Financial institutions looking for tangible value from a new CRM platform should know two things: 1) real-world stories of lessons learned and successes of early adopters are a great source of intelligence and guidance, and 2) implementing a CRM system will prove more challenging than anyone expects.

Two years after the revival of CRM software in banking, the trend of implementation challenges continues. Fortunately, in our travels we’ve come across a number of “CRM Conquerors,” banks and credit unions that pragmatically solved specific pain points. This article shares lessons learned and tells a few stories of real Conquerors that have realized a true impact from their CRM platform investments.

As a quick disclaimer, none of the examples in this article are an endorsement of any specific software; multiple CRM solutions have been implemented across various Conquerors.

One organization stands out among all others in thoughtfully sharing lessons learned from its journey.

At Dreamforce last year, Pete DuPré, CIO of Elevations Credit Union, took the stage to offer up one of the most enlightening and real experiences discussed at the conference. In a session that was sadly limited to 20 minutes, DuPré shared what Elevations did right and where it missed the mark.

One of a handful of organizations to start with implementation in the contact center, Elevations worked diligently through data and integration challenges with some third-party services and even more internal development.

What DuPré said Elevations did right:

Where DuPré said Elevations messed up:

Related to DuPré’s last point, even the brilliant (and humble) minds at Cornerstone Advisors have spent sleepless nights combing through fuzzy ROI modeling. While we believe in a responsible approach that goes beyond simple growth in generic revenue, it inevitably relies on assumptions that should be tied back to a collection of specific use cases for how a CRM platform will be leveraged.

Contact Center

The contact center has been rapidly gaining popularity for CRM platforms in retail-oriented credit unions. The advantage is two-fold: growth and efficiency. The growth is more intuitive as “next best product” suggestions and easy referral capabilities are implemented. Efficiency has come in many forms, including:

Idaho Central Credit Union and Delta Community Credit Union successfully deployed CRM in the contact center. Both thoughtfully embedded inbound call authentication into their respective platforms. Idaho Central estimated it gained two to three FTE worth of efficiency in just the time saved at the beginning of every member call.

Sales & Referrals

Sales and pipeline management has been the bread and butter of CRM, but setting it up in an integrated and user-friendly way has been grossly oversimplified. Paducah Bank warrants mention for its redesign and standardization of a new sales process. The bank not only found opportunities to eliminate the need for manual data entry, but it also estimated that 25 CRM users are saving about an hour per week just by making data easier to find.

Of course, developing an existing pipeline is only half of the growth equation. Lake Michigan Credit Union tackled the notorious “next best product” challenge by incorporating member data and overlaying organizational priorities. Frontline employees are presented with an easy-to-find prioritized list of recommended offers tailored to each member. More importantly, the team designed how a new opportunity will convert from a frontline referral to a well-managed lead pipeline within the same platform. The year-over-year results are staggering:

Lake Michigan calculated that just improving these two metrics has earned the CU millions of dollars with a three-year return of 157% on its investment. And the long-term return will only improve considering the substantial one-time costs associated with implementations.

Digital & Marketing

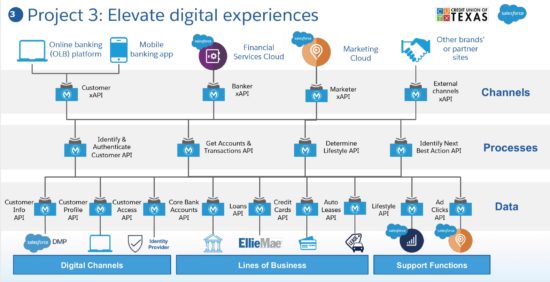

Credit Union of Texas used MuleSoft (purchased by Salesforce last year) to tackle digital banking improvements. The primary focus was integrating authentication with the credit union’s digital banking system to improve the online lending experience with prefilled applications. Further integration with loan origination systems enabled applications to automatically populate virtual queues to be immediately worked by loan officers and processors. The credit union also used marketing automation to collect data and develop journeys that deliver educational marketing materials both digitally and via direct mail campaigns.

The reported benefits were significant:

Business Development

SchoolsFirst Federal Credit Union creatively applied CRM relationship and event tracking capabilities to “in the field” business development activities. By tracking events, budgets, new accounts and their outcomes, the CU can strategically allocate resources where the business development team identified the best opportunities to partner with contacts and better manage their activities. This helps the team seek out new, high-value events. The contacts in this case are an example of a “center of influence” similar to how others might view real estate agents and developers.

BCU is currently implementing a CRM platform to augment its new account, consumer lending and mortgage lending efforts. This CRM Conqueror is tying success metrics that drive ROI to specific use cases. For example:

Enterprise Unification & Workflow

A longtime poster child for Salesforce, $108 billion Huntington Bank isn’t exactly a mid-size community bank. But if it can build complete customer views and operational workflows for 11,000 users within a single platform, then it’s fair to say there is definitive proof it can be accomplished in smaller, less complex financial institutions. Even just using an integrated platform for basic case management functionality that’s shared across the enterprise is a significant financial and efficiency benefit. In addition to the CRM system being a key tool for sales teams, Huntington uses the massive amounts of data passing through the platform to feed its automated marketing campaigns.

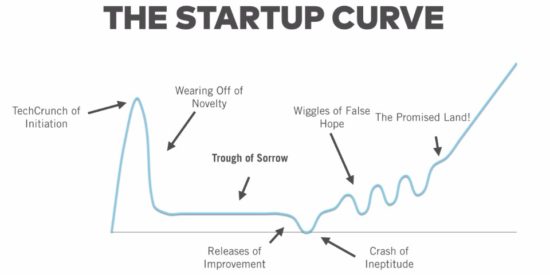

CRM systems are still a relatively new phenomena in banking. They kick off with more work than is manageable. And, it’s a long journey to reach the tipping point to sustainability where the overwhelming list of technical work evolves into a trickling stream of enhancements.

The best illustration of the analogous lifecycle is The Startup Curve from Paul Graham.

Source: The Startup Curve by Paul Graham, Y Combinator

Banks and credit unions must be prepared to get through the Trough of Sorrow where the project inevitably takes more time, costs more money and produces fewer tangible results than desired. But the rewards are worth the diligence. A combination of eager line of business managers, proactive system administrators and supportive executives have creative license to accomplish endless automation and unique customer experiences.

Just imagine the impact if all of the aforementioned use cases were found in a single financial institution!

Reaching a point where mid-size banks and credit unions have the potential to offer efficiency and experience on par with Chase and Bank of America is hard to imagine, but not entirely unrealistic in the foreseeable future. Here’s hoping the Conquerors continue laying the groundwork for other community FIs to cost-effectively adopt as part of an industry experience shift.