In contrast, “future-ready” bankers choose their LOS based on pre-determined objectives and clearly defined targets that subsequently lead to measurable strategies and methodologies.

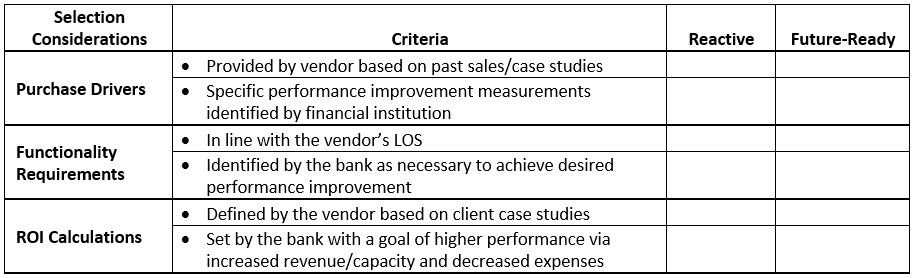

Here’s a little test. Try categorizing each of the criteria in the chart below as either reactive of future-ready.

Is your LOS selection reactive? Or are you approaching it like a future-ready banker?

In a typical reactive LOS selection, the vendor aims to provide purchase drivers during and/or after the system demo that align with the beliefs or position the bank holds. However, because the vendor wants to sell its LOS to a broad range of FIs, its purchase drivers tend to be “fluffy” and lack specificity. For example, the vendor may propose that its loan origination system will:

Yeah, so what?

The future-ready bank, on the other hand, pushes for purchase drivers that are well-designed and well-defined, specific to the institution, grounded in the reality of the bank’s current state, and measurable. For example, future-ready purchase drivers:

These purchase drivers illustrate specific areas for performance improvement at the bank and provide a quantifiable measure of the desired improvement.

This is where the differences are most clear. Reactive LOS selections will obviously have the necessary functionality requirements that support the purchase drivers suggested by the vendor. Show me a vendor where these don’t match up in the scripted demo and I will show you a vendor that isn’t going to be in business very long.

The future-ready banker identifies situations in users’ day-to-day processes and articulates the functionality needed in his LOS selection to correct them. For example:

ROI Calculations

Most vendors have some version of a return on investment based on a client case study. This ROI is real, but who knows whether the client in the case study is a future-ready banker or simply fell into the increase in performance? The point is that the vendor often tries to apply the case study and the resulting performance to any bank as justification. Could it be applicable? Maybe, but the banker that makes a reactive LOS selection doesn’t know for certain. This uncertainty leaves the banker open to and defenseless against challenges by opposing opinions or the plain reality that erodes the foundation of the reactive buying decision. And, it can lead to problems down the road (implementation delays, lack of adoption, etc.).

Future-ready bankers already know the ROI because they have identified the purchase drivers and desired future performance and have measured the impact to their financial institutions. For example:

The Moral of the Story

The reactive bank sees increased cost of delivery and a reduction in its competitive position. The future-ready bank realizes solid adoption of a platform that improves performance and the customer experience while at the same time improving the bank’s bottom line.

With an investment of $250,000 to $5 million or more over the next five years, which path do you want to take?

Great article! You are spot on with how some FI’s are approaching their LOS system. The shift in mindset by the bank to a future-proof LOS system is critical to their long-term success.