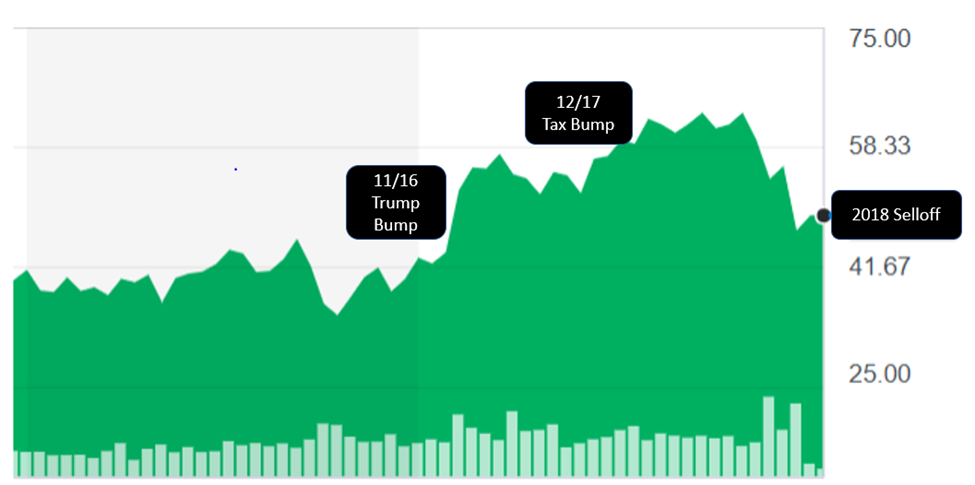

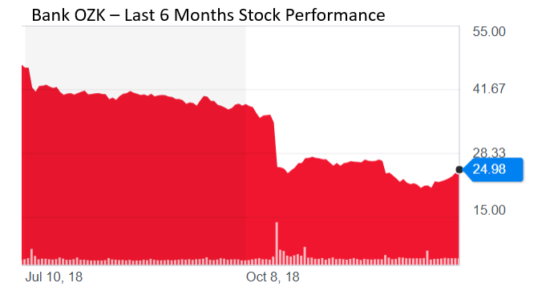

Hopefully your holiday season was restful GonzoBankers – because 2019 is literally going to be a bear. After the initial high of the “Trump Bump” in late 2016 and the euphoria-promoting “Tax Bump” of late 2017, bankers saw their fortunes turn against them in the second half of 2018. The booming stock prices of the summertime have cooled to roughly 25% market value declines as the market fears recession and sees tepid bank earnings growth prospects.

KRE – Regional Bank Stock ETF – Past 5 Years

A growing, anxious chatter in bank budget and planning meetings across the country foretells a more difficult 2019:

The mood kicking off 2019 is teetering between taking comfort in strong industry fundamentals in a growing economy and the fear of a coming recession mixed with global and political unrest. For wise bankers, this is no time for yearning and hopefulness. It’s time to get real and directly face…

THE BEAR!

Bank leadership will face a credibility test in the coming months as team members observe how their organization expects to navigate the gathering storm clouds. Those at the top need to set a proactive tone and quicken their cycle times to deal with incoming market and performance information. For 2019, bankers must be guided by seven timeless rules for facing a bear market:

Rule 1 – Trust but verify when it comes to your risk position. There’s a tendency for bankers to say “we’re fine” when it comes to their credit risk position. Bad idea. Now is the time to marshal some of the best skeptics in the credit, ERM and finance functions and conduct a critical scenario analysis of the bank’s portfolio. A humble, deep dive now can identify ways to reduce vulnerable positions early in this economic cycle.

Rule 2 – Develop your Plan B strategy with a skunk works team. While it’s not time to panic, smart leaders need to form a small working group to analyze strategic options if this year’s earnings forecast starts to go south. Yes – these scenarios must include divestments, reductions in force and delayed strategic initiatives. While it’s distracting to come clean with the entire team on these contingencies, it’s critical to have a trusted group thinking through options and ready to pounce if conditions worsen.

Rule 3 – Demand benchmarks and profitability analysis in every resource discussion. The growth cycle is over in banking … period. Leaders will need to stare down some of their brightest and busiest managers and request more data to justify resources and prove that business lines and products are indeed contributing to the bottom line. There is no time for perfect profitability systems. This is about quickly building performance benchmarks and profitability analyses that meet the 90% accuracy rule.

Rule 4 – Embrace the agility buzzword and avoid gutting future strategic investments. Downturns are always the Petri dish for the next great banking franchises. As earnings pressures mount, bankers must avoid the temptation to slash marketing, training, IT and recruitment budgets. Any bank that cuts off its progress toward digital sales and client experience is asking to be a future acquisition candidate. Instead, banks must hone their focus on small, cumulative projects that have near-term benefits but fit into a long-term investment agenda. The word “agile” is overused, but it’s a meaningful way to describe identifying minimal project requirements in areas like analytics, CRM, IT and talent management that can have tangible value in the next 12 months.

Rule 5 – Take it to the streets to meet your customers and prospects. The very best medicine during tough times is to be knee-deep in gritty discussions with customers. The knowledge to be gained is worth its weight in gold. Banks CEOs should demand that every relationship manager and support team member is out with customers and not hiding back at HQ. Importantly, top management must also create ways to aggregate this market intelligence and build more granular action plans when the macro forces of growth weaken. GonzoBankers dig deep for ways to grow in a downturn.

Rule 6 – Make your operating culture all about radical candor. Now is not the time for cushy “all is well” messages from the C-suite. Today’s bankers are too battle-worn and smart for that drivel. Instead, CEOs need to regularly provide an honest perspective on how industry challenges are impacting performance and priorities inside the organization, whether that’s a weekly email, departmental town halls or personal video clips. The best CEOs will be the most real and accessible to their teams. Don’t hold back – your team CAN handle the truth.

Rule 7 – Quietly prepare for bargain hunting to drive future shareholder value. The beginning of the downturn may create a pause in M&A activity as buyers are less willing to pay premiums for other banks and sellers have concerns about their acquirors’ stock currency after the deal closes. However, when the recession levee finally breaks, smart banks will be ready to go bargain hunting for assets, deposits and fintech intellectual property at much cheaper multiples. While it’s early in the cycle, CEOs should be thinking about ways to effectively deploy capital when fear strikes the broader market and the selloff has peaked.

Load Up

Stock sage Benjamin Graham once aptly concluded, “The intelligent investor is a realist who sells to optimists and buys from pessimists.” Bankers are stuck right now in a psychosis between optimism and pessimism. It’s time to fight against a “wait and see” attitude and literally grab the emerging bear by the claws. GonzoBankers need to be vigilant about how 2019 unfolds and jump on corrections and execution opportunities. It’s time to go hunt the bear.

Steve,

Great article and great timing. I am currently completing a planning document to address the possibility of a 2019/2020 recession and it includes 5 or your 7 points. I have a feeling the other two are going to get consideration now. Application of the adage “better a month early than a day late” in the current environment seems very prudent when you objectively study the existing data. I particularly like your description of liquidity constraint. That is what I see clearly impacting growth and earnings performance for the upcoming year. We are considering focusing on re-mixing our asset portfolio to enhance yields rather than increasing at the margin growth which we project to have adverse impact on ROA. The tea leaves continue to be clouded but I expect anyone who has a clear remembrance of 2008 and 2009 will be a willing follower of your seven steps. Thanks!