Bankers are struggling with their vendors more than at any time in the past, and this pain has increased just when technology has become the most important strategic challenge in our industry. The root cause of this struggle is not that vendors have bad intentions or lack competence. Vendors are struggling to deliver because they are dealing with the same pace of change and complex technical mandates that all businesses are facing, and they are fighting for talent that would much rather work in industries like software, gaming and ecommerce than good old banking.

Bankers and vendors are cramming to learn about digital delivery, sophisticated analytics, robotic processes and API-integrated systems while operating legacy businesses. But when it comes to new technology, for all but the top 20 banks, building new, large-scale systems is cost prohibitive and fraught with risk, while the “buy” marketplace is full of half-finished solutions, unkept promises, and vendors’ tepid willingness to integrate other systems.

In this environment, banks need to carefully buy solutions in the vendor market, demand stronger vendor performance, and look for systems that can easily be configured or customized to the bank’s needs. At the same time, banks must learn how to build the system integrations, customizations and analytic capabilities around the vendor solutions they buy.

The best hope is for executives to acknowledge the need, take more control of the bank’s destiny, and create a new force of superheroes inside their organizations: the Business Integration Team.

The BIT is the talent that holds together the alignment between the bank’s strategy and its technology and analytic capabilities. It’s a cross-functional mix of business and technology professionals that are in the foxhole together navigating through the pain and heartache of software and systems.

Instead of waiting for vendors to deliver on grandiose promises and being disappointed, banks must use the BIT to execute in a more self-reliant manner with technology – sometimes with the vendor and other times around the vendor.

The mantra and mission of your bank’s BIT should be to “utilize process design, focused development, analytics and system integration to continuously deliver the bank’s most important strategic capabilities, leveraging vendor partners when possible.”

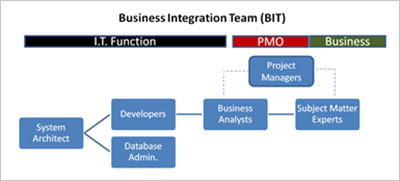

The nuance here is that the bank leads and the vendors follow, not the other way around. An effective BIT blends I.T., project management and business disciplines, with a focus on acquiring and developing this talent versus where it reports on the org chart.

The illustration below outlines key players and functions that make great business integration happen.

GonzoBankers, considering your challenges with technology today, how well is your bank investing in BIT resources?

The System Architect – the system architect is the techie who understands the intricacies of the bank’s application environment and uses tools like application programming interfaces and an enterprise service bus to help manage ongoing system complexity. The architect makes systems talk to each other as much as possible and strategizes with vendors and developers on how to better integrate systems.

The DBA – the database administer is the guru or extracting, storing and organizing data so the business areas can more effectively access information. The DBA creates that “single version” of the truth in the organization and addresses issues where data is inconsistent or unavailable. Great DBAs take pride not in their technology, but in how actively data is used inside their organization.

The Developer – the developer works in web and data tools and business applications that come with software development kits to better customize the technology environment for the bank. An example of a popular application with an SDK is Salesforce.com. Banks can license the platform, but then a scrappy developer with the SDK can customize the tool for the bank’s processes and culture. A good developer leveraging an SDK is worth his weight in gold.

The Business Analyst – the business analyst is the ultimate translator between a business area’s requirements and the system capabilities needed to execute. A good BA has a great EQ with front-line team members, but also a gritty “I know where the bodies are buried” knowledge regarding the bank’s systems.

Subject Matter Experts – subject matter experts are the power users in a business area who ultimately operationalize new system capabilities. SMEs are the disciplined implementers of new systems but they also evangelize among front-line staff to use and leverage these systems. Bank lines of business often try to implement new systems without formally identifying an SME or giving this person time to focus on system implementation. In our consulting practice at Cornerstone, we regularly see banks spending millions of dollars on new systems with ZERO formal identification of SMEs who should own and get value out of these systems.

Most banks struggle with the pieces of business integration described above. However, when a brilliant architect creates a game plan with middleware, a DBA organizes the data chaos, developers sling code for better integration and customization, and business analysts are in the trenches working side by side with engaged subject matter experts … the clouds part, rays of sunlight shine, doves fly out on the horizon and the ’70s hit “Dream Weaver” by Gary Wright plays as the soundtrack. It’s really beautiful stuff to witness, and the team at Cornerstone has seen glimpses of this in select organizations around the country.

Bank executives looking to a future of digital delivery, process automation, analytics and integration have to acknowledge two critical industry realities:

It’s time for bank executives to view I.T. professionalism the same way they view professionalism in their commercial lending and credit areas – it’s that important to their futures. Assess the resources and talent you have devoted to business integration and create a serious focus on these capabilities going forward. As Forbes magazine stated in late 2015, “Every company is now a technology company.” Building out the Business Integration Team is the first step bankers must take to acknowledge the new world they inhabit.

-spw

Great article! The biggest problem in the banking business is to think that banking business is VERY complex. It is not! What makes people think that banking is complex are the layers and workarounds developed over legacy systems, built over 40+ years, that are still running. And the worst is that many fintech startups are currently developing solutions, assuming “that is the way of banking.” It is not! (Why are Fintech start-ups avoiding the core of banking?) The Technology House (of the banks) needs a wise architecture which must be built from scratch without technical thoughts. It should determine that the business is handled “corporately” rather than by line-of-business, thus eliminating the silos and the DWs, having a single source of knowledge for the corporation. It is not to think outside the box, but to forget the box.

The Bill and Melinda Gates Foundation launched an open-source banking platform framework at the Swift Sibos conference in October. My story on Forbes is here:

https://www.forbes.com/sites/tomgroenfeldt/2017/10/16/gates-foundation-launches-open-platform-to-connect-mobile-finance-in-developing-world/#5da597ea3c1b

It is aimed at developing countries to promote financial inclusion, but it has attracted some attention from American credit unions, the developers said. You can access the new software, called Mojaloop, on GitHub. It’s free.