There’s a great line in the movie The Princess Bride: “You keep using that word. I do not think it means what you think it means.”

“Inconceivable” is the word the movie character was referring to, but if we were to apply this quote to the banking industry then the word that is constantly being used is “digital transformation” — and based on Cornerstone Advisors’ research, most banks have no idea what it means.

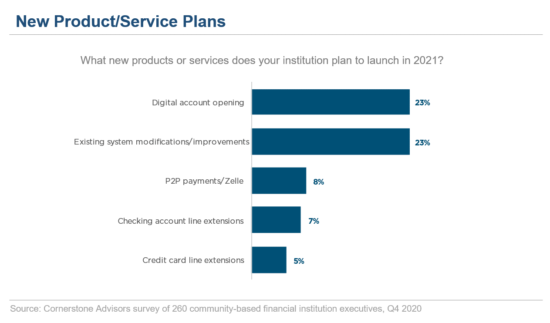

In our annual What’s Going On in Banking survey, Cornerstone asked executives at mid-size banks and credit unions, “What new products or services does your institution plan to launch in 2021?”

The number one answer was digital account opening, which tied with existing system modifications/improvements.

This is a perfect window into most banks’ thinking on digital transformation: “There’s nothing wrong with our products. We’re losing ground to neobanks and other fintech companies because we haven’t digitized the delivery of our existing products and services. Therefore, our first priority for digital transformation must be digital account opening.”

I have bad news — there is something wrong with most banks’ products. It’s why traditional banks of every size are losing ground to neobanks in the fight over primary checking accounts. It’s why buy-now-pay-later has suddenly become one of the hottest sectors in consumer banking. It’s why Stripe is the most highly valued venture-backed private company in the U.S.

The trait that all of these companies share is that they are laser-focused on solving the entirety of their target customers’ problems.

This means building innovative financial products, yes, but more importantly, it means embedding those products into larger, interconnected ecosystems where their customers can go to address bigger, more meaningful problems; problems that often have little to do with financial services in the minds of those customers.

The shift from products to ecosystems is having a profound impact on the competitive dynamics within the financial services industry. Banks that hope to successfully navigate this shift and position themselves for long-term success need to completely revamp the way they are thinking about digital transformation and focus, first and foremost, on building digital ecosystems for their customers.

Want to learn more about how financial institutions can build digital ecosystems? Don’t miss my upcoming webinar with Newgen Software: