When rising technology star Bill Gates bragged in July 1994 that “banks are dinosaurs … we can bypass them,” it struck fear in the hearts and minds of bankers.

For those too young to remember, this was the burgeoning era of the Windows PC, America Online’s screaming modem noises, and a battle for the personal financial desktop between Quicken and Microsoft’s Money product. To grasp just how long ago this prediction was made, the OJ trial was covered in the same Newsweek magazine bearing the famous Bill Gates predictions.

The PC era was the first of many banking technology disruptions in the country, and as the client-server, “dot.com” and mobility eras emerged, predictions abounded that the end of banking was near. So, GonzoBankers, let’s quickly summarize how the banking industry has fared since Bill Gates’ famous prediction regarding banks closing:

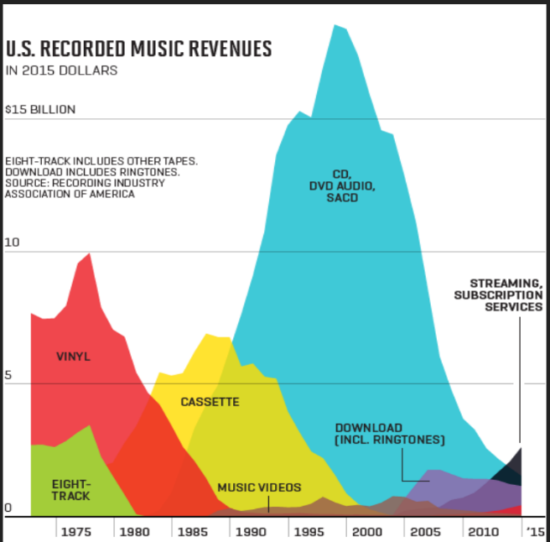

Since Mr. Gates’ grand prediction, bank operating revenue has tripled, earnings have quadrupled, and equity capital has quintupled. At the same time, institutions have been cut in half while branch and employee growth has been modest compared to revenue growth, creating stronger overall productivity. Although banking industry trends have certainly been disrupted by technology and have blown a few things competitively, this has not been a case of industry revenue being pulverized akin to what Napster, Apple and Spotify did to the music industry.

Source: Fortune

In fact, earnings in the first quarter of 2018 were the highest ever for the banking industry, clocking in at over $50 billion.

As we prepare to celebrate 25 years since the characterization of banks as prehistoric creatures, here are a few takeaways that explain how banks have fought off industry threats and are still standing:

For technologists, it sounds so easy at first just to “digitize the whole business.” Yet, the intricacies of commercial lending, income property collateral, underwriting, local title recordings, payment ecosystems and regulatory compliance have proven much harder to disrupt than purchasing a book or downloading a song. Even as banks work to better “digitize” the overall customer experience today, there remains a decade of work ahead.

When Gates made that prediction, net interest margin was a fat 4.9% in the industry, but now it has dropped to 3.25%. Luckily, banks have gotten much more efficient as the non-interest expense/asset ratio has dropped from 3.5% to roughly 2.6% during that timeframe. Driving new sources of noninterest income has also helped to sustain earnings as banking became a thinner-margin business. Going forward, bankers should be prepared for the constant decline of margin and acknowledge that digital delivery, analytics and robotics will be the only hope in achieving future efficiency improvements.

When Gates made his fateful prediction, he imagined a time when most households would load up floppy disks and manage all their finances through an organized family bookkeeping system. Yeah, that didn’t happen! One of the craziest things in our industry is that every new technology brings predictions of organized humans making rational decisions with money management software, and it simply never comes true. The truth is, consumers lurch from one pressing financial need to the next with no plan and no institutional loyalty. Most of us would rather eat Cheetos and buy something we can’t afford on Amazon Prime than plan our financial future. Banks that try to build their business around rational customers will always be disappointed.

When consumers fired Barnes & Noble and Blockbuster, they simply stopped shopping at these stores. With a banking relationship, things like direct deposit, auto-payments and digital passwords involve effort for the consumer or business to start anew. While the Twittersphere may dream of a future of “open banking,” today the industry is messy with switching hassles.

While banks have survived nicely in the past 25 years, the convergence of mobile, analytics and AI could bring forth a tech disruption much bigger than in the past. Every product and experience in banking is now a distinct “use case” that powerful software tools can solve with better process, integration and algorithms. The switching costs of banking may not be eliminated completely, but they are likely to decline faster in the years ahead.

As boring and prehistoric as it sounds, the one thing that has truly tainted banking’s record since Bill Gates’ prediction has been our industry’s tendency to underprice risk during boom times. Bank failures and huge “bad bank” write-offs during credit busts like in 2008 wipe out tons of shareholder value that took years to create. Banks have survived, but we should remain haunted by stories like those of WAMU, Wachovia and Indy Mac. Despite the power to manage risk more analytically, banks still risk losing their shirts through bad credit cycles, and we have yet to make a robotic version of the wise and crotchety credit officers that we count on to safely hold our industry’s reigns.

In 1994, Bill Gates made the common techie mistake of trying to paint banking as simply some new code to be written. Yet, as Gates also once famously said, “We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next 10.” So, how is the future of money? Banks are alive and kicking, but the disruption from technology is going to be substantial in the next 10 years. We will never be completely digitized, but the survivors will be highly efficient and focused organizations with a lot more technical knowledge and capability than the banks we see standing today.

Postscript – Ol’ Gates may not have killed banking, but Microsoft has done just fine as a disruptor. So much for those conspiracy theories! Microsoft’s revenue was under $4 billion back in 1994 and now is a staggering $90 billion. The company’s market cap is nearly $800 billion, and Gates himself is closing in on an unimaginable $100 billion personal net worth.

Great article! I appreciate the statistics and your insights.

I do agree that American consumers will not make rational financial decisions unless/until forced to do so. I would also suggest that on balance this has been positive for the banks (and economy as a whole) since the debt funded spending has lifted most boats. It seems unsustainable to me but it continues – to the benefit of most.

Great comment and true that debt funding is the biggest economic story across consumers, business and government over the past 40 years. However I think consumer financial health will come more from grass roots efforts and education than software. There could emerge a “Fitbit” for finance but so far market interest had been low.

-Steve

Steve – next time you want to stroll down memory lane, look at the 1980 report by Anderson Consulting that predicted that by the year 2000 there would be fewer than 100 banks in the US. Well written with a lot of good analysis and supporting detail. Just wrong.

Jack , I remember that study as well as I spent a bit of time at Arthur in the early 90s. Well, they only missed by 5,000+. 😃

Fantastic article debunking this legend! My eyes roll every time I see this quoted. Lots of room for banks to improve but to paraphrase Twain, reports of banks’ death have been greatly exaggerated!