Credit is an essential tool for building financial health and resiliency. The problem with using an individual’s credit rating as a metric for financial trustworthiness is that the on-ramps to establishing credit are deeply flawed.

It is estimated between 45 and 60 million U.S. consumers are unable to access mainstream credit products. This eye-opening statistic makes it that much easier to understand why fintech companies are interested in making the problem of credit invisibility a priority in their product roadmaps. The challenge is that, unlike overdraft fees, it’s surprisingly difficult to build a good wedge product around the problem of credit invisibility.

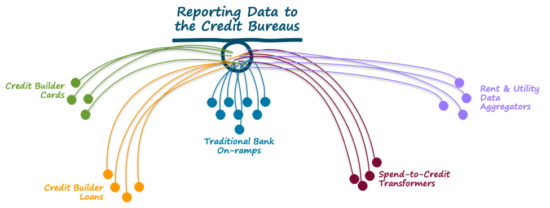

Credit builder products are financial products designed to help consumers establish and develop positive repayment data that can be reported back to the three credit bureaus.

The problem: it’s really difficult to build a product that is novel, holds appeal to consumers and proves effective at responsibly improving consumers’ credit scores. It’s a bit like shooting a basketball: the farther away from the hoop you get, the more your shooting percentage decreases.

Let’s run through a few examples:

These cards, offered by fintech companies such as Chime, Varo, cred.ai, and Step, automatically set aside money from a linked deposit account, ensuring that customers always have the money necessary to pay their bill at the end of the month. Credit builder cards eliminate the risk of default. When the bill is paid, the card provider reports the repayment to the bureaus, boosting the customer’s credit score.

Credit builder cards are great for consumers, but the concern is that the repayment data generated and reported to the bureaus (which is almost guaranteed to be positive) isn’t the most reliable signal for those customers’ willingness to repay future debts.

Installment loans don’t fully pay out until after the customer has already paid them off. Offered by fintech companies such as Self, SeedFi, and MoneyLion, these products are essentially reverse loans.

To put it mildly, credit builder loans are not great for consumers. These loans are marketed as products that allow you to “save money while building your credit,” yet the costs of the loan (fees and interest) far outstrip the yield that customers get on their “savings,” ultimately making them an expensive option for establishing and building a credit history.

These lines of credit or installment loans allow consumers to pay for stuff they are already buying, essentially transforming existing spending into credit transactions that can be used to build consumers’ credit histories.

Unfortunately, these transformers are flawed in that they are essentially the worst of both worlds. Similar to credit builder loans, spend-to-credit transformers are expensive. Transformers offer little-to-no value unless consumers are willing to pay fees and possibly interest.

These services — provided by companies such as Experian, LevelCredit and Perch — confirm, collect, and furnish data to the credit bureaus regarding how consumers are paying their rent and utilities such as Internet service, electricity and even Netflix subscriptions.

Reporting new data to the credit bureaus sounds lovely, yet it only makes a difference if that data influences credit scores and proprietary underwriting models lenders use to make credit decisions.

The most successful fintech companies such as Chime and Cash App are product development machines. You feed in customer problems/frustrations/annoyances and the machine spits out new products and product features to address them.

Credit invisibility is the rare banking problem that breaks this machine.

Trying to build a differentiated solution that doesn’t require customers to do anything different from what they’re already doing and still produces reliable willingness-to-pay signals that the credit bureaus will accept is a difficult challenge to surmount. This problem issimply too onerous to allow for the elegant solutions that fintech product designers prefer to create.

In order to start making meaningful traction on solving the credit invisibility challenge, fintech companies need to enable banks and other fintech companies to change the constraints of the problem. The focus must be shifted away from making difficult shots. Instead, the focus should be on making the hoop itself that much larger.

Start with first principles. Identify the specific segments of consumers that struggle with access to credit: young adults, recent immigrants, military veterans, and even older consumers who have stopped using credit and have seen their credit histories dissipate. Think deeply about the structural challenges in lending responsibly to these groups and focus on building the infrastructure necessary to address those structural challenges.

Granted, this approach isn’t easy. It doesn’t neatly fit into a two-week product development sprint. Rather, this approach takes patience and significant upfront investment. However, in the end it is worth it. The impact on both the fintech company itself and the broader industry (over time) can be significant.

Perhaps most important is the benefit shared by credit-conscious consumers and financial institutions seeking credit-worthy loan applicants. It is in the interest of each of these parties to facilitate the transition out of credit invisibility to credit visibility that sets the stage for mutually beneficial lending.

This post is excerpted from Solving the Credit Invisibility Problem, originally published June 7 on the author’s blog, Fintech Takes.