2017. One word can summarize this action-packed banking year, GonzoBankers – tiring. This year brought us:

Well, you can cross the last one off your list, because THE AWARDS ARE HERE.

It’s time to toast the conquerors and skewer the laggards, GonzoBankers. Seriously, sit back with a pocket flask of Pappy Van Winkle, smoke a cigar (or your combustible of choice if you live in Colorado, California, Washington, Oregon, Nevada, Maine or Massachusetts) and enjoy the 2017 GonzoBanker Awards.

And then invest in at least one nap per day as you glide through the no-work last week of December!

GonzoBanker of the Year – The Gonzo team would like to salute the career of David Rainbolt of BancFirst in Oklahoma. Rainbolt has quietly built a community bank in the past 20 years that is closing in on $2 billion of market cap. Our hats off to BANF’s stock performance during Rainbolt’s two-decade stint as CEO.

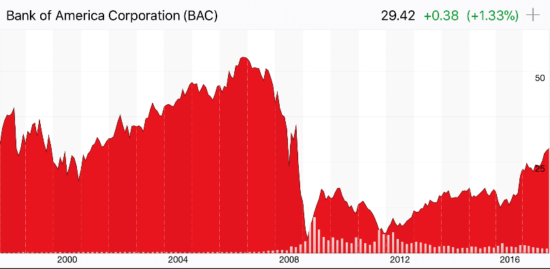

GonzoBanker of the Year – Large Banks. While the Gonzo team loves to celebrate our mid-size entrepreneurial banks who “stick it to the man,” we also need to extend a GonzoBanker salute to Bank of America CEO Brian Moynihan. A badly needed cost restructuring is being executed at Bank of America while the company’s digital prowess grows, and a stock once below $4 when TARP was passed is now approaching $30 nine years later.

Lifetime GonzoBanker Achievement Award – The Gonzo team was saddened by the Dec. 16 passing of Robert Wilmers, chairman and chief executive officer of M&T Bank Corp. For 35 years, Wilmers led M&T with creativity, integrity and the “old-school” wisdom of a community banker who created a $26 billion market cap company. All our prayers and thoughts are with the Wilmers family this holiday season.

Lifetime Gonzo Credit Union Leader Award – Goes in memory of Space Coast Credit Union CEO Doug Samuels. Samuels’ unexpected passing shocked the credit union industry, and the entire Gonzo team salutes the integrity, creativity, wicked smarts and passion that Samuels brought to his credit union and the entire industry. We are all sending our thoughts to the Samuels family this Christmas.

Merger of the Year – The Gonzo team salutes the collaboration of Claude Davis of First Financial Bank and Archie Brown of MainSource Bank for working together to blow past the $10 billion asset threshold to create a solid $13 billion Midwest franchise. Also a great nod to the complementary roles the two will play as leaders going forward.

Best Bank Sale of the Year – Although it was early in the year, the Bank of North Carolina’s (BNC Bancorp) sale to Pinnacle Financial wins. BNC shareholders got a terrific premium, a 47% dividend increase, and a continued leadership role for Richard D. “Rick” Callicutt II, BNC’s CEO. Not a bad way to deal with approaching the $10 billion asset mark.

Best Bank Purchase of the Year – Goes to Heritage Financial for its strategic purchase of commercial niche player Puget Sound Bank. Bravo to CEO Brian Vance, President Jeff Deuel and team for a watershed expansion into the hot Seattle market with a bank whose commercial skills can complement those of its acquirer.

Strangest Sale of the Year – Was the first-failed and then convoluted spin-off and sale of BankMobile by Customers Bancorp to Flagship Community in Florida. While the darling of FinTech conferences, this divestiture seems primarily driven as a means of Customers delaying the $10 billion Durbin hit and maintaining quarterly EPS expectations from the Street.

Credit Union Merger of the Year – Goes to Lake Michigan Credit Union and its CEO Sandy Jelinski for acquiring Florida-based community bank Encore. Expect a lot more cross-breeding of deals between banks and credit unions in the years ahead. Hats off to Howard & Howard attorney Mike Bell for being the catalyst in this new segment of M&A.

The Jump the Shark Moment of 2017 Award – Goes to Aspiration, the challenger bank started by a former Bill Clinton speech writer with $47 million in funds from celebrities and celebrity investors. Aspiration’s PR materials state (and we quote): “The core product for Aspiration is its Summit personal banking account. The checking account provides 1 percent interest and is fossil fuel free. The checking account also lets its banking customers track their sustainability score by monitoring where they spend money and checking it against a sustainability monitoring and scoring system that Aspiration created.” Why does this remind us of Petloversbank.com and BancBowie from the dot.com era 18 years ago?

The “Hit Me Baby One More Time” Award – Goes to Wells Fargo. After the “fake sales” scandal of 2016, Wells was hit again with bad press on overcharging homeowners for appraisals, charging customers for unwanted auto insurance, and cooking records to charge more rate-lock fees to borrowers. These actions DO NOT represent the vast majority of Wells Fargo professionals, but they are symptomatic of an earnings culture gone wild. Here’s hoping a final remodel of the stage coach occurs in 2018.

The Get Outta Dodge (and Focus) Award – Goes to Capital One for exiting a significant mortgage business to focus on cards and direct banking. Takes big ones to walk away from a big business like that.

Platoon Talent Leadership Award – Goes to WSFS Bank’s Lisa Brubaker who, at Finastra’s client conference, pointed to hiring more free-wheeling advisory talent in branches, “backstopped by a sergeant.”

Gunslinger of the Year Award – Goes to Malauzai’s Robb Gaynor at BAI Beacon: “Banking is hard. Let Amazon be a bank. Then they’ll be just like BofA and we’ll kick their butt.” We love the quote and the attitude, Robb, but a total of no one is really kicking BofA’s butt right now. Hell, BofA continues to grow and prosper despite every poll we read saying customers hate BofA. And let’s be honest, no right-thinking banker wants any part of Amazon forming a bank.

The Real “Lending” Stock Award – Goes to longtime player LendingTree. We don’t know if bankers have noticed but LendingTree stock is up a whopping 350% in the past year, climbing to a frenzied market cap of $4.20 billion. Oh, by the way, that Fintech darling of two years ago Lending Club? It had another turd of a year. It will never regain its IPO value and it trades at one-third the market cap of LendingTree.

LendingTree Up but … LendingClub dribbles down

The Credit Unions Can Act Like Fintech VCs Award

Goes to new speculative and gutsy startup ventures in the credit union industry that include CUNA Mutual, AdvantEdge Analytics, the Constellation Digital Banking venture started out of Coastal Credit Union and the CU Ledger consortia now being led by former MasterCard executive John Ainsworth. These ventures show credit unions are not standing still when it comes to technological disruption, and we hope much is learned from these early risk-taking efforts.

The Just Kidding About the Whole Bank Thing Award – Goes to Fintech darling SoFI, whose management shakeup amid “behavioral issues” shifted the legal efforts from charter application to lawsuit and damage control.

Monty Python “I’m Not Dead … Yet” Award – Goes to physical retail. Malls, retail stores and even some bank branch closings proliferated in 2017. In some slower growth or declining areas of the Midwest, Mid-Atlantic and New England, retail is getting slammed. Even West Coast’s Umpqua Bank, once the purveyors of the store-first model in high growth areas, announced material closings, launched a digital first initiative in Pivotus and rolled out a new digital app BFF. At Financial Brand Forum, Umpqua Chairman Ray Davis pointed to the two industry CRE problems: 1. CRE loan concentration and 2. Branches.

The John Waite “I Ain’t Missing You At All” Award – Goes to our recently departed chairman of the Consumer Financial Protection Bureau, Richard Cordray. The Gonzo team understands the value of well-designed regulations and standards, and we too despise the “gotcha” behavior of Wells Fargo and other players who institutionalize manipulating the consumer. However, Cordray’s approach was too bureaucratic (look at TRID) and fostered a litigious tone where every financial institution was “guilty until proven innocent.”

The Lifetime Achievement Award for Financial Regulatory Leadership – Goes to Leandra English of the CFPB for her 15 minutes of fame trying to block the appointment of White House Office of Management and Budget Director Mick Mulvaney as interim CFPB Director. We will call it like we see it – this was pure divided political partisanship on both sides of the aisle. Let’s get back to negotiation and statesmanship.

The Bank Core Deal of the Year Award – Goes to the international core vendors. While the international players have had next to no real momentum in the United States, the press coverage and promises of a cooler mousetrap have stopped many mid-size banks from simply sleepwalking into another boring, domestic system. While the international players do not yet have many wins to their name, they have slowed market momentum for the domestic players, with many mid-size banks deciding to “give it a couple years” to see how the international vendors progress. Editor’s Note: We think the wait will be more like six or seven years before the international players have something meaty to brag about in the U.S. For core legacy vendors, there is a three-to-four year window to put some new technology sparkle in your solutions or risk being tagged for replacement.

The CU Core Deal of the Year Award – No brainer. This one can only go to Corelation signing longtime Symitar poster child and $5B trendsetter PSECU.

The “Fins to The Left, Fins to The Right Award” – Nominees include Finovate winning fintech platform Finn.ai, new Frank Sanchez core system Finxact, Fiserv acquired (from Monitise) FINkit, Vista mashup of Misys & D+H rebranded as Finastra, and … the award winner is … Finn by Chase. The simplest of all … and 24 X 7 service!

Brilliant Conference Idea Award – Goes to CSI for its Wall o’ Donuts during session breaks.

Batch Payments Award – Goes to Cornerstone’s own Steve Williams, who navigated a 10-minute line to pay for a batch of drink tokens with a credit card to barter with bartenders. At a banking conference. With sessions about the future of payments.

The Lending Mo’ Repeat Award – Goes to both nCino in commercial and Encompass in mortgage for maintaining strong market momentum in 2017. The Gonzo team hopes this revenue momentum is fed right back into the delivery of new functionality for these systems and support resources to match the sales success. Nice work in building two major industry platforms.

Demo Quote of the Year Award – Goes to ID Analytics, “Let’s go straight to the demo.”

Best Direct Hit on Venmo from a Zelle Evangelist – Goes to FIS’ Anthony Jabbour at FIS Connect: “I have six batch P2Ps in my trunk for free. Venmo is fine but if you want real time, go to a bank.”

The Crickets Chirping at the Trade Show Booth – Goes to Equifax. Hard to imagine a lot of deal signings headed into 2018 – except the IRS, of course.

The Credit Union Gutsy Vendor Award – Goes to PSCU for inking a deal with Jack Henry (JHA) to offer card processing services to community banks. An interesting precedent in financial institutions working across the aisle.

The Battle of the Garage Bands Award – Goes to all the new vendors hitting the market with new digital account opening and onboarding technologies. Nascent players such as Avoka, Grow, Zenmonics, and Bolts Technologies are joining players like MeridianLink, Bottomline and Finastra in one of the most important strategic initiatives for banks and credit unions in the next few years – the digital “front door” to the institution.

The CNN Award for Not Fake News – GonzoBanker is shameless and greedy, and we give this award to ourselves for predicting the not-so-hard-to-predict purchase of D+H by the new mashup Finastra. Incredulous D+H sales reps sent us poorly written hate mail and literally vowed to aggressively spread word about our industry naivete over our article. We say: Scoreboard.

Straight-Up-the-Middle Tech Quote of the Year: Former White House CIO Tony Scott at Fiserv Forum. “If your information architecture looks like your org chart, it’s a problem. Customers don’t care how you’re organized.”

The Mobile Success Metric Award – Goes to Anchor D Bank’s Guy Langham at CSI’s conference: “The key to mobile success is word of mouth from excited employees. Over 90% of ours use the app.”

New Hot Category Award: Marketing Automation. Horizontal applications Marketo, HubSpot and Salesforce Marketing Cloud are duking it out for who will drive your next email, drip and web page campaign.

The Not Using the Marketing Automation Well Award – Goes to marketing automation providers themselves. Following up from a booth visit with “Dear [Wrong Name]…”

Biggest Branch ITM User: The Security Guard

The “Oh, God, is This the Next Walmart Bank That Will Sink Our Industry as We Know It?” Award: Amazon’s acquisition of Whole Foods. As WSJ’s Dennis Berman put it: “Amazon didn’t just buy … grocery stores. It bought 431 upper-income, prime-location distribution nodes for everything it does.”

Economics Beats Politics Award – Goes to FTN Chief Economist Chris Low at ABA’s Community Banking conference. “When labor markets tighten, we turn to immigration. We’ve heard about a wall … and now we’re hearing about a door in the wall.”

The “Predicted Big Topic of 2018, But No Data to Support It” Award – Goes to Behavioral Economics. Michael Lewis’ new book shines a light on where data helps and where it doesn’t. Knowledge is being able to predict.

The Gonzo Spellcheck Award – Goes to the Baird Equity Research intern who corrected The Wall Street Journal’s frontpage misspelling of industry payments provider Vantiv as Vanity.

Business Book of the Year (If There Is Such a Thing) – Goes to Radical Candor

GonzoBand of the Year: Ween – GonzoBanker would like to thank Ween for entertaining the Gonzo team at our First Annual Compliance and Behavior Modification Symposium in Austin, Texas. After stints in rehab, the band has re-formed and is hyper-energized. This show featured a furious, extended jam during “Tender Situation” and a blistering guest vocal from an Austin local, Sarah Jones, for “Freedom of ’76.” If you find Ween in a city near you, RUN to see one of the most underrated rock guitarists alive today in Dean Ween.

Dang, we lost a lot of remarkable talent in 2017:

Given the Cornerstone team’s love of music and amp-kicking, guitar-smashing antics, we had to share our 2017 playlist.

For the Right Up the Middle Bankers Who Feel Rebellious Streaming Pop On The Treadmill

For the more expletively-open-minded hip hop listeners

For those enjoying some Latin flare

For the teary-eyed family values patriots

For the ostracized and misunderstood death metalheads

#Reality

We hope GonzoBankers everywhere have enjoyed our 2017 tirade. In the broader picture, this year didn’t meet anyone’s expectations. Extreme opinions everywhere, partisan politics and the darling digital channel becoming a Gatling gun of fake news and greasy propaganda – it felt deflating to the big bulging middle of Americans with common sense and sincere intents. Our Christmas wish and New Year’s hopes are that rationality, specificity, pragmatism and progress based upon compromise get a bit more muscle next year.

Whether it’s trying to solve national problems or deal with the digital shift and finding the right vendor partner, we will all be so much better off if we turn down the amps of social media and kick up dust working in #Reality. That’s why we started this Gonzo thing in the first place. Happy Holidays!