Everybody’s talking about analytics these days and it’s not just in the predictable tech and fraud circles but in finance, marketing and lines-of-business. It’s everywhere. It’s the topic we all have in common now … from “robust tech stacks” for techies to lenders interested in – to paraphrase Marketing Profiles, Inc. President John Dean from the early days of banking analytics 25 years ago – “more loans, better loans, faster loans.” (John used another word besides loans.) And these techies, marketers, accountants and line-of-business leaders are increasingly hanging out together and trading notes.

It’s time to catch up. According to recent research, banking analytics is among the areas where banking executives feel the least prepared for the future. As an industry, we’ve been pretty good at using data to manage risk, especially credit and fraud. And, some have been OK at using data to lower costs, especially staffing. But, let’s face it: the industry has been crappy at using data to make lives easier for customers and drive revenue. The data has been there, but too much of it has been either under-analyzed or analyzed and not acted on. It’s an execution problem. Leaders are looking to change that.

At the recent Financial Brand Forum, the main stage sessions I saw focused more on experience and culture as customer interactions head in a digital direction. (Case in point: Umpqua Bank’s Ray Davis – “Data is interesting but let’s know how customers feel.”) Yet, the breakout sessions, sidebars and expo hall discussions seemed slanted toward analytics conversations and converting more data into buying. The more specific and applied the use case, the better. The busiest expo booths were one-off specialists like lending analytics campaign provider Intuvo and digital banking provider Alkami talking about applying data. Meanwhile, general purpose providers Salesforce and IBM Watson had much less traffic. To Davis’ point, data is interesting, but one of the objectives of analyzing data should be to help tell us how customers feel – and perhaps even more importantly, how they actually behave and buy. How we can help them, in real banking ways, like borrowing or making payments or managing money. Or, as creativity expert Ron Tite put it, “It’s increasingly a fight for the customer’s time.”

From what I’ve seen, the people and processes pull along the high-impact data use that really makes the difference with analytics. There is a solid and growing stable of tech options out there. It’s not the data, but what’s analyzed and used to impact the bank’s business model in an ongoing way. That’s where the action is.

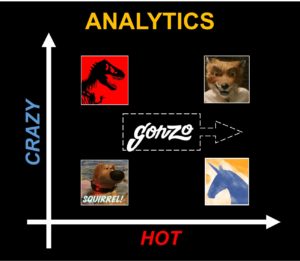

So as your analytics efforts expand, consider where your institution is (or wants to be) on the hot crazy matrix. Hot is the impact to the bank’s business model. Crazy is how complex or costly the analytics initiatives are.

Dinosaur Zone. This is what happens when there is a passionate focus on in-house infrastructure build-out with data warehouse, metadata, and more cubes and pivots formed than you care to think about. Unfortunately, the lack of focus on at least incremental business impact results in extinction, with vendors unplugged, key people fired, or both. You rarely see these situations anymore. They led to irreparable damage to future efforts with bank CEOs. It’s understandable. If you visited Jurassic Park once and survived, you don’t go back.

Crazy-Like-a-Fox Zone. Are there any budding Sergey Brins or Jeff Bezos walking your halls talking up wild ideas using data? Are you doubled down chasing unstructured social media data? This is the exciting apex of hot crazy. Even the much-vaunted Capital One tests and learns across a variety of analytics initiatives. But the fox goes deep for the big analytics win nobody else has found and pushes to bet the farm. The harsh truth is that, unlike Google, Apple and Netflix, we’re in a highly regulated industry (remember those federally insured deposits?) where one cannot bet the farm. Initiatives must be self-funded or funded by value coming from somewhere..

Crazy-Like-a-Fox Zone. Are there any budding Sergey Brins or Jeff Bezos walking your halls talking up wild ideas using data? Are you doubled down chasing unstructured social media data? This is the exciting apex of hot crazy. Even the much-vaunted Capital One tests and learns across a variety of analytics initiatives. But the fox goes deep for the big analytics win nobody else has found and pushes to bet the farm. The harsh truth is that, unlike Google, Apple and Netflix, we’re in a highly regulated industry (remember those federally insured deposits?) where one cannot bet the farm. Initiatives must be self-funded or funded by value coming from somewhere..

Unicorn Zone. Surely we can just keep it on the down low, go cheap, and get some easy analytical wins out there, right? Maybe. It’s getting harder. With key data nestled inside a variety of payment, digital, origination, and other systems, good luck finding the easy projects with guaranteed payoffs by using only core systems or departmental systems like MCIF or profitability engines. There might be nothing wrong with those systems, but cores were designed for transaction processing, and MCIFs and profitability systems do some great things but they weren’t designed with data models that track interactions like, say, where money is going and why. Being an analytical leader is going to take more grit and resources.

Unicorn Zone. Surely we can just keep it on the down low, go cheap, and get some easy analytical wins out there, right? Maybe. It’s getting harder. With key data nestled inside a variety of payment, digital, origination, and other systems, good luck finding the easy projects with guaranteed payoffs by using only core systems or departmental systems like MCIF or profitability engines. There might be nothing wrong with those systems, but cores were designed for transaction processing, and MCIFs and profitability systems do some great things but they weren’t designed with data models that track interactions like, say, where money is going and why. Being an analytical leader is going to take more grit and resources.

Squirrel Distraction Zone. This is where many mid-size banks and credit unions find themselves with analytics because it’s low-risk, low-exposure, and no-fail. They purposefully start in low-impact areas and keep it pretty simple. This is what you have when a commercial bank focuses its analytics on improving something like consumer certificates of deposit pricing. Or the refinement of a compliance report. Or any other “low hanging fruit” that all sounds very reasonable, doesn’t require too much input from those pesky line-of-business prima donnas, and uses the cool tools that make statisticians high five in the hallway. But, it’s not moving the needle on what the bank executive team and board really think about, so the efforts are largely distracting. And it can ultimately get important analytics usage stuck in a low-impact wind-down.

Squirrel Distraction Zone. This is where many mid-size banks and credit unions find themselves with analytics because it’s low-risk, low-exposure, and no-fail. They purposefully start in low-impact areas and keep it pretty simple. This is what you have when a commercial bank focuses its analytics on improving something like consumer certificates of deposit pricing. Or the refinement of a compliance report. Or any other “low hanging fruit” that all sounds very reasonable, doesn’t require too much input from those pesky line-of-business prima donnas, and uses the cool tools that make statisticians high five in the hallway. But, it’s not moving the needle on what the bank executive team and board really think about, so the efforts are largely distracting. And it can ultimately get important analytics usage stuck in a low-impact wind-down.

There are GonzoBankers out there finding success in the middle. Hot enough to keep the fires burning, but not too crazy. What are they doing?

So … how about it? Will your analytics be hot, or crazy? Or a little of both?

-SK

The late Gregg Allman’s music was hot and the Allman Brothers could certainly be crazy. My late brother Joe was a big Allmans fan, and he left some of their music to me. I discovered the brilliant 1973 album Laid Back only a few years ago. If you’ve never heard it, I highly recommend giving it a spin. And I’d love to hear what you think of it.

You give pretty good examples in each of the 4 zones that bankers can relate to in real life. When it comes to your three points about being in the middle, there are no concrete examples of what any gonzobanker is actually doing that fits into that described middle zone to support the claim of success. I would be interested in some examples.

Thanks for the chiming in, Alan. A couple examples that came to mind: 1. Commercial focused mid-size shop used analytics and dashboards for commercial lenders to get them exposed to risks and profitability in their portfolios but ultimately getting their competitive juices flowing on exposure to pipelines and revenue generation. Considering expanding that, but being careful to balance data analytics value with time investment needed on information gathering. 2. Consumer focused mid-size shop used analytics strongly for credit and fraud risk and performance excellence, but ultimately turning that strength into aggressive analytics based credit card campaigns with credit card ultimately becoming a strong and profitable lead product from which to extend their brand. Are these examples helpful? Any examples you’ve seen or heard to share?

Sam, you are missing the most important piece – people.

https://www.raddon.com/raddon-report/coaching-results-it-still-best-practice-banking

Eric, Thanks for chiming in. Agree that people are an important piece. “….the people and processes pull along the high-impact data use that really makes the difference with analytics…..figuring out how to influence the most people (customers and employees)….”

Sam, thanks for the Intuvo shout out! Financial Brand was a hit with marketing folks realizing the need for intelligent, activity-based marketing driven off of true synchronization with mortgage and consumer LOS systems as well as core. Personalized, relevant and timely marketing is key to driving loan pull-though rates and increased NPS (Net Promoter Score).

By the way, the Allman Brothers rock! And are in the Rock Hall of Fame.