You have no doubt read that Sen. Kirsten Gillibrand, D-N.Y., has introduced legislation that would essentially turn our nation’s 36,000 post offices into quasi-banks to squash payday lenders and provide more affordable financial services to the unbanked and underbanked along the way.

The plan calls for U.S. Postal Service offices to take deposits and make short term loans with reasonable rates and fees. Gillibrand’s idea is an unflinching stab at eradicating the predators of the payday loan industry. (Yes, the senator’s Big Idea would boost faltering revenues at the USPS, but not even Gillibrand is pretending that’s what’s motivating her.)

The reaction to just about anything Gillibrand says tends to be pretty predictable. Those with left leanings swoon at the Democrat’s every idea, and those leaning right will write her off as a Lib-Kook. But setting aside any gut-level reaction you might have about the senator or her claim that opposing her legislation is the moral equivalent of a Facebook Like for the Payday Vultures, is Gillibrand’s proposal a good idea?

Well, no. Or, yes. It’s exactly half of a good idea.

Post Office Taking Deposits

Where Gillibrand loses me is with the USPS taking deposits and mimicking bank branches. That is 100% a terrible idea. Anyone in the financial services industry knows that the last thing we need is more bank branches. Seriously, even the most optimistic head of retail banking would be unable to suppress giggles at the wisdom of potentially 36,000 more bank branches across the country.

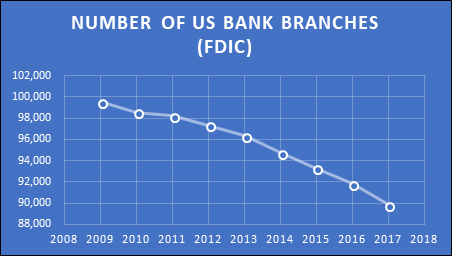

First, in case you haven’t read an American Banker in the last decade or so, we’re moving toward fewer branches, not more. And that’s not because of some evil, efficiency-seeking strategy to save money by serving fewer unprofitable customers. We simply don’t need more branches.

See that line moving down and to the right? That’s not an industry screaming for ANY more bank branches, much less 36,000 more. We have online banking. We have mobile banking. We have ATMs. We have IVRs. Come on.

According to a Federal Reserve study, we’re doing a pretty solid job of providing banking services to the unbanked/underbanked without adding thousands of branches to the mix.

Any more persuasive gymnastics are just insulting to the reader’s intelligence. This part of Gillibrand’s idea plainly lacks any nod to common sense.

Then There Is the Asset Side of the Balance Sheet

Let’s face it, payday loans may have started as a semi-benevolent idea to help those in temporary need of a few bucks until next Friday, but they have morphed into the Heartless Empire of our industry. And as stakeholders in the reputation of the financial services industry, we should be red-faced angry – pound-the-table pissed off – about what payday loans have become. Just how bad are they?

As bold of a step in the right direction as this could be, let’s not pretend that the USPS alone can start making payday loans without credit risk going postal or the agency failing miserably to execute a collections strategy. No, it’s going to take outside partnership to pull this off without the next USPS headline being something like “USPS Payday Lending Loses $1B in 3rd Quarter.” A couple of partnership candidates could include the Center for Financial Services Innovation and notable credit union players like WSECU and its Q-Cash loan.

So What?

Gillibrand brings us half of a good idea. Let’s ditch the talk about taking deposits in the post office. But seriously, why not get behind the lending side of Gillibrand’s idea? Payday lenders dying a slow death at the merciless hands of the USPS will only help the financial services industry’s bruised reputation and bring a much more affordable and sensible borrowing alternative to those who need a little temporary help now and then.

Maybe, instead of unthinkingly writing off Gillibrand’s postal service banking idea as the meanderings of an Ivory Tower Liberal, we should think about the financial services industry’s reputation and how that reputation – our reputation – is affected by payday lenders.

Honestly, I’m all for the government relieving us of the Heartless Empire just because of how predatory and damaging the industry is. Hosting that relief in a side cubicle at the post office is admittedly goofy, but I could live with a little goofiness in the name of potentially shuttering payday lenders.

The honest response to the Gillibrand quote at the start of this article is that you can still be against this proposal without being pro-payday lending – because half of Gillibrand’s proposal is harebrained at best.

(That said, if this legislation eventually passes [it won’t], give me a call, USPS. I can help you find the most suitable vendor partner for your banking software needs.)

GonzoBanker will be here watching. Stand by.

-Hodgins ![]()