In today’s digital-centric environment, consumers expect faster everything – and turnaround time on a loan application is no exception. However, Cornerstone research and data indicate that most banks and credit unions are simply not in step with customer expectations. It’s 2023 and innovations like AI are gaining steam, but dated systems and clunky processes continue to clog the consumer loan pipeline in most financial institutions.

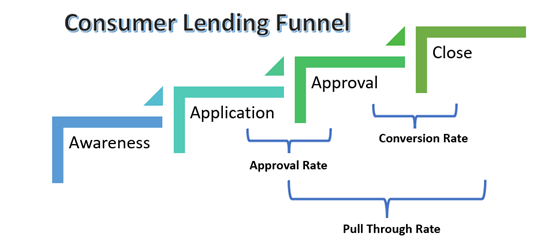

There are four critical stages in driving profitable, high-quality consumer loan growth:

Cornerstone looks at several metrics to track the effectiveness of this loan pipeline in closing deals and growing loan production. Today, many financial institutions are looking to drive a higher level of auto-decisioning using new underwriting engines built on new technology.

While we encourage lenders to build sophisticated auto-decisioning capabilities, implementing a system comes with a big price tag, and shiny new technology alone will not unclog the loan pipeline to create an optimal customer experience. Without an aggressive streamlining of processes and underwriting habits, a decision engine is just an overpriced calculator.

According to Cornerstone’s 2022 benchmarks, only 42% of financial institutions employ auto-decisioning in their consumer lending practices. Our firm would like to see that number much higher. Here are a few interesting stats that reveal lenders’ current evolution:

Cornerstone finds that the best lending performers get very gritty with defined key performance indicators that measure pipeline effectiveness and service level metrics like time-to-approval and time-to-close. Member satisfaction and net promoter analysis are also tracked closely by lending leaders.

Our research data indicates that lenders are not getting the full benefit of auto-decisioning engines because they haven’t completed an end-to-end streamlining of their processes. Here are some key insights that reveal the challenge:

While the business case to leverage new automated decision engines is strong, leaders need to ensure this investment is accompanied by a hard look at the people and processes that stand beside the technology. A comprehensive consumer lending transformation will include taking these actions:

Transforming consumer lending will require that the bank’s or credit union’s leadership gets traditional sales, credit and operations professionals out of their comfort zone and into the fast, data-driven world of smarter consumer lending.