The Banking-as-a-Service (BaaS) gold rush has clearly begun. Early adopters are earning prestige while investors and a horde of community banks explore the opportunity to tap into this new source of revenue. However, if BaaS is ever going to enhance shareholder value, bankers need to ensure they have the strategic focus, operational savvy, and execution commitment to do it right.

In this emerging landscape, financial institutions, often community banks, frequently “rent” their charter to financial technology firms (fintechs) that serve a specific consumer group as a means to grow non-interest income. Internal Cornerstone Advisors data shows that early leaders have enhanced not only revenue diversification but also their stock multiples. As the collision of traditional banking and fintech continues, there will be more competition and more innovative banking solutions due to the increasing number of actors seeking defensible niches and operational scale.

As the gold rush period shakes out, Cornerstone predicts only one in five banks will have a strong enough I.T. infrastructure and the capacity to manage a BaaS strategy to significantly complement the core business. For executives wanting to develop a winning strategy, here are six key strategic takeaways to help banks successfully launch a BaaS strategy:

Rather than viewing fintechs as competitors to be feared, bankers should look at them as a means to benefit financially from BaaS. From an income perspective, BaaS partner banks create a new revenue stream that has shown to increase non-interest-income, ROA and ROE. According to internal Cornerstone research, over the past five years, out of a sample group of 34 banks that offer BaaS, NII grew 67% compared to an industry median of 31%.

New Cornerstone research estimates that banks can realize as much as $25 billion in BaaS revenue over the next five years through partnerships with third-party technology companies. This figure could more than make up for the anticipated loss of NSF/OD income.

However, investments required to support BaaS also tend to result in higher non-interest-expense growth. According to internal Cornerstone research, banks pursuing Baas had an 80% median increase in NIE compared to an industry median of just 18%. As an example, PNC closed shop on its BBVA Open after acquiring BBVA’s U.S. assets, citing high NIE.

Bank execs looking to champion a BaaS initiative must find the balance between the traditional business case model and an innovative investment strategy to drive future growth.

While customer relationships are being redefined by fintechs, there will always be a place for community banking. Executives should embrace technology partners as a means of growing and enhancing their customer value proposition.

To do this, banks can leverage their competencies in payments, lending, operations, and risk management while using the earnings generated from BaaS to transform their core business. Smart bankers will learn how to play on the front end of relationships in their primary business while scaling BaaS revenues in areas where the organization has unique competencies.

According to CB Insights, 43 fintech companies became unicorns (privately held startups valued at over $1 billion) by Q3 2021, many of them raising millions of dollars to help flesh out products and attract customers. As the battle for customer market share heats up and booming M&A activity enables better customer experiences and digital tools, this is the perfect time to explore BaaS.

Companies like Synctera and Treasury Prime are acting as “matchmakers” between community banks and fintechs and even offering access to their application programming interface (API) sandbox for developers to test early-stage fintech ideas. Even beyond fintechs, more and more brands are looking for ways to wrap financial services, especially embedded finance, around their existing products.

Bankers need to move quickly as the BaaS gold rush ensues. Fintechs in need of charters are prompting new banks to enter BaaS seeking a “white whale.” Look at Middlesex Federal Savings, which rented its charter out to Bank Novo and just got $90 million in Series B funding. Or Hatch Bank, which, after partnering with HMBradley, saw deposits grow 300% in the first half of 2021.

Winning BaaS banks will hitch their stars to the fintechs, brands, and challenger banks that can scale their users, transactions, and products. Not every community bank will be able to snag the Chimes or the Brexes of the world, so conducting due diligence and understanding the business case of potential partners is vitally important. Through ongoing monitoring of each relationship, BaaS players can minimize negative investments and test and learn with partners to attain the required scale for profitability.

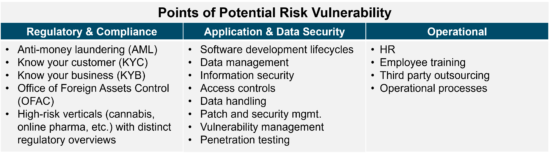

While effective risk management requires close coordination among the bank, the BaaS tech-stack provider, and the fintech, regulators expect to see strong controls throughout the bank’s operations and customer experience channels. It is critical that all players understand and commit to rigorous standards, and a bank that is not equipped to manage the level of third-party risk this undertaking requires could find itself responsible for a partner’s vulnerability and answering to a very unhappy regulator.

Banks that excel at BaaS will take a whole new approach to strategic partnering, more akin to Silicon Valley’s lean startup DNA and less like the traditional bank and data processor relationship. With a new ecosystem of BaaS partners emerging, bankers must ensure that they have the committed resources and the technical and business integration skills necessary to execute.

Cornerstone’s What’s Going On In Banking research reveals that most banks today are dedicating just a few people to fintech and bank partnerships. Aside from a dedicated executive to champion the strategy, there needs to be enough product management and I.T. capacity for integrations to scale with growth. Early leaders like Coastal Community Bank in Everett, Wash., whose clients include white whales such as Aspiration, Ellevest, and BlueVine, have demonstrated resource commitments for a BaaS strategy that far exceed “toe in the water” levels.

More importantly, BaaS banks will need an I.T. and risk SWAT team that understands architecture, APIs, next-gen programming, UX, and technology risk to effectively work inside this ecosystem. This cannot be the extra credit work of a traditional bank I.T. department steeped in running a data center, network operations, and end-user support. Much of this transformational talent is likely to come from outside the traditional banking industry.

It’s exciting that the BaaS gold rush is gaining momentum. Yet, it’s important to remember that most “miner 49ers” in the California gold rush left penniless. It was the mining companies prepared for the investment into prospecting, wages, dynamite, mine carts, timber, and steel to support the shafts that succeeded. The miners with just a gold pan and shovel soon realized that there was little fortune to be found.

Banks contemplating a BaaS strategy need to plan intentionally for the focus, investment, and skills that will be required to execute effectively.

Not sure where to begin? The strategy and technology experts at Cornerstone Advisors can help you evaluate your BaaS staffing and tech-stack readiness.