“I don’t want to get any messages saying that we are holding our position. We’re not holding anything. We are advancing constantly and we’re not interested in holding onto anything — except the enemy. We’re going to hold onto him by the nose, and we’re gonna kick him in the ass. We’re gonna kick the hell out of him all the time, and we’re gonna go through him like crap through a goose!” —George C. Scott as Patton

Gonzos, if that snippet from Patton’s speech to his 3rd Army doesn’t get you motivated, you might want to check your pulse. It is speeches like this that many of the Gonzo Nation CEOs need to be giving their staff these days. Why, you ask?

Most of the big banks fell flat on their keisters and went running to the federal government to bail them out. What the big banks didn’t anticipate, however, was the backlash from customers. Consumers figured out pretty quickly that it would be our tax dollars the government would be using to rescue the big banks, and they didn’t hesitate to move their accounts to other institutions. According to American Banker, during the scuffle between Wells Fargo and Citibank over Wachovia, Wachovia lost $1.2 billion in deposits to BB&T.

I personally transferred my accounts from one of the big behemoths to a regional community bank just last week. Admittedly, I struggled with the decision because I knew the arduous task I would face to transfer all my established bill payees, eStatements, direct deposits and ACH drafts. Nevertheless, I took the risk and I am happy to report that within a few hours, everything was as it had always been – just with a different bank. Hell, I barely broke a sweat during the process.

Carpe Diem

My friends, people are willing to change. On Nov. 4, 2008, the United States of America elected the first African-American as the 44th President. That, Gonzos, is the most powerful statement this country could make. Millions of consumers across this country unanimously screamed, “Out with the old, in with the new!”

Community banks across this country can capitalize on the events that have taken place over the past few months. Many in the Gonzo Nation are in pretty good financial shape, and as the big banks dig out of their foxholes, we should go get their customers. Look at what BB&T did in just a few weeks.

Capturing Market Share

Time after time our industry has talked about integrating our remote delivery channels, but very few financial institutions have successfully pulled this off. GonzoBankers, it is possible. Not easy, but absolutely possible—and absolutely necessary. The demands of both existing customers and potential new ones are ever increasing, and the front line workforce must be able to meet these demands, especially when trying to steal customers from the big banks that have put some of these conveniences in place.

Remote Delivery Channels

Gonzo defines remote delivery channels as the following:

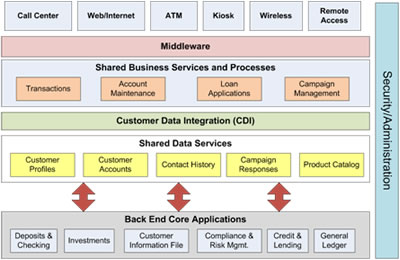

Below is a logical architectural view of a remote delivery channel framework:

A good place to start this journey is by leveraging the following chart and determining the functionalities you currently have and what gaps must be filled in.

|

|

Implemented |

Plan to Implement Within the Next 12mos |

No Plans to Devote Resources in the Foreseeable Future |

| Teller | |||

| Faster customer identification | |||

| Real-time fraud detection | |||

| Integrated compliance reporting, e.g. Currency Transaction Reports (CTRs) and Suspicious Activity Reports (SARs) | |||

| Integration of all ancillary systems | |||

| – Imaging | |||

| – Credit/Debit cards | |||

| Enterprise contact management access | |||

| Simple referral tracking | |||

| Platform | |||

| Straight-through customer account opening (no data re-entry) | |||

| On-demand product information and product selection tools | |||

| Electronic signature and document capture | |||

| Call Center | |||

| Strong skill-based routing tools | |||

| Integration with chat and email | |||

| Enterprise contact management access | |||

| Integration of all ancillary systems | |||

| – Imaging | |||

| – Credit/Debit cards |

For more than a decade, the professionals at Cornerstone Advisors have been helping financial institutions assess the impact of changes in the marketplace to determine how they can best be positioned to successfully and competitively meet industry challenges.

A key component of Cornerstone’s Technology Assessment is an analysis of your organization’s infrastructure, applications, outsourcing relationships and technology support staff.Faced with a radically changed economic environment, we can work with you to evaluate every technology initiative under way in the organization and together devise a strategy for the most effective implementation.

Visit our Web site or contact Cornerstone Advisors for more information.