The only Gonzo Banker function less sexy than enterprise risk management (ERM) is electronic records management (ERM). In fact, those who made it past the title and are this far into the article should give that propeller one more spin and read on. Those inclined to stop here will miss out on ways to:

The only Gonzo Banker function less sexy than enterprise risk management (ERM) is electronic records management (ERM). In fact, those who made it past the title and are this far into the article should give that propeller one more spin and read on. Those inclined to stop here will miss out on ways to:

- Boost compliance;

- Increase effectiveness;

- Drive efficiencies throughout the organization; and

- Build continuity into operations.

Now doesn’t that seem like a worthwhile endeavor?

In our travels we have witnessed numerous attempts by banks of all sizes to eliminate paper. Whether using sophisticated enterprise content management (ECM) solutions or doing it on the cheap with copy-machine scanned PDFs saved on a share drive, a common mistake is too narrow a view of what the goal is. Often a goal or strategy does not even exist. Some department head simply got fed up with paper and waiting for an enterprise strategy so he told his folks, “Start scanning!” While this unit may get a slight, short-term bump in productivity, in the long run the effort is probably wasteful and detrimental to the organization’s records management program. An enterprise content and records management strategy with well defined goals and objectives should always be the first step.

Think about the number of places records exist in an organization. It is really quite a long list. First, there are structured records. These are records stored in transaction systems like the core, loan origination and decisioning systems, bond accounting systems, etc. Other than ensuring access control and that backup and retention plans exist and are functioning, there is not a lot to manage with these structured records. Duh, that is why they are called structured. On the other hand, unstructured records present a much bigger management challenge. Unstructured records exist in filing cabinets, server share drives, desktop and laptop hard drives, smartphones, voicemail, email folders – the list goes on and on. No wonder organizations are scared to try and tackle this. (If yours has, email meyour story and I’ll send you a much sought after Gonzo t-shirt.)

Think about the number of places records exist in an organization. It is really quite a long list. First, there are structured records. These are records stored in transaction systems like the core, loan origination and decisioning systems, bond accounting systems, etc. Other than ensuring access control and that backup and retention plans exist and are functioning, there is not a lot to manage with these structured records. Duh, that is why they are called structured. On the other hand, unstructured records present a much bigger management challenge. Unstructured records exist in filing cabinets, server share drives, desktop and laptop hard drives, smartphones, voicemail, email folders – the list goes on and on. No wonder organizations are scared to try and tackle this. (If yours has, email meyour story and I’ll send you a much sought after Gonzo t-shirt.)

With all of these unstructured repositories, one goal of an ERM program should be to reduce the number of copies of a record to one. “Impossible!” you say. “Not so,” says I. Difficult, yes; impossible, no. Today’s ECM solutions have the ability to replace share drives, integrate with Outlook and SharePoint, and provide a single repository for all of an organization’s unstructured records. The keys to achieving this panacea are:

- Define what the organization considers a record;

- Determine the source of creation or receipt of the record;

- Document the usage or process steps the record follows; and

- Assign the archival, retention and disposition requirements.

Since most of today’s records start out in electronic form (e.g., Word/Excel docs, emails, system generated forms), there is no need to convert them to paper. This common but misguided practice results in inefficiencies and expense, two things Gonzo Bankers abhor. Once a process becomes dependent on paper, its effectiveness goes out the door.

- Paper gets lost (Ever had to ask your customer for something twice?);

- Paper can’t be shared (Do you make copies of paper? Why?);

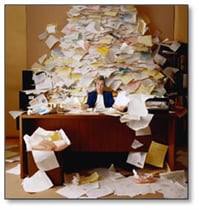

- Paper can’t be found easily (What does your desk – or floor – look like right now?);

- Paper limits a complete picture (Do you know if what you are waiting for is on someone’s desk?);

- Paper can’t tell you who looked at it (Do you require signatures to approve a piece of paper?); and

- Paper is not always accessible (Working late and the loan vault is closed?)

Other unnecessary expenses associated with paper are:

Other unnecessary expenses associated with paper are:

- Storage requirements (Order any filing cabinets lately or looked at your Iron Mountain bill?);

- Handling (Do you have branch check capture but still pay for couriers/overnight to ship paper?); and

- Toner, paper, shredding (It’s insane, spending to create paper so you can incur shredding expense.).

The good news is that we are seeing a crescendo of interest and activity in addressing these issues. The not-so-good news is that we don’t think our Gonzo Bankers are going far enough. Yes, more and more are scanning paper for archive and retention purposes. But few are using the electronic images / records / documents throughout the process workflow, and very few are shredding paper after scanning. We know you can’t shred 100%, but this resistance to shredding will lead to headaches down the road. Trying to manage legal discovery, legal holds and policy-stated destruction of duplicate paper and electronic records is Freddy Kruger all over again. You either have confidence in your electronic records or you don’t. If you don’t, why bother? If you do, why not shred?

Using electronic documents in the workflow is by far the biggest ROI of an ECM/ERM investment. There are so many ways to improve the efficiency and effectiveness of an organization with image-enabled workflow that the only real limitation is desire and creativity. Imagine these scenarios in your organization:

Do you find yourself waiting and wondering if that borrower’s CPA has emailed in the document you requested two months ago?

With workflow, as soon as the updated annual financial statement arrives:

- The outstanding loan exception is automatically cleared;

- The relationship manager is automatically notified; and

- The credit analyst work queue for a new spread request is automatically updated.

Are your branches giving away the bank?

With workflow, when a CSR wants to rebate an NSF fee:

- Other recent rebates are displayed;

- If the amount is between $30 and $60, the relationship manager is notified automatically;

- If the amount is over $60, the relationship manager must electronically approve;

- If the amount is over $200, the division manager must electronically approve.

Losing mortgage refis to Quicken Loans?

With workflow, when a loan payoff quote is requested:

- The request and the quote are stored and retrieved together;

- The relationship manager is automatically notified.

Don’t know if your on-boarding program is working?

With workflow, when a new account is opened:

- The 7 day call to check on the debit card arrival is placed into the CSR’s queue with contact scripts, and tracking and customer comment fields;

- The call results are stored with the new account application and the tracking fields tallied and reported on a monthly basis.

Printing off or viewing 30-page reports looking for four lines?

With workflow, when a report is produced at night:

- Specific line items on the report that meet certain criteria are placed into a queue for action;

- The action results are logged with user/date/time/action stamps.

Printing reports and Excel reconciliation worksheets and keeping a filing cabinet full for SOX?

With workflow:

- The worksheet and report are “stored” together electronically;

- Reports without matching worksheets are automatically escalated;

- The completed pair is automatically put into a work queue for review/concurrence/approval;

- The approval is logged with user/date/time/action stamps;

- Outstanding reviews are automatically escalated after three days;

- The completed pairs are destroyed after five years.

These are but a few of the ways that a well-planned and robust ECM/ERM program with workflow can benefit the bank. If no one is driving this in your organization, you must acknowledge that you are:

These are but a few of the ways that a well-planned and robust ECM/ERM program with workflow can benefit the bank. If no one is driving this in your organization, you must acknowledge that you are:

- Forcing additional FTE on yourself as you grow for non-revenue generating areas;

- Increasing your compliance and audit risks;

- Limiting the speed of your customer service.

Not a legacy to be proud of.

-Croal Dude

MAXIMIZE YOUR EFFICIENCY

Cornerstone’s Imaging and Workflow Automation services are designed to improve your enterprise content management capabilities and turn cumbersome and diverse information repositories into dynamic sources of business insight. You’ll gain:

- Improved sales and service collaboration

- Lower operating costs and increased efficiency

- Minimized time delays and errors resulting from movement of information

- Improved risk and compliance management

- Streamlined fulfillment of front-office to back-office service requests

- Improved overall quality assurance levels

Contact us today to get started on a path to maximum efficiency.