“Nobody’s winning at this kind of game

We’ve gotta do better, it’s time to begin

You know all the answers must come from within

So come on and take a free ride”

–“Free Ride” by The Edgar Winter Group

Have you ever noticed that some vendors and products get a free ride at banks and credit unions? Some project proposals get pushed through the Steering Committee despite everyone involved knowing that not one iota of effort has been put into a “skin in the game” business case.

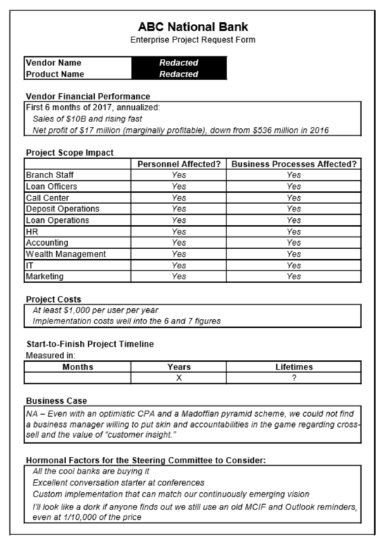

I’ve got a project proposal for your review, GonzoBankers. Imagine you’re a senior manager or director at a bank and receive the following Project Request form from one of your up-and-comers who really HAS TO HAVE this new multi-module enterprise-wide CRM product:

Seriously, how would you react to that stellar software request? You would likely choke on your morning bagel and call in the heavies from Procurement to taunt the requestor. But apparently these types of requisitions are working. How else could so many banks and CUs be clamoring for … you guessed it … salesforce.com?

Salesforce.com makes some admittedly cool software for CRM. Cool screens, cool navigation, cool customization, cool developer ecosystem, cool just about everything. They even have a cool user conference called dreamforce with hip, no CAPS spelling. They even sell out the user conference!

Except, not-so-cool when you have to justify the costs. Executives are hesitant to use math on this request. When you ask someone who has deployed salesforce.com how they justified it, you get responses such as:

The point is that without a clear commitment around business goals, salesforce.com risks being a Vanity Project – a project that looks good at 10,000 feet but gets a little warty as you approach ground level to discuss the specifics. The elevator conversation about it sounds good. You can brag to your friends and colleagues about your salesforce.com implementation. Reaction: “Ooh, this guy is serious about his customers!”

You can go to dreamforce and bliss out at the Lenny Kravitz show and hear such renowned business minds as Jenna Bush Hager, Barbara Pierce Bush and Ashton Kutcher speak. But unless executives want to stand up for increased revenue per customer, hard-nosed correlated increases in customer retention, more volume faster with the same staff, a salesforce.com investment is being driven by the emotion of hope but not the commitment of real change and sales goal achievement. No two ways about it.

And though I’m raining on your CRM parade, let’s be clear: there is definitely room for vanity projects in banking. Nothing says every project needs to have a home run business case attached to it. But usually those projects don’t come with the endless duration, heavy disruption, and beefy price tag of a salesforce.com project. Go ahead – mess around with finding non-Venmo P2P providers. Want to see if your customers like that spinning Money Desktop widget? Knock yourself out.

Regulatory must-haves and tactical, keep-the-lights-on projects are taking up the majority of available project time, leaving little time and few resources in the strategic project budget, let alone enterprise-wide Vanity Projects. If you really want to try for a strategically differentiating project that won’t make your CFO lose his mind, look to push the envelope on projects that maybe some brave executive will step up to owning from a measurable goals standpoint:

Vanity projects have always had a role in making Cornerstone Advisors’ gonzo customers better. We are certain that a more disciplined few of our clients will make their salesforce.com deployment successful in driving better sales and service processes. The point here is that, with very little time to push discretionary, strategic projects, the vast majority of banks’ and credit unions’ vanity projects should focus on the “Little ‘Test and Learn’ Journeys That Could” versus loosely defined “Enterprise-wide Odysseys of Dubious Outcome.”

Every strategic initiative should come under the microscope regarding its cost, risks, benefits and how it fits with the bank’s strategy. However cool it may be, a salesforce.com investment deserves the same scrutiny.

You’ve done it again Scott. Well written!

I’ve never been employed by a vendor that was granted a free ride by a bank. However, since I’m on the sales side of the equation, I’m looking for one.

Hi Jim – Always great to hear from you, and thanks for the comments! Scott

Scott, so agree with your premise and analysis here. I spent almost 20 years at super regional banks and couldn’t wait to get a CRM since I thought we (as corporate lenders) were missing out on the tools that could really drive our performance higher.

When my last bank decided to buy salesforce I was thrilled and expectant. 18 months later the customized installation was complete and it rolled out. The boost in performance? It never came. For me, or my colleagues. My conclusion is that the software mainly provides lots of management insights and data – at a huge price tag.

I think the purchase justification for salesforce is very basic for most companies. They already spend hundreds to thousands per salesperson per month on T&E. If they spend $100/mo. for software that will bring 1-2 more clients a year (per salesperson) it’s worth every penny.

You referenced Hubspot for digital lead management. I have used it at a subsequent job and heartily endorse it. And for your clients that are looking for a CRM, Hubspot has a nice one included in their platform (and it’s much more intuitive and user-friendly than salesforce for the sales professional, imo).

Hi Jay – Thanks for the comments. Glad to hear I’m not 100% nuts in my assessment of salesforce.com, and always good to hear confirmation on Hubspot. Take care – Scott

Great article, Scott!

Salesforce is a tool. If your company does not support and manage it at 100% at every level yes, your money and more importantly time/resources is better spent elsewhere. In my experience the business/bank need to take a good look in the mirror and with sheer honesty, and ask is this who we are who we want to be and will we use it? Is executive management and middle management on board? Do we need the Cadillac version of Salesforce or will a stripped down version due to start. It’s a long process that does not end after implementation. Salesforce works if you “use it”!

Thanks, Philip. Great to hear from you! Scott

Great article Scott. I couldn’t agree more. I’ve met with many community and regional banks, and credit unions that struggle with these issues.

Bankers continue to want tools that help them reach out to customers with helpful insights at the most relevant times. Too much focus has been on requiring bankers to input information for sales management purposes with little value in return. It’s time to refocus on the banker, and give them useful tools that enhance the banker-customer experience. It’s exciting to be innovating in this space.”

Thanks, Adam!

I agree with Jane. The problem with most organizations is that they really dont have the energy or drive to research and do CRM right. Unfortunately there are no easy buttons. Spending more for a top notch system is no guarantee of success. Neither is spending less to minimize your loss. All I can attest to is that the tool does what you need it to do. No work arounds no manualized automation steps.

No system of any significance should get a free pass. In my experience these are the projects that always go bad. But that’s a culture issue not a tool issue.

Guy – Always great to hear from a veteran of the Big, Hairy Projects Wars. Thanks for writing in! Scott