As bank executives navigate rising rates, margin compression and recession risk in 2023, a striking reality has seeped into leadership meetings: the hybrid workplace is here to stay, and there’s a ton of strategic ramifications to this new aspect of the business.

For virtually every financial institution, designing and executing a hybrid workplace strategy is definitely a Work-In-Process with lots of room for improvement.

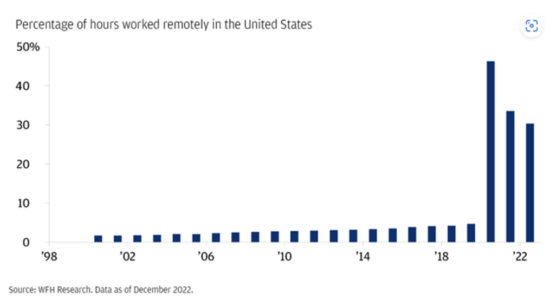

The chart below illustrates just how fundamental this workplace shift has been in America. We’ve gone from roughly 5% of total hours worked to more than a third, even three years after COVID lockdowns.

This summer in strategic planning meetings across the country, bankers will need to deal with some critical realities:

According to Build Remote, 77% of the Fortune 100 companies are operated under a hybrid working model. Data from Gallup indicates 59% of workers prefer a hybrid employer and 35% would be attracted to a fully remote role. Only a meager 6% of American workers prefer a full-time in-office position. Within the hybrid model, employees mostly want two days in-office and three days out. Employers for the most part want the inverse, with no more than 16 hours a week remote – so far the employees are winning this staredown.

For bank talent leaders, the hybrid workplace has really spurred bigger, broader and bolder discussions on workplace flexibility – when, where, how and how much control workers feel about their schedule and expectations. Make no mistake, job flexibility is viewed today by recruiters as one of the keys in fighting the talent wars because it is highly valued by candidates.

The Wall Street Journal recently reported that flexible workplaces are viewed by workers as an equivalent benefit to an 8% raise. Executives are piloting approaches that can tap into this true monetary value of workplace flexibility. One of our clients with more than 50 branches focused on using more part-time staff on weekends so employees could have more family time on Saturdays – a huge hot button for working parents. Because front-line branch employees can’t work remotely, banks are looking at flexible scheduling and benefits to improve retention of these positions.

The hybrid workplace has created huge new design thinking challenges for leadership and new issues around culture that are difficult to address. One is how to better coordinate when the team is in the office so the value of in-person work can be realized. There have been some hilarious Tik Tok videos of Generation Z workers being forced to come to the office only to sit in a deserted cubicle with no human interaction.

In a survey conducted by Executive Networks of 1,300 HR leaders, business leaders, knowledge workers and frontline workers, only 28% of knowledge workers said their company was making returning to the office “commute-worthy.” Financial institutions are working hard to create schedules and events to make their office more of a destination. April Clobes, CEO of Michigan State University Federal Credit Union, has made it mandatory for activities involving the “four C’s” – Coach, Collaborate, Create, Connect (culture activities) – to be done in person.

Better leveraging virtual collaborative tools has also been a bear of a challenge. Kahoot! 2022 Workplace Culture Report found a big disconnect in how employees value online training and virtual meetings. Thirty-five percent of workers said they often mentally check out of online employee training, and 31% often check out of virtual team meetings. The problem is even more pronounced among Gen Z, with 51% of Gen Zers saying that virtual meetings are too long and 31% tuning out because they feel they are being spoken to instead of actively participating.

The truth is over time too much virtual can fray the fabric of the culture. For instance, research from Microsoft found remote working leads employees to have smaller, less well-developed networks. Interestingly, Entrepreneur Magazine reported that while millennials and Gen Z clearly crave some remote work, they also report higher burnout due to the lack of social contact in remote work.

With such a disruptive shift in office usage, bank leadership simply must start to reinvent their office model and start putting pen to paper on just how much capital is trapped in unused office investment. Pretty soon the shareholders will begin forcing this blunt question. In fact, the global workforce survey Cisco recently sponsored found that more than half (53%) of organizations plan to reduce their office footprint. McKinsey has noted that businesses will need at least 20% less office space by the end of the decade, and that estimate is likely to be low.

Progressive companies are leaning into uncomfortable discussions about hoteling and flexible space while designing what’s left for the new realities of work. Salesforce as an example has moved to increase its collaborative group workspace by 64% while greatly reducing its overall square footage.

In all the strategic meetings Cornerstone Advisors has facilitated this year, the most profound lament about new workplace realities has been around the fading and inconsistent work ethic among employees. Sure, COVID became a catalyst for self-reflection and work-life balance, but management today is literally shellshocked by the significant drop in accountability from a segment of the workforce.

The Eric Cartman character from South Park probably best epitomizes this frustration. In a recent episode, Cartman asked to work remotely from his job serving ice cream, takes a mental health day one day after being hired, and reminds his employer about “bare minimum Mondays” and “take it easy Tuesdays.” For bank leaders and talent professionals, the sad reality is that much better profiling of recruits and performance management rigor is needed to separate the professionals from the flakes in what continues to be a tight labor market.

The moment has come where bank leadership can no longer solely react to workplace trends. It’s time to intentionally design a hybrid workplace that recognizes these new realities and brings clarity to the rules of engagement for all employees. It is job #1 for the talent leader to draft this vision and garner the buy-in of the entire executive team. Team members like Cartman won’t build a smarter bank.

Steve Williams is founder, president and partner at Cornerstone Advisors. Follow Steve on LinkedIn.

Great article Steve and right on the money!

After reading this, I can’t help but point out the technological advancements that will facilitate the hybrid environment including flexible “hoteling” options using enterprise collaboration tools, ITM’s to serve clients, virtual client/member care centers and more, all wrapped in cyber-resilient security systems.

Continued advances in digital change provide opportunities to augment self-service with ‘assisted self-service’ through remote offerings. This creates opportunity for remote work. Yet employees still need to be connected to the organization, have in-person face times to collaborate, and contribute to the greater good.

Striking the balance on the “new-normal” will be a key to future success.