“Remind people that profit is the difference between revenue and expense. This makes you look smart.” –Scott Adams, Dilbert Creator

The nation’s banking professionals have more than just “Zoom gloom” these days. The bottom line is this: folks are working harder than ever and dealing with more daily stress – all to generate less revenue. The reason? That damn yield curve.

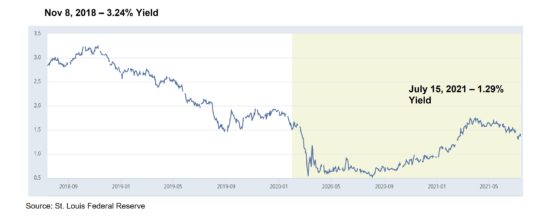

In under three years, the 10-year bond yield has dropped nearly 200 basis points even as the economy opened back up in 2021. This drop happened just as banks became flush with deposit liquidity from a COVID flight-to-safety, and oodles of government relief checks hit bank accounts. Now, every bank CFO wakes up each morning and laments, “Where do I invest all this money?”

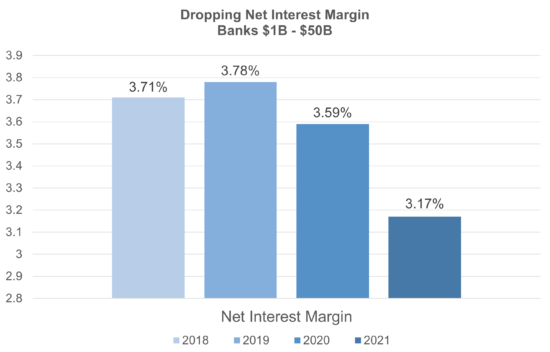

For mid-size banks, the impact to revenue has been striking and problematic. These institutions feel like they have gained the scale to stay in the game, but now their plans to invest in the future are colliding with revenue laws of gravity. For these institutions, the loss of .54% in net interest margin in the past three years has hurt badly, essentially flat-lining revenue even as assets grew.

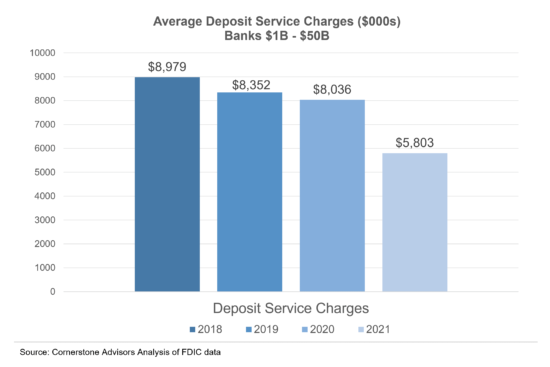

Unfortunately, mid-size and community banks are margin-dependent machines, where noninterest income only comprises 25% of operating revenue. Additionally, continued payment alternatives and COVID pressures have whacked reliable fee income items such as deposit service charges.

While Paycheck Protection Program (PPP) and mortgage banking loan gains have buttressed income in the short term, most bank CFOs are already looking at a 2022 budget that is even more difficult than this year. Here’s the real bummer: all of this curtailed revenue is happening at the same time as banks face extreme pressures to reimagine their businesses around digital, analytic and automation technologies. This shift requires resources and dollars, and there’s a shortage of both right now.

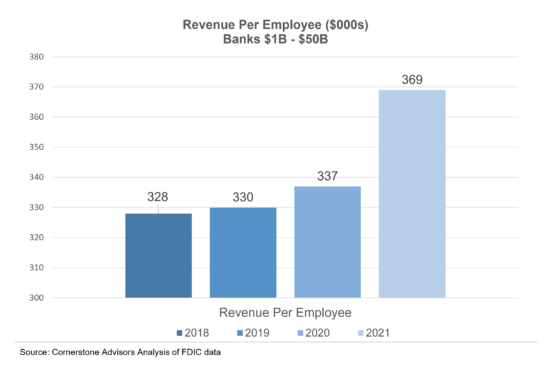

Banks have responded to these revenue pressures by slowing their headcount growth. As the chart below details, new frontiers of revenue per employee will be expected going forward.

For bank executives looking to remain competitive and transform their organizations with a lot less margin revenues to fund the effort, there are five major priorities to pursue right now.

Management teams have three major places to look for expense reductions that can offset new investments: vendor contracts, branches, and operational spending. Deeper analysis and more active management in these areas easily opens millions of dollars to reallocate to future-facing investments.

The harsh reality in banking is that the next wave of growth must come with a few surgical adds to staffing. To effectively flatten compensation expenses, executives need to benchmark every role and function – get granular to get to the truth and set ambitious staff productivity performance indicators for future years.

Banks that grow entrepreneurially in the next era will not rely on informal recruiting within their “friends” network. Instead, aggressive talent functions will attack the market with clear tactics around recruitment, development, performance-based pay, and retention. It will be a bare-fisted battle for the best revenue producers, and human resources teams will need to step up creatively to be part of the solution.

While “agile” may be a buzzword these days, this word gets to the core of how banks must execute in the future. Big long projects need to give way to continuous sprints that are laser-focused on specific business outcomes. “Implement a CRM system” fails the agility test. Yet, “Increase internal referrals 200% by deploying a focused referral management module” passes with flying colors. Executives must quickly force this language shift in their cultures to get better results from execution.

In today’s low-rate revenue recession, it’s tempting to take on more credit or interest rate risk to fill the earnings gap. Really bad idea. All executives should remember that banking is about the long game. Brave leaders will set realistic earnings expectations with their boards during this “bridge” time and be prepared to deploy capital and liquidity to rational deals as they arise. Achieving this level of patience is easier said than done, but the disciplined will be the winners when the external landscape begins to shift. Never forget the fundamentals of sound management, even when things are simply bizarre out there.

Finally, in this crazy environment, one overriding reality must be remembered: long-term revenue growth will come by an expanded base of customers who perceive value to a point where they throw a provider business and recommend the company to others. It’s that simple. As banks work to navigate through the revenue recession, every decision must be governed by the mandate to preserve goodwill with existing and prospective customers. Any short-term move to fill earnings shortfalls on the backs of customers will backfire spectacularly. They’ve got lots of choices these days that are a smart phone click or a Zoom session away.

The best leaders will come through these challenges in creative ways that end up making the organization stronger in both delivering a best customer experience and scaling much more efficiently. So remember, GonzoBankers, don’t let a revenue recession go to waste.

At Cornerstone Advisors, our goal is to deliver tangible business impact to banks and credit unions. Let us show you how laser-focused measurement coupled with strategic execution can translate into smarter technology choices, reengineered critical processes, and more profitable business decisions.

Visit our website or contact us today to learn more.

This might be the best summary of the current challenges and likely solutions that I’ve ever read. For the loan officers it sounds like the old t-shirt saying – “The beatings will continue until morale improves.”

Another homerun article by the GonzoBanker gurus. Spot On my friends!