The COVID-19 pandemic permanently changed consumer banking preferences. Over the past year and a half, customers learned that although they may have been mandated to stay at home, they did not have to accept being told how to do their banking.

As providers like Amazon, Netflix, and Instacart showed consumers that they could easily conduct business from the comfort of their living rooms, it fell on financial institutions to step up their game and deliver virtual services that are consistently quick, simple, and personalized to customer preferences.

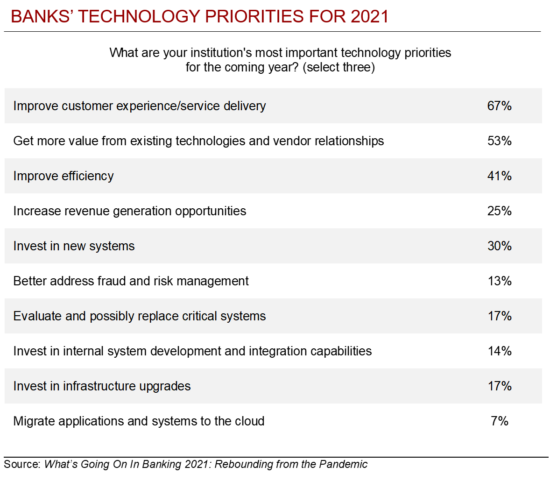

So hats off to executives at community-based institutions who, according to Cornerstone Advisors’ What’s Going On In Banking 2021 study, said improving customer experience and service delivery was their No. 1 technology priority for 2021 – ranking it considerably higher, even, than boosting efficiency or increasing revenue generating opportunities.

Further, this same study found that out of 27 systems, call center and customer relationship management (CRM) platforms both ranked in the top 10 by banks for systems slated for purchase or replacement this year.

A robust customer care function has never been more important. Here we share highlights from the GonzoBanker Customer Care Playbook, designed with your success in mind.

With the increase in digital adoption, the demand for live agent support is stronger than ever. Today’s agents are resolving lengthier and increasingly technical issues, and turnover remains a fact of life in even the very best-run operations. The cost, both direct and indirect, of attrition is high. These tips can help executives manage – and keep – the people so critical to customer care.

Customer care teams find themselves in a Catch-22: they’re expected to resolve customer issues on topics ranging from incompatible browsers to card fraud to bill pay errors, but they are hamstrung by insufficient access and empowerment. Agents spend valuable time navigating manual processes, inter-departmental transfers, and sub-par policy and procedure documentation. Longer call times lead to higher abandon rates and call churn. As a result, internal morale suffers, and so does the customer experience.

The sudden shift to remote work put the contact center technology at many banks under immense pressure. Thanks to hard-working IT teams and creative workarounds, most hurdles were overcome, but the pandemic underscored the functionality and flexibility challenges of legacy platforms. When operating at scale, knocking a few seconds off of average call handle time or eliminating a small fraction of inbound volume can translate to hundreds of thousands of dollars. Technology alone is not a strategy, but there is a solid ROI case for technology that enables exceptional service delivery.

A common pitfall as banks grow is attempting to preserve the personalized, high-touch service that historically worked well without fully acknowledging the required trade-offs. As the old adage goes, “Choose two: speed, quality, cost.” Leaders must make the hard choices. Unfortunately, trying to be “all things to all people” often translates to an inferior customer experience.

In a recent NCR survey conducted by The Harris Poll, 86% of U.S. banking consumers say they would be more comfortable with their financial institutions having access to their personal data than a big tech company such as Amazon, Apple, or Google.

Banks have long carried the critical burden of trust for consumers. Now, as they strive to remain competitive and gain efficiencies in the post-pandemic world, the leaders must not lose sight of the fact that digital transformation is driving new go-to-market strategies – and they’re behind the wheel.