Esteemed Gonzo readers, let’s get right to one of the core challenges in banking. There is immense pressure for financial institutions to generate tangible returns on technology investments, and core systems are a critical variable in supporting or hindering these returns.

Cornerstone surveyed over 300 community banks and credit unions and found that more than 60% are not satisfied with their current core provider across several categories. At the top of this list were two things: 1) The vendor’s ability (or willingness) to integrate third-party systems, and 2) Poor execution of the vendor’s enhancement and new product road maps. As Cornerstone Chief Research Officer Ron Shevlin concludes in What’s Going On In Banking 2024, “Getting their core systems into shape has become either a nightmare or an impossibility for banks.”

Some financial institutions have recently converted core systems, but they haven’t seen material improvements to their customer experience or efficiency. Others still feel prisoners on what my colleague Steve Wildman calls “zombie cores” — core apps that haven’t been sunset and are no longer enhanced by the tech companies that provide them.

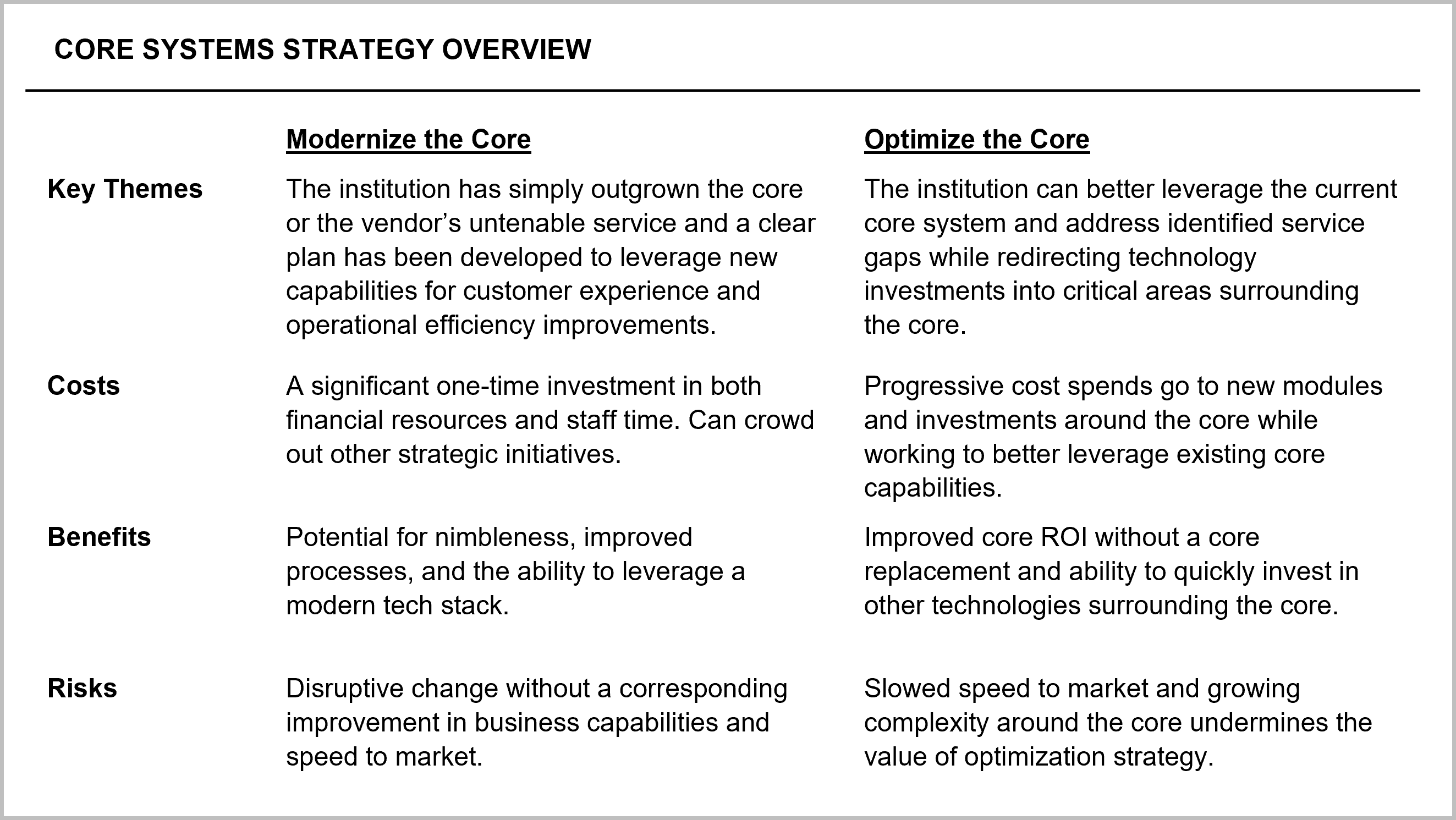

Moving to a new core system is a tough decision that executives may only face once or twice in their entire careers, and it’s not a strategic decision to be taken lightly. For banks and credit union leaders, there are two paramount questions to ask:

The decision to go through “heart surgery” by replacing a core system should never be done emotionally because of day-to-day vendor frustrations. Based on priorities, an institution should choose a strategy that best captures its desired outcomes and benefits.

At Cornerstone, our team led 32 bank and credit union conversions last year, and our firm knows first-hand that replacing a core system can be a resource-consuming and disruptive effort.

For institutions on a zombie core, the answer is fairly obvious. At some point, a migration to a different system must be completed. The only questions are when and to which alternative core system.

In recent years, the industry and trade media have tended to glamorize “next-generation core systems” as some magic tonic to technology transformation. However, with detailed due diligence, an institution will find new cores represent a risky, lengthy and distracting journey for the organization’s tech team and staff. In addition, with social media users ready to expose any impact to customers, financial institutions are anxious about taking undue risks in a core systems project.

The balancing act question becomes whether the financial institution converts to a more proven core system that may lack some degree of next-gen technology or delay the migration until diligence concludes a new core player is market-ready and the risk is acceptable.

If the consensus is to proceed with a conversion to a new core system, financial institutions cannot waste a critical strategic opportunity. Core conversion projects typically span 18 months, and to achieve an ROI on this investment, the team must incorporate process improvements such as a new account opening, universal associate capabilities, card instant issue and month-end closing and balancing.

Because the tasks of data mapping, capacity planning, testing and training are so intense, there’s always a risk process improvement gets relegated to the back burner. Leaders need to challenge their teams to get gritty with new improvements such as how products are configured, how workflows are designed, how seamlessly forms are utilized, and ensuring there is a frictionless environment with third-party solutions.

Cornerstone often finds financial institutions highly frustrated with their core systems provider, yet they haven’t taken the time to review processes for inefficiencies and ensure that most of the current core capabilities are being utilized. Our consultants frequently find teams struggling because of bad habits or creating processes with unnecessary workarounds. A core system is only as good as what the end-user does with it. Executives should ensure their team has leveraged the potential of workflow tools, system configuration, electronic forms and additional product modules.

Often, a bank or credit union can optimize its core by reducing its role to a “system of record,” surrounding it with components that address important gaps in the existing platform. For instance, for a bank whose core does not fully support servicing complex construction or SBA loans, acquiring and integrating a best-in-class system can be a more pragmatic solution. The cost of these solutions can usually be offset through effective renegotiation of the current core contract to achieve savings.

This approach enables financial institutions to minimize the importance of the core vendor and therefore lower its core spend. This is a lower-cost, lower-benefit, but lower-risk approach for institutions that would rather prioritize their technology spending in areas like digital transformation, lending automation, data analytics, CRM and improved fraud/payments platforms.

So GonzoBankers, there are “pull your hair out” days with core systems providers — we’ve been there too. However, this decision must be a “leave your emotions outside the door” decision. Banks and credit unions need to make sure that the process used to determine the best action is data-driven, accountability-focused, and aimed at supporting the strategic plan with the best return on investment.

Gaining a real-world understanding of options in the core market and assessing how well the current core is being leveraged are two great places to start. Smarter banks will reach the next level of performance through smarter technology decisions, reengineered critical processes, and accountable team members who are ready to fully leverage any technology investment.

For your next executive team meeting here’s a quick core system “cheat sheet.”

Elizabeth Hollis is a director at Cornerstone Advisors. Follow her on LinkedIn.