Most banks and credit unions don’t have a single vendor, single system, end-to-end, integrated loan delivery solution. Actually, no institution has one of these. What the heck is the holdup? It’s not like we started lending money yesterday!

First, I’ll discuss why the need is more pressing now than ever, and then I’ll convince you that this is one you have to do yourself.

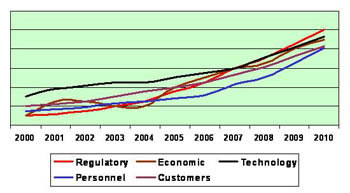

In the loan delivery process there are many stakeholders. Regulators are pushing portfolio management on us – Basel II, SOX, BSA, GLBA and a number of other alphabet soup mandates. If we think it will lighten up with the new Congress, hopefully we’ll be proven right, but don’t hold your breath. There is an economy that swings daily from inflationary to recessionary and global to regional growth and decline. There is mounting consumer and government debt. Wall Street only cares about what we are doing this quarter, and 10% growth is not good enough if the Street expects more. Technology is both the Holy Grail in front of us and the gorilla on our backs. One project is hardly finished before four more are knocking on the door. Bankers don’t invest in nearly the right proportion when comparing system dependency to business continuity. Hackers, spammers, phishers and pharmers are gnawing at the electronic door to our electronic vault. Baby boomer personnel will be retiring in droves to be replaced by Gen X & Y’ers who want nothing to do with manual, cumbersome and repetitive tasks. They want Web-looking applications. Web apps with iPod, IM and cell phone integration would be most welcome. Fewer and fewer middle managers are developed with strong technology and strong business skills. Finding affordable propeller heads that can communicate without (or even with) email is getting tougher and tougher. And finally, those pesky customers. Geez, Louise!! How much more could we get done if they would just leave us be?!? They expect to be able to conduct all their business online. They expect us to know all about them and keep it private. They want fast turnaround times, and they don’t expect us to make our profit on their backs alone.

Looking at all these pressures graphically produces a chart something like this:

It is absolutely critical that processes are streamlined and simplified before this train wreck runs bankers out of business. But where to start? Realize this is not a two, three or six month endeavor. Bankers have been making loans for 25, 50, 100 years. Don’t think for one second that these processes get reworked in a couple of months. This is easily a two to five year process, depending on how much change the organization is used to.

Taking the Strategic View

Banks should look down the road five years from now and project how they will reduce the turnaround time and increase the accuracy/quality of their loan delivery systems. The only way to have a material impact is to have fewer, integrated and robust systems. Hurling bodies at it will not get the job done. However, revamping systems should be preceded by a complete policy, process and employee review.

Policies-Procedures-Policies-Procedures

Just as the IRS never makes the tax code smaller, bankers never take anything out of their loan policies. Here are a few tips GonzoBankers can employ to streamline their overblown policy documents.

The reason bankers end up with processes that are not value-added and executed flawlessly is because we have employees that don’t understand the big picture or the detail beyond their job specific role in the loan delivery process. If we don’t have a program in place that requires and rewards our employees for understanding the whole process and mastering pieces of it, shame on us.

Systems

The number of systems required in the loan delivery system is more than any other banking function:

Is it any wonder it isn’t feasible to insert a CD-ROM, run D:\Setup.exe and have an operational loan delivery system?

If you are still waiting for one of your system vendors to come out with release thirty six dot one that does all these functions, call me. I’ve got some ocean front property in Arizona.

So if the vendors aren’t going to solve the problem, what are you going to do about it? Chances are you already have some of the pieces in place to have an end-to-end, integrated loan delivery system. But you probably also have some pieces that won’t work, and you certainly will have to build some interfaces. Some basic criteria for the systems that can be used are (a) open back-end database, (b) Web-enabled front end and (c) documented APIs. Because you have a tightly scripted, business recovery application restoration priority, you should already have the list or inventory of all the systems, including ad hoc and one-off reporting/Excel “systems,” that are used in the loan delivery process. Walk through this list engaging the vendor to see what direction it is heading with its products. An ideal situation would be that a vendor of one of the main systems has additional products that can be acquired and replace existing systems. This should eliminate a custom interface requirement.

It sounds easy, but getting the lending and I.T. staff on board to replace an in-use and working application for a new, integrated application will involve politics in one camp and become a competing priority for the other. But if the goal is to have a single point of data entry, enhanced customer self-service, simplified back-office processes and reliable sources of information, it is imperative to find the wherewithal to tackle system replacements.

For those remaining systems that aren’t talking together, you need to make the decision to use whatever resources it takes to build and maintain the necessary interfaces to eliminate manual and duplicative data entry. You won’t get as much flak from the lending side of the house on this one, but, again, carving out the technical resources to get ’r done will be a challenge. Communicating the benefit of your strategic, long-term view is the only way to jump to the front of the queue.

Document Imaging

Don’t underestimate the power of integrating document imaging into your workflow. A best practice implementation can help lower those turnaround times. When the required documents are captured as early in the process as possible and made accessible to the enterprise, not only do you reduce turnaround time but you also assist your compliance efforts. Knowing which documents you have is great, but knowing which ones are missing and what’s wrong with the ones you have is better. Not all imaging systems offer this level of tracking.

Interfaces

Once you have two systems in place that need an interface, build it. The efficiency and accuracy gains of every interface will pay for itself quickly, and seeing the results will push you to get the remaining ones complete. Don’t be afraid to contract with your vendors to make it happen or assist if you don’t have the internal resources. They are the experts in their APIs. There are plenty of middleware tools that can be used, and where there aren’t, ASCII imports and exports are clunky but better then duplicate manual input.

Bottom Line

The steps to take are:

Mid-size banks and credit unions are at risk of being out-serviced by the big banks. Why would customers want to come to your branch and wait two weeks, when they can go to your competitor’s Web site and have the money deposited to their checking accounts in four days? It won’t be long before you’re slashing prices to keep and attract the business, and that won’t last for long. Imagine the most efficient process for your organization and put the pieces in place to make it happen. You have to do this. You may need assistance, but if you are waiting for it to be handed to you or available for purchase, you’ll get run over.

-mc

Cornerstone Advisors can help your institution with a complete policy, process and employee review to determine your level of readiness for a loan delivery system integration initiative.

We can assist in the development of a program that educates employees on the big picture and rewards them for demonstrating a masterful level of understanding.

Finally, we can work with you as a team to communicate the benefit of your strategic, long-term vision to senior management, vendors, lending and I.T. staff.

As Croal states in his article, “What the heck is the holdup? It’s not like we started lending money yesterday!”

Let’s get moving. Contact Cornerstone today.