Reaching the efficiency levels of a next-gen bank will take ambitious productivity targets.

Mid-size banks have taken immense pride in driving down their efficiency ratios to levels once reserved for the most penny-pinching or leveraged institutions. In the past three years, the median efficiency ratio for banks with $1 billion to $10 billion in assets continued to shoot down to an impressive 56.5%. Some high-performing mid-size banks have targeted 50% as their new golden efficiency ratio goal, and they clearly tout this ambition to their institutional shareholders chomping at the bit for more progress on this bellwether productivity target.

But here’s a truth mid-size bankers need to wake up to: despite an impressive efficiency ratio, you are NOT efficient.

Progress made in the efficiency ratio has primarily been achieved by:

This type of hat-trick cannot be repeated any time soon in the future banking environment.

As our cost of funds rise, loan growth rates plateau and margins in areas like payments and mortgage face continued stress, scaling to new levels of true operating efficiency will be a huge priority for bank executives. To reach the efficiency levels of a next generation bank, leadership needs to set more ambitious targets for employee and staff dollar productivity.

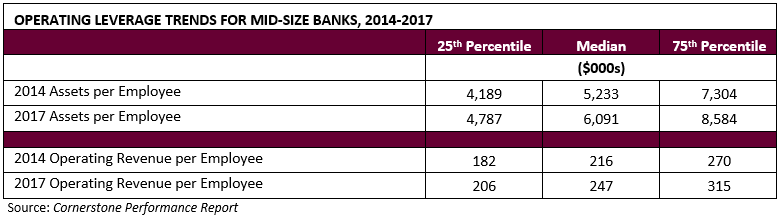

Recent analysis by Cornerstone Advisors reviewed the marginal growth of employees at mid-size banks over the past three years. Median assets per employee increased from $5.2 million to $6.1 million, and operating revenue per employee increased from $216,000 to $247,000. Importantly, the high-performing revenue-per-employee banks had almost 30% more in revenue per employee than median banks.

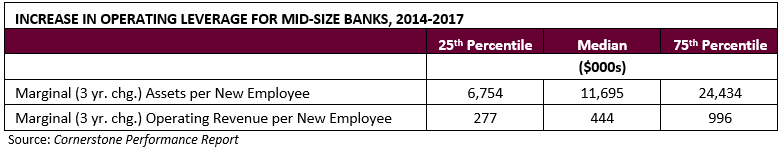

Even more striking is the marginal assets and revenue per employee ratios over the three years. The median bank added one new employee for every $11.7 million in new assets; high performers only added an employee with every $24 million in assets. Median banks added a new employee for every $444,000 of operating revenue, while high performers only added an employee when roughly $1 million of operating revenue was incrementally generated.

So What?

While “efficiency” figures can be somewhat skewed by wholesale or highly leveraged institutions, the writing is on the wall for bank executives. As banking becomes a more commoditized business where knowledge is the only true differentiator, high performing institutions will likely have fewer well-paid employees who leverage the heck out of technology, analytics and process automation.

Imagine CFOs at budget time saying, “Our operating revenue is only projected to go up by $7 million so we can only afford seven new employees.” Wow – would that get some puckered looks and appeals.

To take a clean look at efficiency and strive to reach high performing targets like $300,000 in revenue per employee, bank executives need to take a hard look at the legacy issues that are keeping their organizations stuck in the old efficiency model. Here are a few key opportunities Cornerstone recommends pursuing:

The plain truth is that banking has too many high paid managers who would struggle to justify what they do productively with their 2,000 hours of work time per year. Banks in the future will address areas with a narrow span of control and evolve to the player/coach leadership models seen more in professional service firms than in traditional, regulated financial institutions. Want to strip back the onion? Pull a list of every employee making $100,000 or more and determine what percentage of total comp this group represents. Then ask the question: What is each of these employees contributing and doing productively with 2,000 hours per year?

While efficiency targets and productivity initiatives have been common in banks, the fragmented and expensive commercial lending and credit function has gotten a pass. Very little end-to-end process automation is implemented, data is buried in spreadsheets, and profitability is hurt by putting too much origination and servicing expense on small deals. It’s time to go after this monster with serious process and automation improvements.

While banks have been successful in getting their retail customers to mobile banking, they have just scratched the surface of how much “gas” customers could be pumping on their own. Most banks have horrible business, mortgage servicing and wealth management self-service capabilities, and the amount of online lending and deposit account opening is sad compared to more innovative players like USAA and Capital One 360. Executives should drive overall self-service strategy scorecards in their organizations that highlight origination, servicing, fraud and back-office functions.

Banks will never get to high-performance efficiency cultures if they continue to use blunt measures such as efficiency ratio and the old dictum of “stay under budget.” Efficient and agile banks of the future will require that EVERY manager operates with a scorecard of key revenue, efficiency, service and risk management metrics. Executives should be able to do a spot inspection of any business line or support function and see what key performance indicators are driving excellence in that area.

The lack of rigor and consistency in performance management is truly the “silent killer” of efficiency in most banks. CEOs should not hesitate to ask executives for the one- or two-page dashboards that drive their business to see where the bank stands today. From there, projects get created with a consistent look and feel. Performance dashboards across the organization can have a real positive impact on a bank’s operating culture.

We are entering an era where revenue growth will be more difficult as loan growth slows. Bank executives should not take comfort in current efficiency ratios and instead should be building strategies to shoot for high-performance targets in a knowledge-based and more automated organization.