Is a Zombie Core Eating Your Bank’s Brain?

Being on a zombie core doesn’t have to end in an apocalypse, as long as you know how to manage the system – and the vendor.

I recently heard a banker refer to his institution’s core banking platform as a “zombie core.” They’re not alone; the core system landscape is littered with platforms still in use but with no hope of reanimation.

As we know from a variety of movies and TV series, zombie cores can come in different forms:

Night of the Living Dead

Like the undead in the granddaddy of zombie movies, zombie cores can infect the living cores around them. Major vendors with multiple core solutions in their portfolios can turn off bank and credit union clients to the entire brand because of staff attrition, declining service levels, and a lack of product evolution in an aging zombie core division.

The Last of Us

The title of this year’s hit HBO series should resonate with financial institutions remaining on some zombie cores. Scrounging for what few enhancements are available, banks and credit unions have experienced the loss of familiar, knowledgeable vendor resources to rely on for support and are finding themselves with scarcely any peers to collaborate with.

Warm Bodies

This zom-rom-com told the story of R, a zombie, and Julie, an uninfected girl. Some zombie core vendors have loyal followings who, like Julie helping R hide his rotting flesh with layers of makeup, keep their core usable through customization and the implementation of middleware to integrate complementary solutions.

Vendors may roll out a new user experience (UX) in an effort to extend the life of the core, but unless this fresh makeup is accompanied by meaningful product enhancements and architectural upgrades, the effect is simply postponing an inevitable “living dead” state.

Spotting the Signs

Here are five key identifying signs of a zombie core:

- No Sales. New clients not only bring new revenue to reinvest in a core product, but they often bring new requirements and new third parties with which to integrate – enhancing the product for all clients. Conversely, client attrition results in fewer and fewer investment dollars going back to the product, leading to greater client dissatisfaction, increasing departures and vendor staff turnover, all of which further degrade service.

Emerging third parties looking to grow market share may not invest in integrating with core solutions that have declining client bases. - Legacy Tech Stacks. Just as zombies in the movies stagger around aimlessly, legacy architectures impede the agility of zombie cores. Vendors, particularly those with multiple core solutions, avoid the cost and disruption of modernizing the technology in their zombie cores.

If a bank’s core vendor’s roadmap does not include consistent milestones achieved in the modernization of the architecture, the team could be headed for Zombieland. - Look and Feel. The rotting flesh is a dead (sorry) giveaway for zombies. Zombie cores have unintuitive navigation based on arcane transaction codes or tabbing between fields.

While vendors may make certain user interface changes, it’s easy to smell what’s underneath the makeup and recognize the new UI as a distraction from an aging tech stack and a lack of new features. - Staff Attrition. Just as body parts slough off zombies, experienced developers, support staff, account representatives and management have left the zombie cores, resulting in continued declines in support levels.

Vendors have attempted to minimize the optics and impact through reorganization, often consolidating development and support teams across multiple core solutions, leading to the unintended consequence of dilution of remaining expertise. - No New Partners. While they may travel in packs, zombies are loners. Fintechs looking to increase their market will invest their R&D dollars in integrating to core solutions with vibrant, growing client bases. Additionally, legacy architectures present greater integration complexity than those with application programming interfaces built on modern development standards.

Financial institutions running zombie cores may run into resistance when looking to integrate an emerging fintech solution with their core platforms.

Zombieland

Rules for surviving the zombie apocalypse were sprinkled throughout Zombieland. Similarly, if you are on a zombie core, there are ways you can more effectively manage the system and the vendor until you decide to migrate off the platform.

- Negotiate. Banks and credit unions getting decreased value from their aging cores need to adjust the price they pay for these solutions and use the savings to fund the surrounding tech investments and temporary workarounds to keep the organization moving forward.

- Use the tools at your disposal. Many core solutions have scripting tools that allow financial institutions to develop their own customizations, and there are often third parties that can assist with developing capabilities outside of vendor-provided enhancements.

- Don’t isolate yourself. Identify peer clients on zombie cores with whom you can share best practices or partner for paid enhancements in lieu of a viable product roadmap.

- Have an exit strategy. No one wants to be the one who turns off the lights. Ask your vendors for a list of new sales (not renewals) with specific client names for the past two to three years. Additionally, ask for the names of clients that have migrated to other platforms. Use these tactics to start planning for an eventual conversion:

- Develop a core strategy that de-risks an eventual core migration

- Lay out a timeline, gain an understanding of costs and get early board buy-in

- Consider opportunities to commoditize the core by moving core features such as general ledger, mortgage servicing and account opening to best-of-breed solutions

- Deploy a middleware solution

- Begin data cleanup

- Start due diligence of possible replacements

Being on a zombie core doesn’t have to end in an apocalypse – your particular situation may not require immediate action. Core conversions are expensive and disruptive to a bank’s operations and may not always be a necessary strategy.

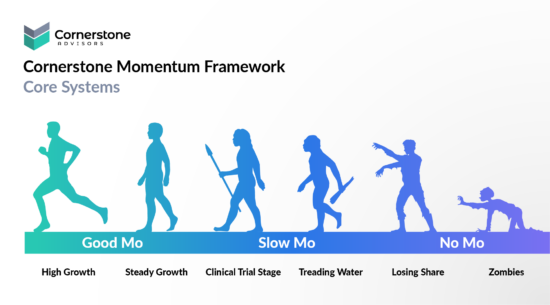

Is your institution on a zombie or does your core have a long, healthy life outlook? Are you somewhere in between? Cornerstone Advisors maintains extensive research on the core banking market that includes vendor wins/losses, migrations, solution road maps and talent movements within the industry. Our framework allows us to evaluate each market vendor along a momentum spectrum and which core best fits with a bank’s or credit union’s strategy, operating model and financial appetite.

Financial institutions are invited to join Cornerstone Advisors on Halloween for an exclusive webinar when we will share objective perspectives on the high-growth players in the market and which cores are falling into the zombie category.