Before I begin this week’s fountain of wisdom I must correct a statement I made in my last Gonzo article (Security, Compliance, and the Costs… Oh My!). I realize it’s hard to believe, but even the GonzoBankers make a mistake every now and again. In my prior article I stated that TriCipher was a hardware token provider of multi-factor authentication. It is not. Sorry guys. Now please stop sending me emails pointing out my error.

Jeopardy anyone?

Answer: This company has 100 million accounts, crosses 55 markets worldwide, processes an average of $823 in total payment volume every second, and supports payments in U.S. Dollars, Canadian Dollars, Australian Dollars, Euros, Pounds Sterling, Japanese Yen, and even Chinese Renminbi.

Question: Who is Citigroup? I mean Bank of America. I mean Chase. Uh uh…..

Time is up.

All of your questions are incorrect. But thanks for playing.

The correct question is – Who is PayPal?

Yes GonzoBankers, PayPal has eclipsed 100 million accounts. Any way you slice it, my friends, 100 million accounts should finally make us pay a little more attention to this “little” Internet payment company.

Who is PayPal?

In December 1998, Peter Thiel and Max Levchin founded PayPal. In its initial incarnation, PayPal was a service for users to send money via PDAs (personal digital assistants, e.g. PalmPilot or Pocket PC). Even with Star Trek’s “Scotty” as its spokesperson, PayPal via a PDA never took off. Discarding the PDA version and opting for a Web-based system, PayPal quickly became the payment mechanism of choice on a somewhat popular Web site called eBay.

It did not take long for eBay, the online auction company, to see a huge rise in online payments and how being able to facilitate those payments would be a perfect match for its online auctions. Instead of partnering with PayPal, eBay decided to create its own payment service, Billpoint. Billpoint was a raving failure. While eBay was trying to get its payment service off the ground, PayPal became the first Internet company to go public following 9/11. Ironically, the publicity became a lightening rod and attracted none other than Mr. Hodge’s favorite person, NY Attorney General Eliot Spitzer. (See “Chest Thumpers Unite,” GonzoBanker 7-1-05) Yep, you know you have arrived when Mr. Spitz comes knocking on your door.

Taking a page from the Attorney General himself, PayPal filed its own legal complaint, an anti-competition complaint, against eBay. PayPal was offended by eBay establishing its own payment service and believed eBay was strategically using its auction Web site to promote Billpoint and force PayPal off the site as the preferred payment method. After a few months of bickering eBay and PayPal kissed and made up. But you don’t become an eBay by accident. Seeing that its own payment service was being used by only a few thousand auctioneers versus PayPal customers in the millions, in October 2002, eBay bought PayPal. As the saying goes: “if you can’t beat em, buy em.” Not sure who said that but I am sure it was a banker.

eBay quickly buried Billpoint and PayPal became the promoted payment mechanism of choice on the auction site. What effect did this have on other online payment services?

Let’s see; in late 2003, Citibank closed its c2it payment service. Then in late 2004, Yahoo dismantled its PayDirect platform. Lastly, BidPay ceased existence in December 2005.

Seriously, are online micro payments (P2P) really that big a deal? Many of us probably equate online commerce with adult type Web sites such as Internet gambling or (dare I say it?) pornography.

eBay was definitely thinking about this. When it purchased PayPal, eBay barred PayPal from being used in any form of “adult” type services. Damn, those eBay folks really knew how to take the fun out.

However, even without the alleged “adult” services, in 2004 the total volume of transactions through PayPal was $18.9 billion, and in 2005 it was up to $27.5 billion. Ka-Ching!

Who needs that adult stuff anyway?

What is PayPal?

According to Wikipedia, PayPal is an Internet business that allows the transfer of money between email users and merchants, avoiding traditional paper methods such as checks and money orders. You can use PayPal to pay for online auctions, purchase goods and services, or even make donations. PayPal also performs payment processing for e-commerce vendors and other corporate users.

PayPal falls under the category of peer-to-peer (some folks say “person-to-person”) payments, or P2P. P2P payments can be defined in the following manner:

How does it work?

A basic PayPal account is free. You can send funds to anyone with a simple email address, whether or not that person has a PayPal account. The receiver of funds will get an email message from PayPal informing them that “You just got paid,” or something like that, and to actually collect those funds the receiver signs up for their own PayPal account.

Confused?

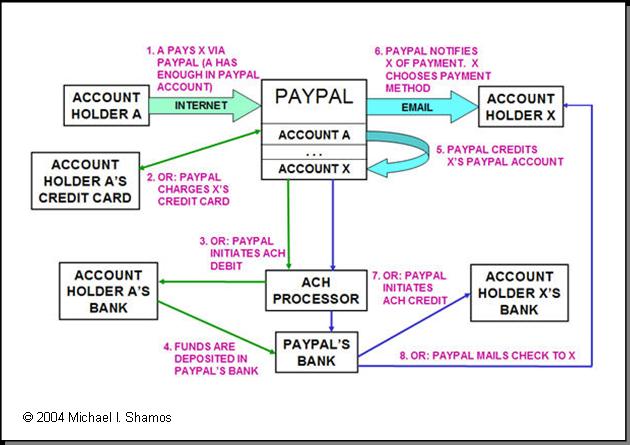

No worries, below is a graphical representation of how PayPal works.

Going after merchants

In June 2005, PayPal decided to take its payments service directly to online merchants. With the introduction of PayPal Payments Pro, merchants could accept PayPal payments, and instead of customers having to complete their transactions on the PayPal Web site, they can finalize transactions on the merchants’ Web sites. Did I forget to mention that PayPal also charges merchants a considerably smaller fee than banks do for their credit card merchant accounts?

Having to pay a much smaller fee to PayPal versus a bank is a pretty good motivator for small and medium size businesses.

Wanting to get an even stronger foothold in the merchant processing arena, PayPal decided to purchase Verisign’s payment processing business in October 2005. Having its own payment processing platform makes PayPal a bona-fide threat to credit card companies in the online commerce arena.

Keeping the merchant theme going strong, PayPal in late 2005 struck a deal with the boys from Dell. What that means is that when you are purchasing a new Dell computer online, you have another choice besides Visa and MasterCard. Last time I checked Dell sold a fair number of computers via its Web site.

Going mobile

Earlier this month PayPal introduced PayPal Mobile, a text message-based service allowing buyers in the United States and Canada to send money from their mobile phones. The buyers must first activate their phones for this service, but once it is activated, the buyer sends a text message to PayPal. PayPal then calls the user back to confirm the mobile payment, and then sends the money to the recipient. Don’t know about you Gonzos, but I think this is pretty slick.

GonzoBankers, PayPal has become a force to reckon with in the payments arena. If you have ignored it up until this point you might want to pay a little more attention. What works for PayPal online may also work for in the offline world.

Hmmm…something to ponder.

With competition from PayPal seemingly increasing, banks may want to consider the following payment strategies:

Understanding that the PayPal system currently relies on funding from bank checking or credit card accounts, I don’t think PayPal will seriously hurt our bottom lines. However, with 100 million accounts, it is bound to make an impact on customer loyalty.

On that friendly note, if you are wondering what the X factor is in the payments world these days, just click the following link: www.x.com.

Off to the races. Seriously, it’s NASCAR weekend in the desert. Vroom vroom vroom.

Later,

tj