GonzoBankers, 2018 has been a troublesome year. We’ve simultaneously disdained and feared the fintechs, artificial intelligence and blockchain consortia. We’ve stressed over loan growth and then sweated how to fund it. We’ve seen the big Wall Street banks raise the hurdle (and clear it!) for creative customer skewering.

Not sure about you, but we think it’s time to kick back with an adult beverage and relax … think a little bit with no emails, IMs, LinkedIn drivel or budgets to cloud our weary minds. Let’s think

about the best and worst in banking for 2018 and get fired up to start again in ’19. Ladies and gentlemen, we bring you the 2018 GonzoBanker Awards!

THE BANKING AWARDS

GonzoBanker of the Year – Large Banks

Although all banks faced stock headwinds in 2018, we give the nod to William Demchak at PNC Financial Services. PNC made a Gonzo move with a national digital expansion in 2018 with the unique idea of building a small number of branches in target metro markets like Kansas City and Dallas. Leveraging the Virtual Wallet brand it built years ago, it will be worth watching how PNC fares in 2019.

GonzoBanker of the Year – Mid-Size Banks

We have to give a big nod to James (Chip) Mahan, who crosses the entire financial ecosystem from bank CEO at Live Oak Bank, to fintech founder of red-hot nCino, to digital startup with Apiture and even fintech ventures with Chip’s Canapi project. To be in Chip’s presence is to soak up energy, optimism and the mash-up of traditional banking and technology. It’s pretty potent stuff.

The Don’t Stop Believing Award

Goes to the most overused word in our industry in 2018: journey. Although the customer journey mapping discipline is a great tool and something Cornerstone leverages, we can’t help but think that the most productive journey this year was Steve Perry’s return to high-pitched vocal finally belting on a new album.

Bank Lifetime Achievement Award

Is a tie between retiring CEOs Brian Vance of Heritage Financial Corp. and Doug Hultquist of QCR Holdings Inc. – both great bankers who blended honor and entrepreneurship to build great quality franchises. Importantly, both grew their banks bigger and bigger while their egos remained as humble as ever. We hope we see you on the green boys!

Lifetime Credit Union Career Achievement Award

Goes to Greg Smith, retiring CEO of Pennsylvania State Employees Credit Union. Greg was way ahead of his time in building the branchless financial institution long before bankers uttered the words digital, virtual or omni. Hats off to Greg for taking a $600 million credit union to a $5 billion innovator over his 25 years at the helm. Greg also leaves the organization knee-deep in technical innovation as PSECU has deployed Corelation core, Kony digital, Temenos origination and Sitecore CMS among other new solutions.

Bank Sale of the Year

Goes to the always-sharp Mitch Feiger and the team at MB Financial for the bank’s sale to Fifth Third at a 24% premium to market price in May. Timing is everything, and Feiger knew that after tripling the stock price since the 2009 downturn, it was time to get the shareholders a solid payback. Despite some controversy about the deal bidding structure, the point is that MB got close to $5 billion for the franchise and locked in an exchange rate before the bank equity market softened. Easy as a golf swing.

Bank Purchase of the Year

CVB Financial acquires Community Bank. These are two longtime classy Southern California outfits dedicated to building relationships versus a transactional commercially focused bank powerhouse. A lot of opportunity for two great teams to work together if the cultures can integrate effectively.

Bank Merger of the Year

CenterState Bank Corporation and National Commerce Corporation merge to create a $16+ billion southeastern player. There is a nice mix of the executive gene pool among these two organizations to build the future leadership team, and this deal helps CenterState gain scale as it moved past the dreaded $10 billion regulatory mark.

The I’m Serious About Digital Transformation Award

Goes to Elevations Credit Union CEO Gerry Agnes, who brought in a new CIO, SVP of Digital Experience and agile-focused PMO head in the past year to support this organization’s vision of being a “technology leader with a tech savvy work force” that ultimately wins its second Malcolm Baldrige Award for excellence. Gerry is a financial executive who truly gets the impact of the technology shift under way in banking.

The Inclusion Award for Best Performance Serving Hispanic Households

Goes to Idaho Central Credit Union, which has certified more than 150 employees in Spanish-speaking skills while making a bilingual experience available through the organization’s website, branch, telephone, email and chat channels. With active investment and community engagement, Hispanic membership growth at ICCU is now more than twice the rate of other household segments. Another example of sincerity and innovation making an impact on local communities. Bravo Green Machine!

Establishment Gardening Leave Award

Megan Caywood goes from Starling Bank to Barclays. This was another example of disruption intended to stick it to the establishment, and then … becoming the establishment. Caywood is a huge name in fintech with Starling being a recent industry darling around innovation. “TechCrunch says Caywood has been placed on gardening leave, although relations remain cordial, and will join Barclays early next year.”

Strategic Alignment Niche Acquisition of the Year Award

Goes to City National Bank (an RBC Company) for its August acquisition of Exactuals, a tech company focused on complex payments in the entertainment industry. The alignment is spot on as CNB has a longtime focused strategy as “bank to the stars.” This is also the first time we’ve seen a BI/analytics acquisition get past the techie buzzwords to tell a clear business story about how something like metadata had an explicit value with something as specific as distributing entertainer royalties.

Talent War Quote of the Year Award

“It’s not just about technology, but the talent we need to drive it.” –Randy Dolyniuk, CoastalStates Bancshares, kicking off the AFT conference

The FI Mantra Award for 2018

“Deposit beta” is the “it” term being murmured in the halls of banks and credit unions nationwide. The industry has seen a cost of funds increase of 22 basis point in the first nine months of 2018, and who knows what Q4 will show? The fight for core deposits in 2019 will be fierce, and cost of funds will have front-and-center focus.

Banks Leveraging Fintechs Award

Cross River Bank in New Jersey ($1.1B) has found a nice niche providing back-end decisioning and servicing solutions for fintech lenders such as Affirm, BestEgg, Coinbase and TransferWise. This has produced a sporty 3% ROA and several rounds of funding from fintech investors into the bank’s holding company. Somebody was going to step up and fill this niche. Good on Cross River for getting there first.

The Best Quote About Rising Bank Technology Spending

Goes to an unnamed mid-size bank CEO who recently quipped to Cornerstone’s Steve Williams, “We’re going to earn a 1.3% ROA this year and that’s after paying for all that new $#*%! the team convinced me to buy.”

Strategic Clarity Award

This award goes to Capital One for making bold moves on exiting the mortgage and online brokerage businesses and refocusing efforts on its core card and banking businesses. Capital One quit mortgage late in 2017. Rather than try to sell its origination capability, Capital One simply shut it down in the face of rising rates/questionable profitability. In February 2018, the bank announced it was closing its online brokerage business and selling its more than 1 million brokerage accounts to E*Trade Financial Corp. It takes big kahunas to know where you want to focus for strategic growth and, equally important, where you do not. Given the recent “what bank is in your wallet” campaign, it will be interesting to watch CapOne’s deposit growth in 2019 as most banks scramble to retain and attract core deposit amid rising rates. Our bet is it will outperform.

No More Feet Left to Shoot Award

After robbing its customers blind for the past several years, Wells Fargo is trying to improve profits and get out from under the Fed’s asset cap by reducing 10% of its workforce by 2020. If you’ll permit the hunting metaphor, maybe the Wells BOD should be aiming closer to the head versus shooting the minor appendages off one at a time.

Pedal to the Metal Award

This award goes to Ally Bank’s mind-numbingly fast growth in its auto lending unit. According to BankRegData, Ally has grown its auto lending portfolio by 68% since 4Q15. More impressive than that? Ally accounted for over half of the entire bank auto lending industry’s growth over the same period.

Let’s keep our eyes open, though. Ally’s delinquency rates have also grown, more than doubling since 4Q15. Concentration risk? Casey Jones, you better watch your speed …

The Deadly Threat We Forget to Talk About Anymore

Walmart getting into the banking business. At this point, checking accounts and mortgage loans are yet to become a Black Friday doorbuster item.

THE VENDOR AWARDS

The Fintech That Roared Award

Goes to all the front-end digital origination vendors that were busy selling or partnering with other big players who seem to innovate and develop products for market as fast as these smaller outfits. Players like Zenmonics, BOLTS Technologies, Gro, Avoka, MeridianLink, Blend, Roostify all had big deals and partnership announcements during 2018. Congrats to all for a lot of heavy lifting on the tool-building side of our industry. Banks have lots of work ahead to leverage these tools in the digital sales process.

Big Vendor that Actually Developed Something

The award goes to Jack Henry and Associates for its new JHA Treasury Management platform. We all know the big three development roadmaps are often painstakingly slow, and the good stuff too often comes from acquisitions. So it was refreshing to see JHA’s new Treasury platform come out of beta with a focus on meeting the needs of its mid-size Silverlake banks. We need more competitive Treasury Services offerings, and JHA has thrown a well-conceived salvo into the market.

Enron Smartest Guys in the Room Award

This award goes to Robinhood for launching a 3% checking/savings account with the implication that the deposits are insured when, in fact, they clearly are not. Robinhood backtracked after the initial announcement, but only so it can work with regulators and refine its pitch.

Chip & Joanna Gaines Award

This one goes to Zillow for its November acquisition of Mortgage Lenders of America. Perfect bedfellows. The mortgage loan demand gen powerhouse just became an ambitious lender too. Hey, why just flip those 23 million leads a year when you can flip more of the assets too? Prenup terms were not disclosed, but Zillow says there’s still plenty of room for other lenders. Which isn’t reassuring. And a little creepy.

2X Innovation Barrier Award

The 2X award is presented to the large tech company that gave a fintech startup a $50,000 incubation award and later asked the fintech to pay a $100,000 core integration fee. You know who you are.

Radical Candor Award

The rad award goes to new NCR CEO Mike Hayford who, at a company conference, kicked off with a speech that dispensed with the usual buzzwords for some refreshing directness on areas wanting improvement including the need to be better listeners. Hayford also talked up six different clients by name.

The ‘I’d Rather Switch Than Fight’ Award

Credit Karma, which is everybody’s category killer go-to for integrating credit scores and customer credit score management, boasts a 30-second enrollment, easy to use tools, and users’ ability to receive reviews/offers without them appearing on the credit score. All that and its $370MM in revenue is paid mostly by banks!

Core Win of the Year

$121B, 355-branch MUFG Union Bank selected the FIS Profile core system in 2018’s Core Win of the Year. Profile edged out international powerhouse Temenos T24 for this coveted account. Nice win, FIS, and let’s hope this goes smoother for Union than the Finacle project!

The Golden Cufflink Award

Despite being a Texas A&M graduate, Sarah Dyess from Jack Henry’s Silverlake core banking division ran away with this year’s Golden Cufflink Award. Sarah was the most impactful and relatable product presenter that the Gonzo team saw this year, performing equally effectively at rural community banks as she did at much larger international banks. Congratulations, Sarah!

THE TECHNOLOGY AWARDS

The A.I. is A’ight Award

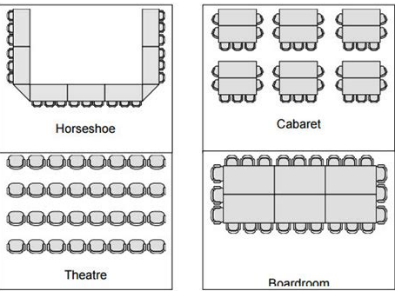

GonzoBanker’s inaugural winner for the most pragmatic use of artificial intelligence in banking goes to the team at First Community Bank and Trust in Feign, NY, for its self-developed conference room reservation management system (C2RM). C2RM manages room scheduling across the bank’s headquarters and 19 banking center locations. This crafty bit of intelligent code considers everything a bank needs to schedule conference meetings in a hands- and paper-free manner: room size, chair count and arrangement, speaker phone and other media availability, Bluetooth-delivered snack and beverage inventory levels, etc. They have thought of everything – helluva job to all involved!

THE REST

The Niche Speaking Engagement Award We’re Almost Sorry We Missed

Ernie Chan had a spot left for a sponsor panelist on an “edgeworthy” alternative data panel at Quant World Canada. Quant World Canada, eh? Sounds like a barn burner. The lobby bar in that Toronto Marriott must have poured pints of Moosehead with Crown Royal chasers at a record clip.

The Millennial Over-Transparency Award

Goes to a Monzo bank customer who’s just a little too excited to share on social media.

Five Numbers That Should Scare Traditional Bankers in 2018

The Monty Python “Stop That It’s Too Silly” Award for Robotics

Goes to HSBC for introducing “Pepper” the robotic branch greeter in New York.

We understand Pepper has recently started a remote relationship with Little Dragon, a robot worker at the China Construction Bank.

The Hello Newman Award in Tech

Goes to Microsoft for briefly overtaking rival Apple in market cap during November after Apple fell from being the first company to hit a $1 trillion market cap in August.

MAGA in Action Award

MAGA in Action Award

By pulling all political strings necessary to change the name of the Consumer Financial Protection Bureau (CFPB) to the staggeringly innovative Bureau of Consumer Financial Protection (BCFP), acting CFPB/BCFP Director Mick Mulvaney has proven his ability to focus on the crucial issues.

Storyteller Quote of the Year

“In 1991 I registered Virgin Galactic Airways. I also registered Virgin Intergalactic Airways because I’m an optimist.” –Richard Branson at Money2020

Omni Reality Check Quote of the Year

“The only reasons I go to a branch are safe deposit box and cash. Set yourself apart with great [digital] content. Write articles about helping people with taxes or something.” –Former Apple exec Guy Kawasaki at Financial Brand Forum

BUCKLE UP BIG TIME BANKERS!

So in late 2016, bankers got the “Trump Bump” and in late 2017 the “tax cut” bump. This year we got the crud kicked out of our stock prices like the rest of corporate America – and maybe it all reflects a reset to reality.

The banking industry goes into 2019 healthy but running scared about funding, working harder to meet loan targets and more closely watching classified assets, all at a time when our investment agenda in tech, talent and new markets has been ambitious and pricey.

There will be a reckoning starting in 2019. It will be harder, more volatile and potentially more political inside banking organizations when the pressure mounts. So this holiday season, we ask GonzoBankers to commit to get their game face on and be ready for what comes next year. Don’t completely starve your strategic investments with quick budget cuts, don’t whistle your way around emerging credit issues as they arise, and don’t start turning on each other when realities cause performance hiccups. Good bankers always soldier on through cycles, and the very best recognize the downs early and jump boldly into cheap opportunity before the next recovery cycle.

This time things will be different – we may face economic recession at the same time we face a more pronounced impact from tech-driven disruption and an unbundling of banking that’s been talked about for 25 years now. The threats on the traditional business model are more real than ever.

As Bruce Springsteen, who just finished a historic run on Broadway, once foretold:

“There’s a dark cloud rising from the desert floor

I packed my bags and I’m heading straight into the storm

Gonna be a twister to blow everything down

That ain’t got the faith to stand its ground”

Have a great holiday season, GonzoBankers – recharge the batteries, hang with the loved ones and get in touch with the faith and strength to lead your organizations in 2019.

Great firm with great people. Best of luck to you all in 2019!