Well folks, they’re back—the cries from the rooftops, in the media and at conferences that “Scale Matters” in our consolidating and technically transforming banking industry. A recent round of bank merger announcements and the marquee Capital One/Discover deal illustrate this mantra’s popularity. It appears nothing else matters but the urgency to get big and get there fast.

It’s very hard for regulated banks and credit unions to gain any meaningful efficiencies under $1 billion in assets. Cornerstone believes the bulk of the 7,000+ institutions that fall below the $1 billion mark will be consolidating fast through this decade.

But let’s call time out for a minute. While it is factually true that the average efficiency gets better as organizations reach greater asset tiers, these averages gloss over the fact that there are great winners and pure dogs across all asset sizes.

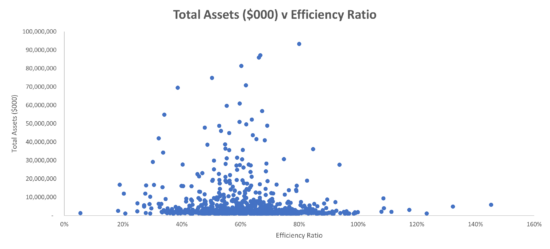

To provide a glaring illustration of this, Cornerstone data whiz Von Sowards analyzed all banks between $1 billion and $100 billion and plotted asset size versus efficiency ratio. Well fellow Gonzobankers, here’s the brutal truth:

As one can see, these data do not simply bunch up and to the left as our industry mantra about scale would imply. In fact, for the statistics geeks the correlation coefficient or “R” here is a measly .0018! There are banks with a few billion in assets running with better efficiency ratios than banks with $50 billion in assets.

At Cornerstone, we wave the flag not for being a scaled bank but for becoming a Smarter Bank—a dynamic organization that puts a traditional bank, a fintech and a top-talent workplace in a blender and comes out with a modern organization that is differentiated, hyper-efficient, nimble, data-driven and opportunistic.

So, while growth and scale are helpful, bank leaders need to dive deeper into the key areas that will drive a new frontier of smarter efficiency. Digging into enterprise performance data can help executives focus on where the smart efficiency opportunities lie. Here are five key areas that Cornerstone would encourage management to start:

So, let’s do a quick thought experiment, Gonzobankers. Imagine if a group of investors built a brand new Smarter Bank using all the new tools available today: cloud technology, digital-first delivery, data and workflow integration, AI-infused tools and systems, connected ecosystem partners, agile execution approaches and workplace best practices. What would this institution’s potential efficiency ratio be? Sub 40%?

As industry consolidation continues, scale will be part of the future story, but smart ultimately wins the day.

Steve Williams is a founder and president of Cornerstone Advisors. Tune in to Steve’s Plugged In podcast and follow him on LinkedIn and X.