In my younger days (think post-cave drawing but pre-smartphone), my friends and I used MapQuest for navigation. Does anyone remember MapQuest? Once we fed our destination into the website on our PC, we had to print the turn-by-turn directions plus the map on paper! Compared to today’s Google Maps smartphone app, the MapQuest Mode was seriously clunky. But at the time it was the bomb, and we dug the way it got us where we needed to go.

Today I’m the bearer of bad news for commercial lenders. Many financial institutions are still using legacy credit memo functionality in their loan origination systems, an old-school paper-based practice that I will liken to the MapQuest Mode for navigation. Now, the credit memo goes by many different names, including credit approval request form, credit approval form and loan approval request form. But however it’s labeled, a backward reliance on this functionality is greatly impeding the potential of today’s end-to-end commercial LOS platforms. And it’s costing banks a lot of money.

So fast forward to today’s end-to-end commercial LOS platforms. I’ll call this navigation functionality “Google Maps Mode.” These systems enable financial institutions to better capture loan details and supporting documentation/data provided by borrowers and/or third parties. While it may be in a slightly different (and uncomfortable/unfamiliar) format, the data elements are readily available in real-time. Source/supporting documents are available in the LOS and organized by client, collateral or loan record, making access more readily available. There’s no need for a credit analyst to provide a lender with the paper-based “most recent version” — everything is available in real-time, speeding the overall process and moving banks forward in their commercial lending digital transformation.

But when MapQuest Mode is forced back into the process, digital transformation comes to a screeching halt. The financial institution forces the system to execute an extreme, parallel, “point-in-time” version of various elements using the MapQuest Mode while trying to keep up with the real-time version using the Google Maps Mode.

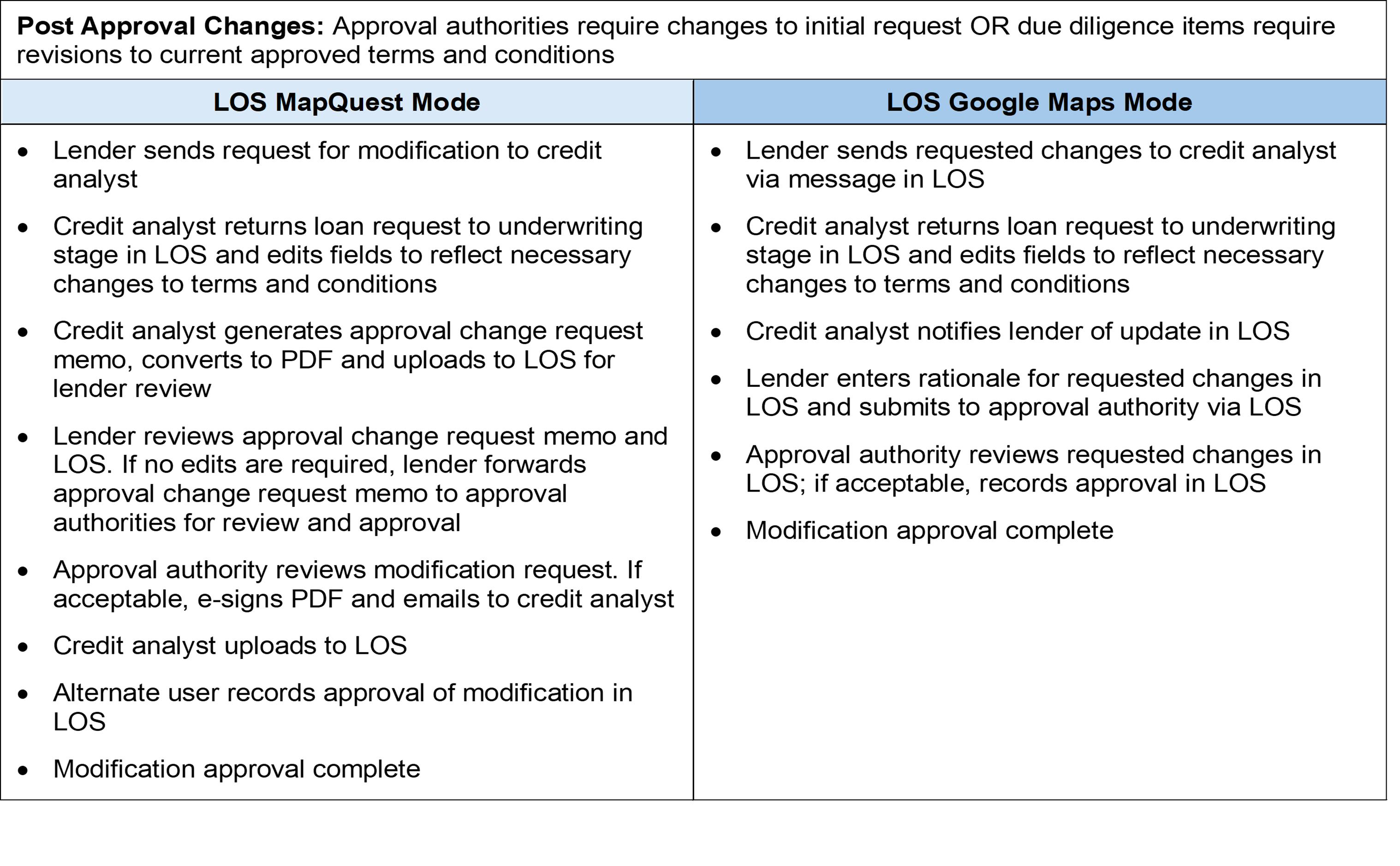

Here’s a comparison of post-approval commercial lending activities using MapQuest Mode and Google Maps Mode:

Reviewing the above comparison, we are hard-pressed to justify retaining LOS MapQuest Mode. The familiarity of the old credit memo is comforting, and transformation is uncomfortable. Still, the benefits are well worth it for everyone involved at the financial institution and, more importantly, the customer/member.

Financial institutions caught in MapQuest Mode with their commercial LOS should begin their trip down the road to recovery with these five steps:

The forced use of the credit memo in the origination process is one of the greatest obstacles to the benefits available in a commercial loan origination system. Only when financial institutions break out of MapQuest Mode can they move forward on their commercial lending digital transformation journey.

Joel Pruis is a senior director at Cornerstone Advisors. Follow Joel on LinkedIn.

I really like the MapQuest analogy! The credit memo is such a beloved artifact of all commercial loan origination systems. So much time (often months) and $ spent to get the credit memo designed to closely mirror the layout of some legacy Word doc that is often overwhelmingly driven by the visual tastes of one stakeholder at the bank. When that person leaves, a new person wants it changed to mirror their tastes, and they will pay $ for the privilege each time. Lather, rinse, repeat.

Like Joel said, the value is in the content. Don’t waste time and resources monkeying with the layout, or printing and re-printing the doc (like the old MapQuest directions). In most cases, the content is in the LOS but the security blanket of #2 in your list is a powerful force that opposes change since bankers love the familiar.

AI tools might help accelerate the transition, since they can quickly scan all of a deal’s data and compile, summarize and update it without some of the manual touches that are a drag on today’s efficiencies. It will be interesting to watch how that plays out.

Google Maps mode will win this battle eventually, but it’s going to take time.

What I find, and we are nCino users, is that even the MapQuest mode is too clunky. One example – In our implementation, the proposed loan is not just a 3 year term loan. The proposed loan is a 3 year term loan with a specific booking date, a specific start date, a specific first payment date and a specific maturity date. These dates are entered optimistically and then the approval drags. The loan is approved and makes its way to loan documentation who discovers the errors and maybe that the because of the passage of time the “wrong” action was used. At that time we follow your proposed “modern” solution and pull everything back, make a few changes and push everything back through the approval cycle with the comment “technical changes only”. I think it was a better world when loan documentation had the power to make immaterial changes.

You are on the right path with how many things you and I dreamed of 20 years ago are poorly implemented. What happened to the “data warehouse” where every data element would be available to prepopulate everything? What happened to the “digital loan file” that would eclipse the need for multiple copies of key documents in a user friendly format? What happened to “push a button” processes that would fire off automatic searches, save to the file, and flag irregularities? Even the auto-approval and “book no look” servicing of small loans is still a reach for many.

I guess that’s why we still need Gonzo Banker. I always appreciate your insight.

Interesting thought on AI pulling together a summary of the data captured. I would be interested to see what type of narratives AI could generate within the LOS especially as banks/credit unions build the depth of data.

One way vendors may accelerate the move to the Google Maps mode would be to adjust the views of the data by user type/stage in the origination process. Still staying away from the Credit Memo format but create a more user-friendly view allowing the credit officer to see the data in a logical progression and eliminate the number of clicks or ‘hunt and find’ the data they want to see.

Great comments!

Bill,

You have captured an excellent example of “just because you can doesn’t mean you should”. To establish the first payment date anytime before the actual generation of the loan documents is really pointless. Too many events even in the small business space have yet to happen that may change the actual value. Doc Prep needs to be empowered and sometimes forced to take accountability for entering/modifying those types of data fields.