Banking: It’s a financially leveraged industry run by financial experts who like to geek out on… well, finance.

These days the world of finance even dons matching uniforms with “Finance Bro” vests. And when these finance brothers and sisters think about a bank’s franchise value, they immediately reference equity capital.

According to the FDIC, the banking industry has roughly $2.5 trillion of capital today.

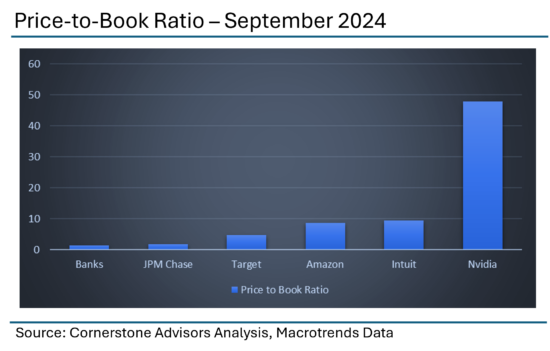

Bank valuation is typically expressed as a price-to-book ratio, and today the average bank trades between 1.5 and 1.75 times book value. Stock darlings like JPM Chase trade at 1.9 times book value. In heated M&A transactions, a bank may fetch twice the book value for shareholders.

However, as banking morphs into a niched and diverse, tech-driven industry led by knowledge workers, a new form of capital needs to enter the banker’s vocabulary: intellectual capital.

The Corporate Finance Institute defines intellectual capital as:

The value of a company’s collective knowledge and resources that can provide it with some form of economic benefit. It’s also used to identify a firm’s intangible assets and divide them into meaningful categories.

In today’s world, value is not created simply with physical or financial assets, but rather the institutional “smarts” that help predict future competitive advantage and earnings. For illustration, look at the price-to-book multiples of other companies versus the banking industry.

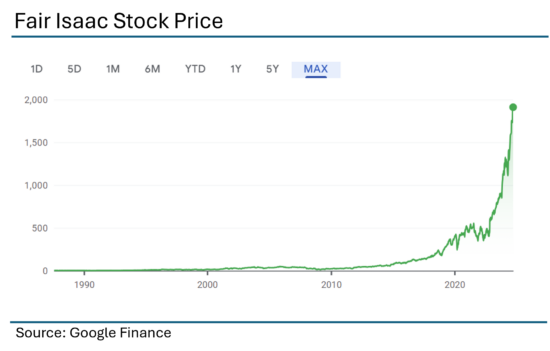

What’s noticeable? Certainly brand, technology and unique assets like patents play a huge role in what drives a company’s overall price-to-book value or “intellectual capital.” These are crazy times to watch Nvidia stock explode, but think about the patents, chip design expertise and AI market lead driving this rocket ship to shareholder value.

Executives may wonder: Are banks just different animals (like the old utility stocks), or can intellectual capital play a more significant role in future shareholder value creation? This answer is yet to be revealed, but banks that seek to enhance franchise value may want to reflect on how well their organizations are developing the three core sources of intellectual capital:

So Gonzo bankers, as the industry kicks into strategic planning for 2025, leadership should consider the following questions:

In our travels, the Cornerstone team sees certain Gonzo bankers conducting test-and-learn experiments with the creation of intellectual capital. Think about the niche capabilities and nationwide relationships Live Oak Bank has built with its SBA-driven small business platform. Think of small Citizens Bank of Edmond launching the military-focused digital brand Roger. Think of Eastern Bank developing the Numerated small business credit application and spinning out into an independent company.

Banking is a highly leveraged business, and it’s great that our industry has built an intense rigor around managing financial capital. However, in the new world of finance, Smarter Banks will transcend not just financial capital but also the drivers of intellectual capital to achieve the greatest value creation over time.

Let’s go, future Smarter Banks!

Steve Williams is a founder and chief executive officer of Cornerstone Advisors. Tune in to Steve’s Plugged In podcast and follow him on LinkedIn and X.