“And now, the end is near And so I face the final curtain My friend, I'll say it clear I'll state my case, of which I'm certain” –Lyrics from “My Way”

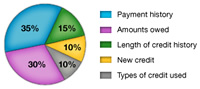

Fair Isaac’s FICO is the credit scoring method most widely recognized as the industry standard for lenders. Based on information contained in a credit report, it examines the borrower’s:

Payment history

Payment historyThe three major credit reporting agencies, Equifax, Experian and TransUnion, have also developed their own credit scoring products aimed at providing a higher level of precision in risk scoring, building on the FICO score. Credit scores have promised lenders a fast, objective measurement of a borrower’s credit risk. Before the use of scoring, the credit granting process could be slow, inconsistent and unfairly biased.

But here’s the rub: for all the high levels of rocket-science and statistics deployed, it’s clear that lenders have been lulled into underwriting laziness by the FICO score. As opposed to a diversity of underwriting models and credit risk strategies, banks basically “nationalized” and commoditized consumer underwriting with their excessive reliance on FICO. Sure, humans can be inconsistent and messy, but with all of the technology we have today, why didn’t highly sophisticated analytics predict the credit meltdown we’re experiencing? The answer lies in the “unlearning” our industry has experienced regarding the famous C’s of credit.

But here’s the rub: for all the high levels of rocket-science and statistics deployed, it’s clear that lenders have been lulled into underwriting laziness by the FICO score. As opposed to a diversity of underwriting models and credit risk strategies, banks basically “nationalized” and commoditized consumer underwriting with their excessive reliance on FICO. Sure, humans can be inconsistent and messy, but with all of the technology we have today, why didn’t highly sophisticated analytics predict the credit meltdown we’re experiencing? The answer lies in the “unlearning” our industry has experienced regarding the famous C’s of credit.

“Regrets, I've had a few But then again, too few to mention I did what I had to do And saw it through without exemption”

The C’s of Credit

Savvy consumer lenders learned early in their careers that a borrower’s request for a loan should encompass a systematic evaluation of three components:

Credit scores simply became a way to automate the evaluation of a borrower’s Character – their historical propensity to pay.

During the FICO explosion, bankers simply forgot that the borrower’s future Capacity to pay and the protection that Collateral provides are also critical to loan quality.

During the FICO explosion, bankers simply forgot that the borrower’s future Capacity to pay and the protection that Collateral provides are also critical to loan quality.

Two other C’s have been used over time, more by business lenders, but important nonetheless:

While FICO seemed to work like a charm during a long-term economic and real estate expansion, lenders suddenly found themselves in a different space with newer, more complex adjustable mortgages, no-money-down transactions and a move downstream to subprime borrowers. In hindsight, it’s evident that factors like loan-to-value ratios or an individual’s income (neither of which play into a FICO score) took a back seat to the “rear-view mirror” algorithms that drive FICO.

Fueled by massive competition, lenders became more and more aggressive in the granting of credit. As lenders became increasingly addicted to credit scoring and automated underwriting, a whole industry developed aimed at helping people, whether they deserved it or not, to improve their credit score (not all of the tactics were legal or moral).

And ultimately, these new practices by lenders brought out the vulnerability of FICO. This recent excerpt from Forbes magazine nicely illustrates the situation:

In 2006 Lehman Brothers sold a $1.2 billion subprime loan portfolio in which the borrowers had an average FICO score of 631. Fair Isaac predicts that borrowers with these scores will default 5% of the time. But 18 months into the trust’s life 15% of the borrowers are 90 days behind on their payments, meeting the mortgage industry’s traditional definition of default.

“I planned each charted course Each careful step along the byway But more, much more than this I did it my way”

By relying on automation to create credit scores which rely on historical patterns in a person’s credit file, a tremendous amount of credit was granted to people that, quite simply, could not and cannot afford it. We lost sight of basic underwriting. We created new loan programs that require a certain level of sophistication for borrowers to comprehend. We based decisions on the assumption that the world was green and getting greener everyday. Then, WHAM!

“Yes, there were times, I’m sure you knew

When I bit off more than I could chew

But through it all, when there was doubt

I ate it up and spit it out

I faced it all and I stood tall

And did it my way”

As with all economic conditions, this environment will change. Doomsayers predict a prolonged period before there’s a turnaround while optimists predict a short cycle before we rebound. We don’t even have agreement on whether we’ve hit bottom.

As with all economic conditions, this environment will change. Doomsayers predict a prolonged period before there’s a turnaround while optimists predict a short cycle before we rebound. We don’t even have agreement on whether we’ve hit bottom.

FICO Part Deux?

Meanwhile, Fair Isaac and the major credit bureaus are busy working on and bickering with (lawsuits included) each other over FICO 08 and VantageScore Solutions – the new and improved scoring tools that will reduce some of the exposure allowed by prior models since they reflect recent economic trends and important shifts in consumer credit behaviors. VantageScore is a joint venture of the three credit bureaus that was rolled out in 2006. FICO 08 is still being rolled out and is impacted by pending litigation.

As we move through another dark period of credit conditions, it’s clear the world of consumer credit will evolve:

A well respected GonzoBanker, Allan Stevens from Franklin Mint Credit Union in Broomall, PA, shared some thoughts on this topic with me. Roughly 50% of loans are still being auto decisioned in his shop. We discussed some common sense thoughts for lenders to keep in focus:

In speaking with other community bankers, I noted a general theme. They all said that for the last two years they anticipated an economic downturn and made efforts to tighten their underwriting. In general they feel their underwriting has been adjusted as much as possible and still allow them to service their customers.

The Consumer Federation of America has proposed the use of a suitability test before giving a consumer a loan. Along with a prospective borrower’s FICO score, the lender will look at the borrower’s ability to handle added debt payments or interest rate increases.

Dr. Mark Greene, CEO of Fair Isaac, wrote in a Forbes Commentary on Jan. 30, 2008: “For that good idea to be widely adopted, it will also have to be automated. Such a tool is well within the ability of the industry to deliver.” I think I sense yet another new scoring product on the horizon… but a product, not the next credit panacea.

-SP