In the ever-evolving world of banking, Bank Director’s Acquire or Be Acquired Conference remains a constant. Early this week, the conference was the epicenter of discussions, where 2,000 attendees descended upon Arizona to strategize and set the tone for our great industry’s future.

As we step into February, banking leaders continue to navigate a complex daily ritual … performing to stay relevant while searching for areas to evolve to remain competitive.

From the strategic puzzle of loan growth to the constant tug-of-war for deposit expansion, the financial Everest we face demands a delicate dance between risk and reward. Costs of funds add complexity, while the quest for non-interest income becomes a creative journey to bolster the bottom line.

GonzoBankers, it’s a high-stakes arena where trimming non-interest expenses is a must, all while keeping a watchful eye on the credit quality tightrope. And don’t get us started on the challenge of succession planning.

Here are the key themes that emerged from this year’s Acquired or Be Acquired Conference, essentially a field guide for the troublemakers who didn’t make it to the desert this week.

While we can’t predict the future, we sure can prepare for it.

We can’t sleep on non-bank competition, bigger banks controlling even greater market share, or big tech and embedded finance. Leaders need to be honest about succession plans and realistic about the Fed and rate shifts, which led to compressed margins and pressures on investment portfolios and contributed to the failures of First Republic, Signature and Silicon Valley banks.

Concerns about successors to today’s executive leadership teams dominated many presentations. While the mood felt upbeat and optimistic (maybe it was the sunny and mid-70s weather?), many we talked with in the halls acknowledged that credit quality remains a wild card to start the year. Investors are concerned about earnings, and more than one presentation posed the question: “Will credit replace margin?”

The French have a saying that it is the fate of glass to break. For the bankers we talked with, acknowledging challenges—think NIM, credit, regulation, election uncertainty, unemployment and CRE—while portraying resilience created quite a few compelling narratives throughout the event.

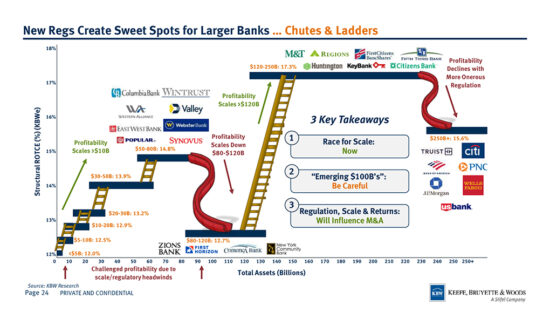

Tom Michaud, CEO of KBW, kicked off the conference by showing that “all signs point to a consolidation boom as banks race to scale, fixed cost of regulation increases, and balance sheets improve.” Since banks with less than $10 billion in assets continue to struggle in deposit gathering, scale and overall earnings, we wonder how many will not be here in five years?

How many times did we hear a speaker admonish the audience to “be sure and sign up for the FDIC notification list.” Five? Fifty? Five Hundred? (Oh wait, this is the new asset size, in terms of $Billions, that people reference for banks …)

Deposit funding costs pose a big risk to banks. Our just-released What’s Going On In Banking 2024 research authored by Ron Shevlin reveals that cost of funds is the top concern for 70% of banks and credit unions this year, and deposit gathering was in the top four for half of both groups.

We didn’t hear the tired buzzword “digital transformation” as often as in prior years—but we did hear that bankers remain focused on leveraging technologies to enhance existing processes, with AI getting its fair share of attention.

Let’s face it, there’s not one metric that’s ever perfect. But kudos to Michaud for acknowledging this could be the busiest graph/image he’s ever presented. We happen to like it.

Some of our favorite one-liners from the halls of the JW Marriott:

Q2 makes a run with its pickleball set (the massage gun is a nice touch, Kirk Coleman and co.) but Baker Hill gets the Gonzo award. As Sam Kilmer put it, “This is either the most brilliant (or insane) swag of the conference.”

Last year, we wrote about how the techies have graduated from the kids’ table to a prime seat alongside industry leaders. Joint presentations between bankers and fintechs abounded, showcasing collaborative initiatives. As disruptive innovation finds a home in banking, the industry anticipates a surge in technology’s ability to drive tangible business outcomes.

Last year, we left AOBA noting that most bankers were optimistic about deals picking up later in 2023 and that the chances of a raging 2024 were strong. Well, we’re in 2024 and let’s talk about that “promising outlook” that seems to be building toward Q3.

Amid a lack of buyers and low valuations, we anticipate more mergers of equals (MOE), especially in the $8 billion to $18 billion space. You don’t want to dip your toe over $10 billion given the regulatory costs incurred and compliance burdens added, and banks need to keep pace on the tech side while increasing earnings and enhancing franchise value.

While we continue to hear marks and accumulated other comprehensive income (AOCI) significantly impact the M&A math, that isn’t slowing the talk of who’s buying and who’s interested in an exit. The opportunity to diversify liquidity sources is real.

The Cornerstone AOBA team of Anne Arvia, Quintin Sykes, Brad Smith, Clio Silman, Ryan Rackley, Stacey Bryant, Eric Weikart, Ron Shevin, Sam Kilmer and I thank Collyn Gilbert, chief strategy & marketing officer at Valley Bank, and John Eggemeyer for talking Smart(er) Banking with Quintin on Monday. And we salute the entire Bank Director team for yet another exceptional event.

30 years is a long time to stay relevant, let alone lead the industry with the preeminent conference. Ramble on!