One of my favorite things about banking is that it’s exactly like football. OK, it’s not, but indulge me a little because I feel an analogy coming on.

Now that one of the most entertaining Super Bowls ever has concluded, we football fans desperately cling to our passion by looking forward to the increasingly popular NFL draft. For the uninitiated, it goes like this: general managers spend months evaluating their options and eventually select players whose paychecks are surpassed only by their skyrocketing egos. And even though tuning in to the draft feels more each year like watching an overrated reality show, it’s a critical process for every football team.

Similarly, each year bankers are (or should be) looking at their incumbent vendors to determine whether they 1) are living up to the institution’s expectations, and 2) continue to meet the evolving needs of the organization. If a vendor’s product comes up short in either of these areas, it may be time to look at replacement options that would help the company maintain a competitive position.

When it comes to reviewing vendors and system selections, none is more complex than customer relationship management software. There are literally hundreds of products advertised to fulfill CRM needs. Deciphering the pros and cons of each vendor makes the media-hyped NFL player analysis look easier to solve than a one-color Rubik’s Cube. That said, managers in both industries have an additional layer of complexity because all the existing components must play well together. This level of complexity inevitably leads to a mixed bag of success at the end of the CRM system draft.

Any sports fan knows that no draft strategy is complete without a carefully crafted list of team needs. So, loyal readers, to help you prepare for your next CRM system draft, I offer up GonzoBanker’s CRM Team Needs Checklist.

The best CRM users are the ones who know what they want to accomplish with a CRM system and how the system will be used to achieve established goals.

The best CRM users are the ones who know what they want to accomplish with a CRM system and how the system will be used to achieve established goals.

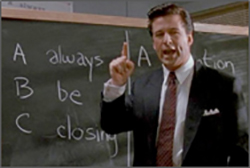

A well-thought-out plan is especially critical when considering an enterprise CRM with nearly limitless capabilities such as Microsoft Dynamics or Salesforce. The upfront planning also avoids the risk of allowing a vendor to dictate strategy or sell tools that don’t contribute to the institution’s vision. You wouldn’t put a branch in Glengarry Highlands or Glenn Ross Farms just because the sales rep was peddling the real estate opportunity of a lifetime.

Team Needs:

The effects of a CRM system implementation are felt way beyond the marketing department. This is true even for sales automation tools like Marketo or Adobe. In fact, a marketer at a client bank told me that the contact center was the most significantly impacted department after he implemented a sales automation platform. Rather than merely adjusting staff to accommodate increased call volume, stakeholders should co-design workflows and educate customer-facing employees to manage referrals across the organization.

The effects of a CRM system implementation are felt way beyond the marketing department. This is true even for sales automation tools like Marketo or Adobe. In fact, a marketer at a client bank told me that the contact center was the most significantly impacted department after he implemented a sales automation platform. Rather than merely adjusting staff to accommodate increased call volume, stakeholders should co-design workflows and educate customer-facing employees to manage referrals across the organization.

Team Needs:

A significant risk with CRM systems is scope creep, which results in increasing costs and compromises the key benefits driving the need for a system in the first place.

I heard a sales rep tell a client that his platform could integrate with any other system and was limited only by the integration capabilities of the other systems. No kidding?! I had to rub my eyes to make sure it wasn’t the star of the Hotels.com commercials, Captain Obvious. Do not try to boil the ocean, and take the grandiose claims of “easy integration” with a grain of salt.

Team Needs:

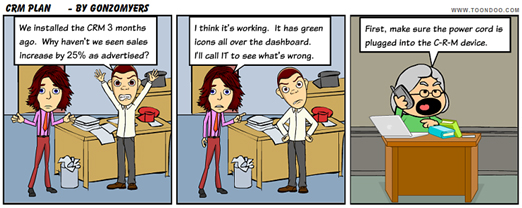

Research from Gartner, The Economist and Forrester estimates that the CRM system failure rate from the perspective of the buyer is a staggering half of implementations. Atop the many reasons for the high failure rate is 1) a lack of understanding of how to incorporate a CRM system into the organization, and 2) not investing enough employee or financial resources into the deployment.

When I see banks functioning without a robust implementation plan, I can only assume they’re operating under the assumption that the CRM system is a magical box full of rainbows that generates pots of gold when it’s plugged in.

Team Needs:

The reward for intelligently acquiring a CRM system is unique. It’s the only software a bank can purchase that can create a competitive advantage. Therefore, it’s no surprise that in What’s Going On in Banking 2017, Cornerstone Advisors found that 63% of CEOs planned to add/replace their CRM system or improve utilization of an existing one. CRM ranked third among software across all business lines, trailing only digital account opening and mobile banking. The downside is that a CRM platform is one of the few technical purchases that can stunt growth for the entire company if it isn’t planned and executed properly.

The best general managers in football know the team’s strategy on the field and create an “off the field” strategy to enhance it. Drafting a great athlete is a complete waste of time and effort if he is the wrong fit for the organization. For banks, a successful CRM draft entails 1) knowing where the organization is going, 2) devising a plan for how a CRM system will enhance that vision, and 3) finding the right vendor to fit needs that have already been defined.

Start tackling the tedious planning and use cases now and earn your way to becoming a CRM winner next season.

-rm