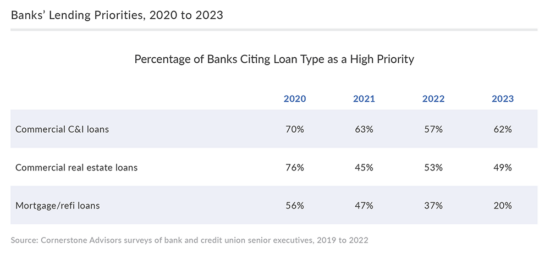

Senior bank and credit union executives have ranked commercial and industrial (C&I) loans as a top lending priority over the past several years in Cornerstone Advisors’ annual What’s Going On in Banking research. But further analysis shows the execution is not measuring up. So, what’s the problem? Let’s explore the numbers, the challenges and tips for a winning strategy going forward.

A review of bank call report data from 2016 to 2022 for over 4,200 banks with assets of less than or equal to $70 billion reveals that:

If C&I has consistently ranked so highly in the minds of lenders, why have we seen so little change? In a nutshell: real estate lending.

Most of the talk about commercial lending is currently focused on commercial real estate and market conditions for office properties. Certain characteristics of CRE and mortgage/refis make C&I lending an unfamiliar and potentially uncomfortable segment for banks and credit unions:

Sales Cycle – Unlike real estate, C&I lending doesn’t present a consistent flow of applications and opportunities. C&I relationships require a financial institution invest time into building new networks and be ready to displace the incumbent when the opportunity is presented.

Credit Risk Appetite – Changing from real estate lending with its tangible collateral and emphasis on loan-to-value, rent per square foot and debt service coverage to C&I lending with at least a portion of the collateral considered intangible (such as accounts receivable or, worse yet, enterprise value) and the emphasis on cash flows, fixed charge coverages and working capital cycles is a fundamental shift in credit risk evaluation and monitoring.

Treasury Management – To displace an incumbent financial institution, the full relationship must be converted, not just the loans. Account analysis, positive pay, ACH, wires and many other services are of equal importance when it comes to building the C&I portfolio. Without a strong treasury management offering, a bank or credit union will only have transactional opportunities (equipment purchase, for example) resulting in marginal improvement at best.

Digital Engagement – With C&I comes more frequent engagement/monitoring activities. Quarterly financial statements, monthly borrowing base certificates with A/R agings, frequent line of credit draws and paydowns are things not typically performed digitally when most of the portfolio is real estate. Cornerstone’s finding that an estimated 50% of banks and credit unions do not have a commercial platform to support this type of digital engagement only increases the complications to achieve the needed digital engagement.

With all of these challenges, is C&I worth it?

Our analysis of key performance numbers comparing the top 20% C&I banks to the rest of the banks from 2016 to the third quarter of 2023 reveals that only 10% of banks with the minimum 18% of their loan portfolio in C&I loans in 2016 were able to rise to the top 20% in 2023.

The top 20% had an average of 24.27% of loans in C&I, more than two times the middle 60% at 11.89% and almost five times that of the bottom 20%, which had only 5.55% in C&I.

Those in the top quintile outperformed the other 80% as it relates to:

Looking at the above performance differences (plus many others noted in the full analysis), I have a hard time seeing the disadvantages of a strong C&I portfolio.

So the big question is, when should a bank or credit union start the initiative to grow its C&I portfolio?

The answer is, RIGHT NOW!

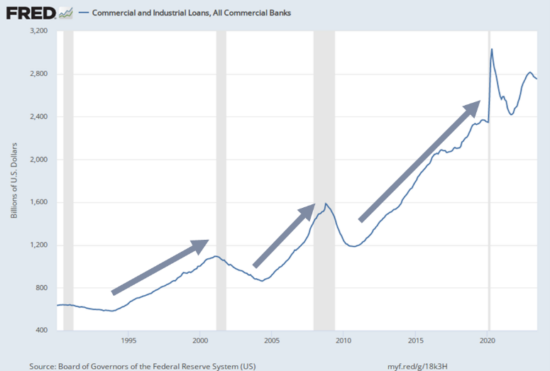

Trends in total commercial and industrial loans from 1990 to 2022 reveal significant growth in C&I following an economic slowdown or recession. It seems obvious that when the economy shrinks, so would C&I loans, and when it is growing, so does C&I lending.

With the Fed completely focused on bringing down inflation with increased interest rates and the intent to create some type of recession or reduction in GDP, we know that afterward, the focus will shift back to economic growth, and that means growth in C&I loans. One sign that we may be at the start of the slowdown is that C&I loan balances have declined in each of the past two calendar quarters.

Should banks and credit unions just wait for the economy to go through the slowdown/recession and when growth returns start to pursue C&I? No. Those that wait for the rebound are already behind the competition.

There is minimal downside risk to start prepping now for the rebound to take full advantage of the future growth opportunity. We recommend incorporating these activities in your 2024 C&I lending strategy:

Through it all, maintain patience and persistence. C&I is playing the long game, and early quick wins will be few and far between. But that said, C&I lending is worthy of being a high priority at any financial institution. The performance benefits are evident, and the future growth opportunity looks to be on the horizon. So, lenders, PUMP IT UP!

Great article Joel. Do you happen to have any data on RLOC utilization? Many business owners used excess cash (and PPP funds) to pay-down their line of credit balance as interest rates increased. Have banks begun to see utilization increase to pre-PPP levels yet? A small increase in line usage would have a significant impact on C&I loan balances, even for a small bank like ours.

Rob,

Sorry for the late reply. Unfortunately I do not have any data on the line utilization, just the actual total outstanding balanced. You make a good point about the actual outstandings and the impact the PPP funding had on any balances.

Great points Joel! Good stuff and spot on from my perspective. Now is the time to get going if this is part of your bank’s strategy.