The banking industry has been trying to define digital transformation for the past decade. The thing that everyone seems to have finally agreed on is that digital transformation is a journey – a phased approach focused on continuous improvement across various systems. This article defines the critical nature of payment systems along a financial institution’s transformation journey and explores when a payment hub makes sense as a solution to an oft-fragmented collection of systems for processing ACH, wires, checks, P2P, and instant payments.

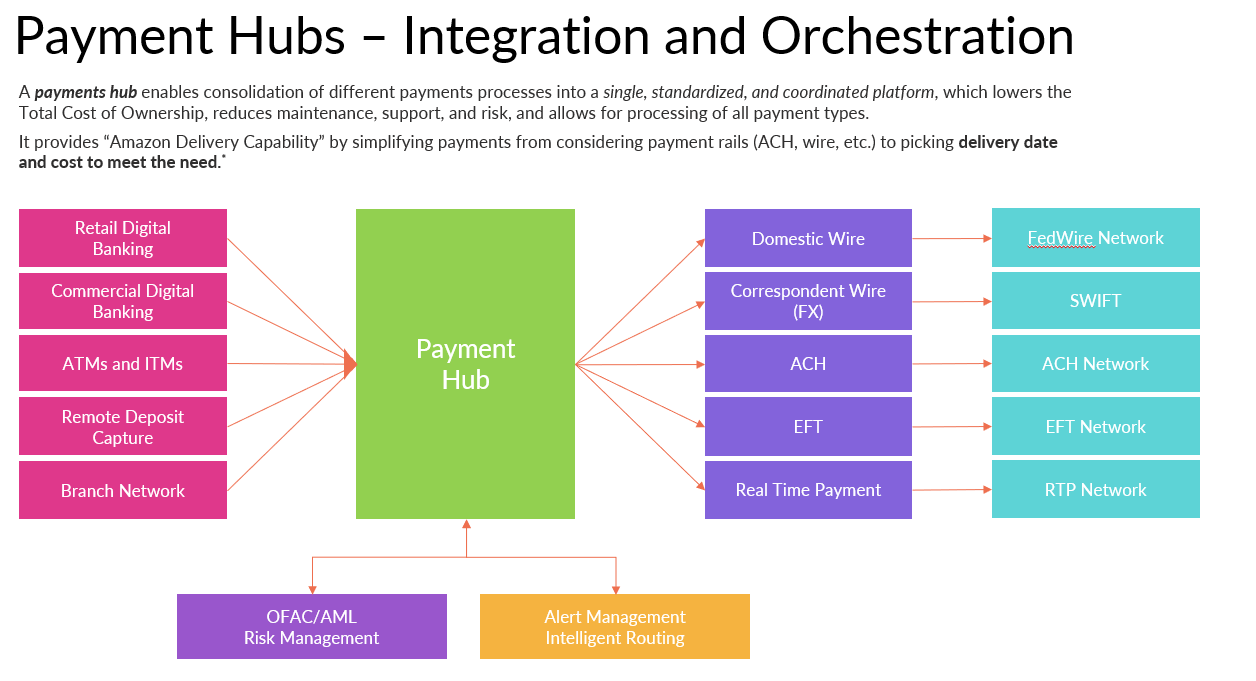

First, a little background on payments. Payments are processed on “rails,” the infrastructure that carries money between a payer and a payee. Like rails for a train, payment rails allow money to travel between banks and customers. A payment hub would enable the consolidation of different payment types into a single platform. Rather than end users sending a wire transfer or originating an ACH transaction, payment hubs provide a simplified customer experience with easy-to-understand options (e.g., delivery date and cost) and the associated different cost levels for each (“I need $5,000 to get to this person by this date and I do not want to pay for it.”)

With a payment hub in place, end users identify the payment attributes, to whom they are sending money, the amount of the payment, and when it needs to arrive. Based on these selection criteria and the agreed-upon cost of the transaction, the payment is routed to the appropriate payment rail within the hub.

As payments become more fluid, flowing from rail to rail based on delivery requirements, financial institutions need the means to consolidate multiple payment rails. Payment hubs give financial institutions a singular view of all incoming and outgoing payments, which enables them to establish cross-functional operational resources and manage holistic payment risk. Payment hubs also display a comprehensive view of account balances at the FI level, giving a clear view of daily liquidity, an area of increased importance given the fight for deposits and recent industry events and concerns.

Payment hubs provide a lower total cost of ownership through the reduction in maintenance, support, and operational resource requirements to complete daily payment processing. Many financial institutions still segment their operations by payment rail, leading to a siloed back office and a disparate view of customer behavior. A payment hub allows financial institutions to restructure their back office teams into the more cross-functional, diverse teams they need in order to scale and handle more complex payments and new payment rails.

Why is it important to look at a payment hub today? One significant factor is a steady adoption of instant payments, the first new payment rail in nearly 40 years. In addition to The Clearing House Real-Time Payments (RTP) network, the Federal Reserve announced that in July it will finally launch its FedNow product, increasing instant payments access to a significant number of financial institutions and U.S. households and businesses. Jane Larimer, CEO of NACHA, has discussed how the addition of FedNow and RTP adoption will undoubtedly provide competition to the ACH network while also filling gaps left by today’s payment rails.

Financial institutions should consider a payment hub if they have one or more of these situations:

As with all technology solutions, no single provider is the perfect fit for everyone. It is important for a financial institution to understand the vendor landscape and what each provider offers in order to partner with a firm that will fit its specific business needs.

By implementing a payment hub, financial institutions can truly modernize their payment systems, ultimately bringing increased efficiencies, an updated user experience, and the potential for new revenue streams to a foundational area of the institution.

In this episode of the What’s Going On In Banking podcast, Cornerstone Advisors’ Ron Shevlin and Peter Davey, senior vice president and head of product innovation at The Clearing House, discuss the upcoming FedNow real-time payment service, its impact on banks and credit unions, and the technology behind it.

Listen to the podcast on your favorite platform.