It has become crystal clear that digital transformation is now the largest technology initiative for regional and community financial institutions. As information technology departments move from being the provider of all technology services to orchestrator of technology innovation, chief information officers are rightfully asking, “How do we reinvent ourselves in this digital age when we’re saddled with legacy tech debt of 30-year-old, difficult-to-integrate, flat-file-based core systems?”

My colleague Steve Williams observed in What’s Going On In Banking 2021: Rebounding from the Pandemic, “Many banks that were taking an incremental approach to digital were shocked into reality during 2020, and executives realized greater investment and faster transformation is needed to stay relevant.”

Maybe this is the new reality for community bankers, but Cornerstone Advisors is seeing little evidence that they’re serious about implementing a comprehensive digital strategy. Only one in five bank executives surveyed for What’s Going On In Banking think their core vendors have made significant contributions to their digital transformation efforts. Topping their list of complaints: speed to market/pace of new improvements (or lack thereof) and integration challenges.

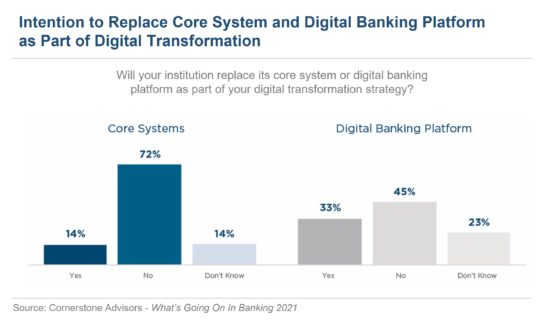

If bankers are this frustrated with their core solutions, why is it that only 14% of these surveyed banks plan to replace their 20- to 30-year-old cores as part of their digital transformation efforts?

The Big 3 core vendors are loath to use the term “sunset,” but they are essentially doing just that to a number of tried and true, reliable systems, nudging FIs to evaluate their options.

At the same time, they’ve been busy buying payments and digital companies, causing many FIs to wonder whether these vendors can be relied upon to provide core, digital and payments solutions – or if they are really just payments companies now selling core to drive more payments.

There is no question that a financial institution’s core system needs to be part of its digital transformation journey. But we understand not every institution is working at the same pace and with the same end goal in mind. To help banking executives choose a course of action that will accommodate different budgets, business cases, and visions for the future, we present three winning core strategies:

Many banks and credit unions have a value prop that doesn’t require a strong core. Maybe they’re executing on a low-cost or specialized product strategy. Commoditization enables these financial institutions to minimize the importance of the core vendor and therefore lower their core spend. This is a low-cost, low-benefit, low-risk approach for institutions that don’t need a first-tier core or that want to redirect their technology dollars to other, more strategic initiatives like digital or new lines of business.

As regional banks get tired of waiting on the international and next gen core options, many have “de-coupled” or “de-risked” their core and now just use their core vendor for commoditized processing like consumer deposit and consumer loan servicing. They then redirect their core savings to pay for more specialized “core-like” processing needs from a Black Knight for mortgage servicing or an AFS for commercial loan servicing.

There are typically two keys to a successful commoditization strategy. The first is maximizing the cost savings from their core vendor using effective contract negotiations. The second is based on whether and how the institution needs to integrate with third parties. Is the existing core integration adequate? Does the financial institution need to move to the core’s newer API-based middleware solution, and at what cost? Does it need to invest in third-party middleware solutions like Mulesoft to work around core limitations?

Many FIs are on perfectly serviceable cores, but they haven’t maximized the value of those investments. Maybe they have not yet invested the time to redesign their processes to take advantage of core-driven automation. Many are missing important core add-on modules like workflow or haven’t explored robotic process automation (RPA) to gain more efficiencies. An optimization strategy enables an institution to increase the ROI on its core spend without the time and expense of replacing the system – essentially, it’s transformation “lite” without the conversion.

An optimization strategy also can work for institutions that have long-term plans for transformation but have too many other initiatives going on – digital projects, payments upgrades, mergers, etc. – to tackle core right now. For these institutions, a slower, departmental optimization rollout can drive measurable results without the enterprise-wide interruption.

The key to success for most optimization strategies is a focus on functionality-, workflow- or integration-driven process improvements that ideally come from core but sometimes from third-party CRM, analytics, and RPA systems. So once again, integration models and tools are important.

In What’s Going On In Banking, Ron Shevlin, Cornerstone’s research director and author of the report, observed: “Banks will find out that if they don’t replace their core systems, there may be no digital ‘transformation.’”

The transformation strategy is the CIO’s or CTO’s once-in-a-career chance to transform business processes into something significantly better while modernizing the organization’s tech stack. It’s reimagining the financial institution’s processes from a customer, efficiency, and risk management perspective without being constrained by dated technology or the old way of doing things.

Transformation is a high-cost, high-benefit, high-risk enterprise initiative that has the potential to make an institution nimble, improve its customer and user experiences, and realize advanced process efficiency.

Transformation strategy success is measured by customer-facing key performance indicators (KPIs) such as five-minute-or-less account opening across digital, call center and branch channels; efficiency KPIs such as a 50% reduction in ACH exception processing times; and risk management KPIs such as 95% compliance on the FI’s check hold policy.

Achieving this desired state of improved processes, integrated third parties, accelerated time to market with new products and fintech partnerships, and better data and analytics takes an enormous investment in time and capital. It also requires both top-down and bottom-up commitment as the institution will be breaking down departmental siloes and developing new ways of managing risk.

As this article points out, a core system replacement may not be in the cards for every institution. At least, not right now. But it is definitely time to make a strategic decision and move forward with a plan.

Author’s Note: Thanks to Steve Wildman and Scott Hodgins for their contributions to this article.

Good insights as always. The core is a pretty big elephant. I liked Fiserv when I worked with it. I think a fourth strategy is to limp along as long as you can and then sell the bank when you are so far behind in the technology curve that there is no catching up. Also, what ever happened to the “Data Warehouse”. Since interfaces to the core, with other software applications, are expensive and problematic just park all the data in a place that does support web services and is easily integrated with all the cool, whiz bang, innovations. I used to joke that the most expensive gesture in technology was the one where the sales person interlocks their fingers and says “then we’ll build an interface.”

Thanks Bill. For banks looking to sell, shortening your contract term and minimizing liquidated damages are at the top of the list of core considerations. Re: data warehouses…they haven’t become the panacea everyone hoped for, in part, because of what you picked up on – interfaces. Also, those projects tend to become unwieldy with more focus on getting the data into the warehouse than on what you’re going to do with the data. I think killer use cases drive successful data warehouse/BI projects.

Do reliable, proven, compliant cores that actually allow you to do #3–Transformation–exist? It seems like their may be more international core options than there are cores that meet the needs of a US domestic bank. I suppose it depends somewhat on how outdated your current core is. Some cores that have been around a long time seem to have kept up to date better than others.

Mike, there absolutely are proven, US-based cores that can support your transformation options. While none are perfect, when you combine continuous process improvement with the right core for your target state environment, the ROI can be compelling. The ROI on the international solutions is a bit trickier for branched banks, but the Zions story shows promise.