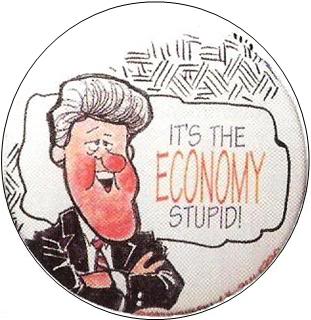

Every time a presidential election passes, I feel a little pang of nostalgia. Not for any deep reasons surrounding great hallmarks of our democracy and all. Instead, the candidates’ taglines are my favorite part. There’s “Make America Great Again” (Donald Trump) and “Change We Can Believe In” (Barack Obama), but my all-time favorite is Bill Clinton’s, “It’s the economy, stupid!” Simple yet effective.

Every time a presidential election passes, I feel a little pang of nostalgia. Not for any deep reasons surrounding great hallmarks of our democracy and all. Instead, the candidates’ taglines are my favorite part. There’s “Make America Great Again” (Donald Trump) and “Change We Can Believe In” (Barack Obama), but my all-time favorite is Bill Clinton’s, “It’s the economy, stupid!” Simple yet effective.

Maybe I’ve spent too much time breathing re-circulated plane air, but I couldn’t help but think of President Clinton’s tagline as I read a concerning statistic in the recently released “What’s Going On in Banking”: more than half of both credit union and bank executives reported that their contact centers are not “future-ready.” That’s startling.

Community banks and credit unions across the country are struggling with the evolving role of the contact center and technological change while also attempting to keep up with call volumes and service levels. But as contact center leaders worry about preparing for future challenges, they’re too often overlooking the most critical component of success: the people who are answering the phones.

As a result, I feel it’s my duty to start my own, one-man contact center modernization campaign with a Bill Clinton-inspired tagline: “It’s the people, stupid!” This campaign is all about focusing on what my colleague Jim Burson calls the “human voice behind digital transformation.”

Think about it. In the modern age of banking, a bank’s contact center reps might be the only human that most customers will directly interact with! For too long, bankers have developed world-class visions of customer experience while funding second-class call center operations. Bankers need a reality check as to how they can deliver an outstanding customer experience without attracting and retaining the very best remote sales and service talent. There is a “new covenant” that needs crafting with some of the hardest working people on the front line.

I propose three areas that bank executives can focus on to excel at hiring and retaining top contact center talent. Here’s my campaign platform:

1. Empowerment

High performers empower contact center reps to directly solve customer challenges at the point of initiation. Consider these examples:

The default mode of thinking for Edge is “one and done” resolution. High performers like Edge encourage and act upon employee feedback related to processes as well as (good and bad) customer experiences. Reps have autonomy and a real stake in achieving contact center goals because the bank’s top leaders have supported this environment culturally and financially.

2. Career vs. Job

The latest Cornerstone data shows annual contact center turnover for bottom quartile performers well above 30%. How can you maintain service levels and ensure high quality interactions when you’re losing a third of your reps each year? It’s no wonder contact center managers often feel that they can barely keep up with hiring,  onboarding and training demands.

onboarding and training demands.

To avoid this perpetual churn, executives should take a hard look at how the position of contact center representative is viewed—by both current employees and candidates. At high performing banks, a rep position is part of a challenging and rewarding career, not an entry level job. In practical terms, that means competitive compensation with a significant “at-risk” component based on performance and meaningful opportunities to be trained and advance. It’s no secret that clear career path and leadership opportunities boost employee retention and build management bench strength. Bank executives who admire strong remote players such as USAA and Vanguard should recognize that these companies position their contact center roles as meaningful professional careers, not an entry level chaos zone with high turnover.

3. Flexibility

Bank executives often miss just how busy and stressful the life of a contact center agent can be. Many are single parents, financially strapped, and commuting long distances. Any reasonable flexibility in terms of when and where reps work is emerging as an effective way to fight for the very best talent.

Top performers are embracing technology advances that enable reps to work remotely with the same secure access to critical applications and the same monitoring and coaching tools as if they were physically in the building. This expands the pool of qualified candidates to fill jobs as work-from-home is viewed as a major job benefit to a well-qualified and educated segment of the labor market.

At the same time, remote agents are not the only way to demonstrate commitment to flexibility. Merely providing adequate workspace and investments in noise reducing headsets and dual monitors for when reps are in the office are small but important details that can make the job feel more professional and rewarding.

Finally, while the use of “workforce management” scheduling applications has taken off, the technology is not without limitations. The value of employee feedback, flex scheduling, and the ability for employees to trade shifts should not be underestimated. Traditional means of scheduling simply won’t cut it as contact center hours continue to expand and qualified agents have options in the labor market.

Behind the major digital disruption ahead, bank executives must not forget that the “human voice” delivered through the contact center will continue to make or break the customer experience. The technology to deliver banking services remotely is exciting and powerful, but GonzoBankers who relentlessly focus getting it right when it comes to building up the talent and work environment in the contact center will be in the best position to succeed.

Our sax-playing, 42nd president might put it more simply: “It’s the people, stupid!”

-rb

Ryan – do you happen to have any statistics as to the number or percentage of community banks/credit unions that allow contact center employees to work remotely?

On a related note, is there any data on these financial institutions outsourcing this function?

Thanks.

Jeff- Good data is hard to come by on the remote stat… so Cornerstone is going to start tracking (stay tuned).

Great article. So true.