Considering the number of times the term “the customer experience” is used in business circles every day, you would think it was a well-understood concept.

I’ve never understood the term. What is “the customer experience”? Don’t customers have many different types of experiences? Don’t different types of customers have — and need — different types of customer experiences?

In a survey from the CMO Council, senior marketers were asked, “What do you believe are the most important attributes and elements of the customer experience to your customer?”

The responses to the survey question are fraught with inconsistency:

Here’s a question for the marketers who said “fast response times” is important:

How do you think that happens, if not with “knowledgeable staff,” “multiple channels of engagement,” “readily available multi-channel information,” and “multiple touchpoints that add value to the customer?”

I’m still left wondering what exactly “the customer experience” is. My search for a good definition has not been fruitful.

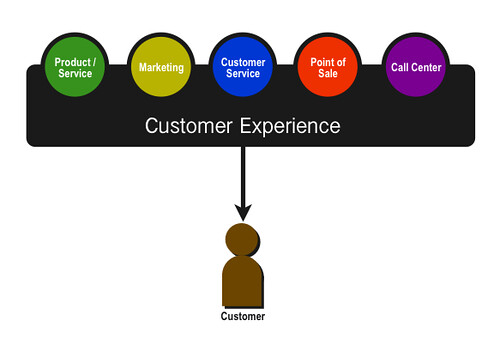

One graphic I found (see above) implies that CX (that’s what the cool kids call customer experience) encompasses the product/service, marketing, customer service, point of sale, and call center. So what doesn’t it include?

Here’s a not particularly helpful definition:

Internal and subjective response? Huh?

One website I found had this to say:

“What does customer experience mean? Defining a great customer experience refers to the complete experience the customer has with your business.”

That doesn’t make any sense. I don’t think that statement is even grammatically correct.

There’s no denying that “the customer experience” is important to business execs, however.

Three-quarters of respondents to a Customer Management IQ survey rated customer experience a “high priority” within their organizations. A blog post on SAP’s website said that “a Bloomberg BusinessWeek survey revealed that delivering a great customer experience has become the new imperative.”

What we’re left with here is:

Brilliant. Simply brilliant.

If that’s not enough to convince you that this CX stuff is a bunch of nonsense, read this from a tech vendor’s blog:

“George Colony, Forrester Research CEO, visited the CMO of a very large bank to provide her with her company’s new Forrester CX Index score. Upon review, she remarked that her next biggest competitor, who spent one-fifth the amount as she did on customer experience, had a better score. George explained that it was likely because the way the two companies approached their customers was vastly different. The CMO asked for evidence and George obliged. After reviewing letters from the CEO to shareholders, he found their competitor used the word ‘customers’ much more often.”

There are three problems with this story:

The Problem With the Customer Experience

The Problem With the Customer ExperienceHere’s the problem, and some of you are not going to like hearing this: This whole “customer experience management” nonsense is a reflection of a desire to simplify the complex, and find a silver bullet — the one thing — that can be done to fix a problem and/or achieve success.

Just fix “the customer experience” and your business will have loyal customers who never complain and buy more and more without you even having to ask them to do so! Sadly, it’s not that easy.

The harsh reality is that you have to take a much more granular approach, and:

What this means: Organizational attempts to create a “chief customer experience officer” are doomed to fail.

What purview would this individual have? What authority would s/he have to change existing processes and functions that are run and led by other executives? How much of a budget would/should this person have, and out of whose existing budget is this money coming from?

And more importantly: Why aren’t the executives currently managing the processes, functions, and department that produce “customer experiences” already improving “the customer experience”?

Ironically (or maybe not ironically), the same mentality that produced the “the customer experience” mentality–the expedient desire for a quick fix–is what produced the rise of a so-called senior executive position to deliver on that quick fix.

Note to CEOs: Are there parts of your firm’s “customer experience” that are broken? Here’s what you should do:

In other words, this isn’t about implementing entirely new applications and systems (which may very well be part of the longer-term plan), but about finding the quick fixes — the changes to workflow, for example — that can make “the customer experience” a little better.

Little changes in the flow (i.e., customer experience) can go a long way to improving customers’ impressions and overall satisfaction. Especially if it’s a process (OK, experience) that they repeatedly engage in.

-rs

Ron, as always, enlightening and entertaining. Would agree with almost all of your points but believe there can be a place for a CXO depending on org structure and complexity – and the ability for execs to play nice in the sandbox without one. Replacing senior management to fix the CX might be cheaper/easier but then again, not everyone who believes in improving CX has the ability to make it happen. Just a thought.

Tim –

Thanks for the comment.

I don’t disagree with you. I chose my words carefully (kind of). I said “doomed to fail,” not “WILL fail.” The position CAN work.

But too often, I think there’s a mindset among CEOs that simply creating the role and filling it with the “right” person will take care of the “problem” (whatever the “problem” might be).

My point is, if your organization is going to create the role, there are a bunch of questions you should address BEFORE doing so.

Ron

I’m a big fan of yours, Ron, and I appreciate your tackling the tough topic of CX, as it is one that I believe is misunderstood in the credit union vertical. What’s surprising to me in this particular post was how dismissive you were of the data from a national survey of CMOs of organizations with more than $500M in annual revenue.

Your rationale for irrational inconsistencies rests on the “cannot choose this if you choose this”; however, the survey requested that respondents choose their top five from a list of options – many of which were worded slightly differently to highlight various aspects of CX. As such, the conclusions you drew threw me off (i.e. not irrational at all). They were not intended to be all-inclusive; rather, the top concerns of CMOs, who were asked to choose five (whose descriptive language best described their CX concerns; again, some were similar, but worded differently).

CMOs and marketing execs in the credit union space, though, have their work cut out for them. Customer journey mapping and much of what the CMOs responded to in their top 5 lists – are what many execs are actively working on – do inform and address much of the broken member experiences you speak of – yet, because it’s a different nomenclature, not everyone yet understands it.

Credit Union marketing used to be creating and placing ads and billboards. No longer. Now it’s digital UX, PPC, SEO, SEM, customer journey mapping, cross-channel campaigns, member education, personalized trigger communications, data analytics/segmentation, and integration of member touchpoints and mapping across channels (branches, mobile/internet banking, digital signage, microsites and social networks). It’s pricing strategy/elasticity, market and member research, product R&D, defining target markets, and much more. All impact CX, but at different junctures on the journey.

Until this vertical starts thinking about marketing more broadly, we will be woefully inadequate to address the very real issues facing us re UX and CX. I don’t disagree with your assertions that addressing broken member experiences remains vital. Having an ongoing hot list is critical and significant and cross-functional teams and accountability are a must.

With the demand for seamless digital integrations continuing to rise, though, the front-end development SMEs in marketing will be necessary to inform UX and work collaboratively with virtual and technology to get the work done efficiently.

Without stepping back and proactively and cooperatively addressing messaging across channels, UX across channels, time per application (and associated conversions and cost), UX education via channels, and more, though, credit unions will stay in the dark on knowing what CX really means.

Credit Unions who both simultaneously address a top 5 list AND also simultaneously look at the universal big picture of real CX – customer journey mapping and rethinking marketing and its implications – will in the end be better prepared to meet the needs of its members long-term.

Who else is best equipped to integrate a predictive analytics (next best product offer) in a trigger email campaign after a member logs on to check their balance via Internet Banking or Mobile Banking? That’s CX that involves marketing, business intelligence, virtual, and technology.

Seeing “Welcome Back, Ron.” when you come back to your website with offers and imagery customized to you with educational content and product and service offers specific and personalized for you. Or receiving a “Take a break…Here’s $20 Starbucks card” during the loan approval homebuying process with next steps outlined. These are some of the digital CX experiences that are being designed. It’s an exciting time for credit unions to move forward and adapt best practices. Time is of essence though.

Deborah–

First off, thanks for reading the article, let alone leaving such a detailed comment. Greatly appreciated. A few responses:

1) You’re totally right about the “irrational inconsistencies.” The problem wasn’t with the responses, it was with the survey design, which didn’t provide mutually exclusive (or comprehensive) choices.

2) I’m hesitant to jump on the “customer journey mapping will fix broken experiences” bandwagon. There are far too many examples of teams getting lost in the weeds in these efforts and focusing on what I believe is the wrong objective–namely, to “understand the customer journey.” The objective should be–in my opinion–“Find–and capitalize on– opportunities for competitive differentiation.” If you can’t find those opportunities, you’re probably wasting a lot of people’s time by journey mapping.

3) You wrote: “Until this vertical starts thinking about marketing more broadly, we will be woefully inadequate to address the very real issues facing us re UX and CX.” I couldn’t agree more, and I’d go even further to say that until credit union think about marketing more broadly, the (negative) impact goes well beyond CX/UX. But this begs the question: How is that going to happen, i.e., what will get credit unions to think more broadly about marketing? It’s a tough pill to swallow, but I think the reality is that there are a lot (or at least, too many) credit union CEOs who just don’t think of marketing as a strategic function. Conversely, there are a lot (or too many) credit union CMOs who aren’t strategic enough, and just don’t have the personal skills and/or influence to enact that change.

Ron