Despite a healthy economy, banks are closing branches at a record pace. According to a recent report from the Wall Street Journal, more than 1,700 branches closed in the last year. Data from the recent Cornerstone Performance Report for Banks supports this trend, with the average branch processing just three consumer loans per month. Can a bank making just three loans per month per branch justify the physical distribution of sales?

Big banks have been in the driver’s seat on growing their market share in retail, while paring down branch networks. Wells Fargo, Bank of America and Chase opened more new checking accounts in the last year than the next 17 largest banks combined and have more than 70 million total mobile users. Meanwhile, Wells plans to close 450 branches by 2019, BofA has closed 1,600 branches since 2009, and Chase closed 365 since 2015.

While this might all seem scary, it means bankers need to look at new ways to adapt and grow as customer expectations evolve with the times. This adaptation includes using mobile and digital channels, not just to provide the capabilities clients need and expect, but also to shift time and resources to other channels with more growth opportunities.

Much like a bank that over-concentrates itself on commercial real estate lending, banks that rely too heavily on physical channels for consumer and business customers risk attrition, lost revenue and increased expenses.

Consider these numbers from PwC’s 2017 Digital Banking Consumer Survey:

Similar trends also apply to business banking. Whether customers need to approve a positive pay, initiate a wire, or apply for a small business loan, digital has shifted from a nice-to-have capability to a must-have proficiency. Customers expect to be able to use their mobile devices to do all their day-to-day activities, and strong digital capabilities can attract and retain not just millennials, but all new customers.

Bank spending continues to skew heavily toward branch distribution while fewer than one in five dollars is allocated to new digital marketing initiatives. According to Cornerstone Advisors research, on average banks are spending 70-80% of their direct channel expenses on branching, 15-20% on contact centers, and roughly 5% each on ATMs and digital. At the same time, just 16% of banks’ marketing budgets are going to online channels and data, while nearly 45% goes to offline channels and direct mail and 27% to sponsorships and donations.

To be future ready, an institution must strategically align marketing spend with growth opportunities in terms of customer interactions.

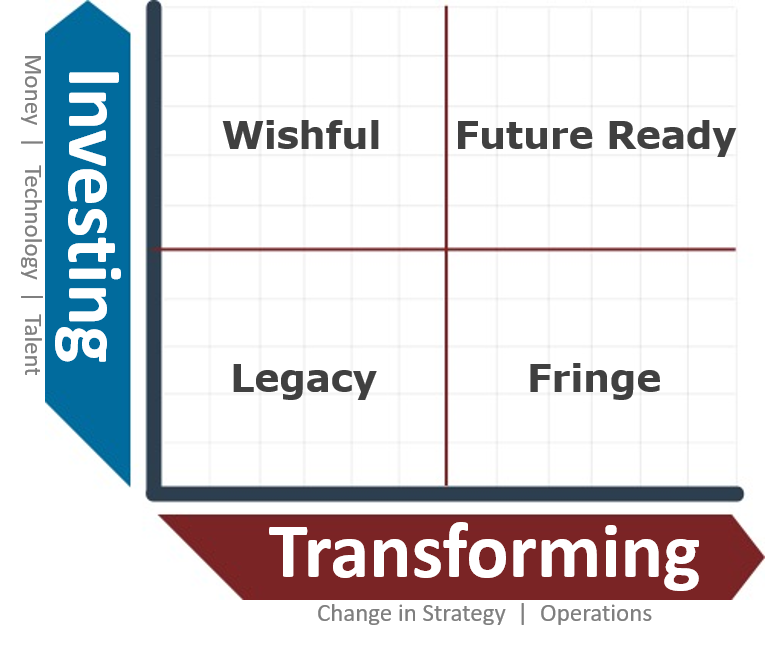

The lines are blurring between the way customers interact with a bank’s sales, marketing and service teams. Sellers are becoming marketers, marketers are becoming  sellers, and the people in the contact center are becoming loan officers. Navigating this new world requires a strong commitment to both investment in terms of money, technology and talent, and transformational shifts in strategy and operations.

sellers, and the people in the contact center are becoming loan officers. Navigating this new world requires a strong commitment to both investment in terms of money, technology and talent, and transformational shifts in strategy and operations.

Throwing money at new technology without a change to strategy or operations is a fool’s errand based on wishful thinking. Simply offering a new capability without shifts in thinking will not drive different results.

Conversely, attempts to transform an organization without investment will force change to occur around the edges, constraining the effectiveness of the desired change.

Here are four key mandates that every banker must address to effectively respond to shifts in the market and proactively position their marketing and delivery channels for growth.

Behavior is changing and expectations are increasing. Successful banks will drive transformational shifts with their customers; the rest of them will simply hope they can enjoy the ride. What bet will you take?

Thank you to Sam Kilmer and Steve Williams for their contributions to this article.

Regarding the following statistic, “46% of consumers use ONLY digital channels today”, is the ATM considered a digital channel? In other words, if a customer uses an ATM, are they no longer considered using “ONLY digital channels” ?

Thank you.

Dave, I cant’ speak for PWC but we would suggest that ATM’s should be considered a digital (self-service) channel. Cash is still relevant and absent a branch the only choice is an ATM. Hope that clarifies.

Jim