown, spreading around the new TARP money, non-stop congressional hearings and that little U.S. Presidential election we’ve got tomorrow, but I was hoping I could bend your ear for a minute.

My name is Johnson “Chip” Smith II and I am the President and CEO of the People’s Bank of Pleasantville. We’ve been around in Pleasantville since my granddaddy founded the place in 1938. By sticking to our knitting, we’ve made a go of it and now we’re darn near close to $1.5 billion in total assets.

Now boys, I’m writing you because I’m terrified about what may be coming out of Washington, D.C., soon – I’m just sure it’s going to wreak havoc on my nice little bank.

I guess what concerns me the most is that it seems all banks today are being painted with a single broad brush when the news is bad out there, but when it’s time to talk about how we fix things, we smaller banks are just being ignored by you guys.

You can imagine how strange it felt for me and my fellow community bankers to see the hundreds of billions of dollars lost by the big banks and Wall St. followed by the sheer tenacity and passion that you all showed to pump financial oxygen into them. That must have been one hefty “too big to fail” gun at your heads ’cause you all were scampering like weasels in a woodpile.

Now Ben and Hank, you strike me as well-intentioned, patriotic guys, but you can imagine the indigestion I’m getting with you all sitting so chummy with these same Wall St. and money center bank folks to think about ways to fix the problem. It must be exciting in those smoke-filled rooms with the likes of Chase’s Jamie Dimon, B of A’s Ken Lewis, and Citi’s Vikram Pandit just talking about how the next version of our financial industry might look, but it’s sure starting to feel like a country club where I’m going to end up parking cars.

By the way, my hat goes off to Mr. Dick Kovacevich at Wells for making a stink before you all twisted his arm to take the TARP money. Like me, I think it made him downright angry being painted as part of this mess.

Anyway, you can imagine the panic that’s ensued here on the Main St. of Pleasantville since the financial crisis. Even though my daddy (the Chairman) and I have been conservative lenders our whole lives and we maintain over 9% core capital, we’ve had to answer an awful lot of questions about our “safety and soundness.” You can imagine how tough it’s been watching some of our customers actually move deposits to the big guys out of a feeling of “comfort” – oh brother!

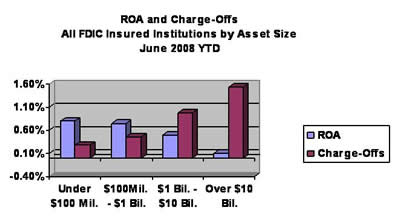

And that, you see, is why I am writing you fine gentlemen. I just wanted to remind you that this here financial crisis seems to have been caused by a certain greed and arrogance and reliance on “sophistication” that we just don’t entertain here in our part of the world. Everywhere in Washington, I hear these cries that we need to consolidate the industry to shore up the balance sheets. I would, however, like to show you a recent summary of financial performance by size in the banking industry.

It’s interesting with all this talk of the need to consolidate into big, grand institutions that loan charge-offs are actually higher the bigger the institution, and the superior profitability levels (ROA) are actually at the smallest institutions. Again, given the sad stories of Countrywide, Bear, Fannie, Freddie, Indy, Lehman, WAMU and Wachovia, I’d love to hear why creating financial mega-powers seems like the best public policy right now? (By the way, my dear brother-in-law who runs the credit union here in Pleasantville wanted to remind you all that their industry ROA year-to-date is .52% with about .70 bps in total charge-offs – better than the big guys. While I like to joke that he’s a “communist” at our family dinners, my brother-in-law has a point that credit unions didn’t create this mess either.)

By the time you all read this, we’ll have a new President of the United States with a clear mandate to reform the financial system. Barney, I have to candidly admit I’m damn scared you’ll be the point man on this whole effort. Ben and Hank – it’s clear that people are expecting both the Fed and the Treasury to make a power play in this regulatory reform and so I’m hoping you might take some of my thoughts to heart as you prepare for the Treasury issuing its regulatory modernization report by April 2009. You may be off fishing by then, Hank, but your fingerprints are sure to be on that modernization report.

My granddaddy always said the most important thing about a business is its integrity – “The only thing they can’t take away,” he used to tell me. So, it seems that any good reform of the financial industry should be based on sound principles like these:

#1: Quit subsidizing bad decisions – It’s amazing to me how Wall St. Bond Daddies and big banks and consumers are all acting like victims during this financial mess. When my wayward cousin the manicurist told me she was buying a $550,000 condo in Henderson, Nevada, with no money down, I knew our country had lost its common sense – now she’s telling me the government had better do something to help her. I just don’t see how a financial system can stay afloat if we promote a line of thinking that people are not responsible for their financial decisions.

#2: Stop pandering to Fannie and Freddie – We’ve spent enough time waxing over the great social benefits that Fannie and Freddie have provided to America while in truth they have put our country’s sovereign credit rating at great risk. I’d like to see us once and for all split up the private sector securitization parts of the GSEs (privatize them) with the direct social subsidies we want to give the less fortunate. Government subsidized greed wrapped up in a “do-good” social policy package is about as awful as things can get.

#3: Punish the bad, but don’t over-regulate the good – Barney, while I know you believe in your heart that regulations protect the little guy, I’m here to tell you first-hand that most of it doesn’t work. Bad guys figure out how to game any regulation or mounds of paperwork, and good guys are forced to document and attest to their natural piety on a monthly basis. All of the great deeds my bank has done around here in the Pleasantville community have had nothing to do with CRA regulations. I’m just terrified that the coming regulations on mortgage licensing and disclosure, card products and checking fees will hurt the solid banks that weren’t soaking the poor consumer with fees and deception in the first place.

#4: Remember that diversification is our strength – Every decade or so in my banking career, the pundits come out from Columbia or Wharton telling me that our banking system is inefficient and needs to look more like Europe or Asia where a handful of banks control the whole country. Boys, it sounds great in academic white papers, but I’d ask you to study a bit of banking history and remember that our decentralized, dual-banking (state and federal) system has its roots in our U.S. Constitution. Since Thomas Jefferson penned the Declaration of Independence, a key strength of our country has been our federalist system and valid fear of concentrated power anywhere. So, when the big boys say it’s time to lift the national deposit market share cap beyond 10%, remember what a few big guys just did to our economy and our country and remember what the very first Americans feared the most! When we think about the need for a “super-regulator” to protect the consumer, remember it was many individual states that raised the red flag on sub-prime and predatory lending long before the folks in Washington ever woke up that this issue was real.

#5: Don’t make us the victims of regulatory infighting – Since I deal with the FDIC, the Fed and the state regulators, I can certainly appreciate the need for some streamlining of our regulatory structure. However, please be realistic that there will be a huge power battle among Fed, OCC, FDIC, OTS, SEC et al. that could make us bankers feel like the kids in an ugly divorce battle. Please anticipate and work to mitigate this natural reaction as you implement any regulatory consolidation.

#6: Remember, it’s okay to make money – Barney, I despise seeing those big Wall St. bonuses and AIG executive boondoggles as much a you do, but I’ve become very worried in recent months how the word “profit” is being equated with some idea of evil committed against the common man. My family has always believed that profits earned fairly and through hard work are the fuel for doing more good things. In college, I remember hearing that profit comes from the Latin word “proficere,” which means to make progress or move forward. Sometimes, Barney, it seems you’d like some regulated system where we all earn fixed civil-servant grade salaries no matter how hard-working or creatively we run our business. Sure, there are some high-profile exceptions out there who took horrible amounts of money from their shareholders and their customers – but let’s not establish compensation micro-management for the vast majority of business leaders who are honest and entrepreneurial.

In summary, boys, I’m hoping in all your high-profile C-SPAN hearings and hob knobbing with all these new financial “celebrities” you remember that it’s the grass roots of our country that has and always will have the power to bring us out of bad times. I’m urging you to think about and protect this nation’s grass roots. I’d like you to think back to that great economist Friedrich A. Hayek who warned, “’Emergencies’ have always been the pretext on which the safeguards of individual liberty have been eroded.” Like many times in our country’s history, we are living through a crisis, but let’s not forget the responsibility that folks like us here in Pleasantville demonstrate when we are given the freedom to pursue our success and do the right thing. You may call me naïve, but I believe most bankers and business folks in general will continue to do the right thing if we have a chance to fairly compete.

My thoughts and prayers are with you as you design the financial system that all of us will live with for the next several decades.

Sincerely,

Johnson “Chip” Smith II

President and CEO