Bankers are obsessed with discovering the “secrets” of getting consumers to change banks, while market researchers feed that obsession with survey data that purports to reveal those secrets.

Sadly, bankers are barking up the wrong tree, and most surveys do little to help those bankers understand consumers’ real behaviors and attitudes.

A consumer study from S&P Global—which asked mobile banking users which mobile banking features might get them to switch banks—reveals the contradictory responses consumers often provide.

Roughly a third of respondents said that mobile banking features like account alerts, fraudulent transaction disputes, card spending limits, chatbots, and digital account statements would make them “extremely likely” to switch banks.

In addition, about three in 10 respondents said reporting lost or stolen cards, cardless ATM access, turning debit and credit cards on or off, and person-to-person (P2P) payments were features that would lead them to be “extremely likely” to switch banks.

But consider this: Minna Technologies evaluated the mobile banking apps of 24 large banks and fintechs, identifying which of them offer 30 mobile banking features. Of the financial institutions evaluated, all of them provide account alerts, 22 enable customers to lock and unlock cards, 11 have chatbots, and 10 offer cardless ATM withdrawals.

So why aren’t millions of mobile banking customers switching to those banks?

Despite consumers’ stated likelihood to switch banks, just 13% of mobile banking customers switched their primary checking account from one institution to another between May 2021 and April 2022 according to the S&P Global survey.

Respondents to the S&P Global survey weren’t very consistent with their answers to the survey questions. Although more than half of consumers said they’d be at least somewhat likely to switch to get 18 of the 23 mobile banking features asked about, just 20% said a “better mobile banking experience” would get them switch banks when asked in a separate question with other prompted responses.

In response to that question, about a third said financial incentives, higher interest rates on deposits, and/or lower fees would get them to switch banks.

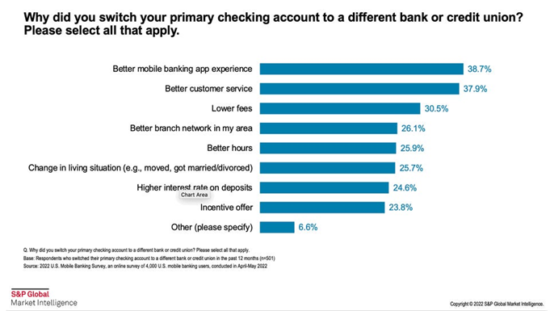

Looking at the reasons why the mobile bankers who did switch switched provides some clues on what’s going on here.

Although just 20% said a “better mobile banking experience” would get them switch banks, among those that did switch, nearly four in 10 said they did so to get a better mobile banking experience. But a similar percentage said they switched to get better overall customer service, and many identified other reasons like lower fees, more branches, higher rates, and incentives.

Conclusion: A better mobile banking experience by itself isn’t enough to get people to switch banks.

If it were, would Chase have to offer prospective customers $600 to open a new checking account, considering it has one of the best mobile banking apps in banking?

Today’s reality is that while some people change who they consider their primary checking account provider to be, increasingly they don’t actually switch accounts—i.e, close out one account and open another.

More than a third of all Americans have more than one checking account, and among Millennials that percentage is nearing a half. Consumers use multiple checking accounts for specific purposes like making international money transfers, making specific types of payments, or to access personal financial management tools.

Banks strive to become consumers’ “primary” bank. That label is meaningless today.

Banks like Chase are deluding themselves, believing that, if they force customers to meet behavioral requirements to qualify for a financial incentive, they are becoming the “primary” bank and buying those customers’ loyalty.

That strategy isn’t working.

This article originally appeared in Shevlin’s Fintech Snark Tank on Forbes and is reprinted with permission.

Honestly – one of the best articles I have read on this topic ever. You hit it out of the park with this one, Ron.