Yes, GonzoBankers, the buzz around mobile commerce is back. Sure, sure, we heard the buzz before. Remember the late ‘90s? Unlike the vaporware promises of the ‘90s, fiction has now become fact, and cell phones may become more important than wallets. Who knows? It might just replace them. (Note: I don’t think a cell phone will ever replace a purse. The storage space on cell phones is just not that big.)

According to Mercator Advisory Group, there are roughly 200 million cellular subscribers in the U.S. and annual cellular revenue is approaching $120 billion. With those numbers it is easy to see how Celent projects worldwide mobile payments will reach $24 billion this year and $55 billion by 2008. But what is different this time around?

Real Mobile Payment Technologies

Today the two front-runners in the mobile payment standards are Short Message Service (SMS) and Near Field Communications (NFC). The two technologies vary significantly.

SMS

Short Message Service enables text messages of 140 – 160 characters to be transmitted from a cell phone. Unlike pagers, but similar to email, SMS messages are stored and forwarded at SMS centers, which means messages can be retrieved at a later time. SMS messages travel back and forth from cell phone to cell phone over the system’s control channel, which is separate from the voice channel.

Several companies have leveraged the SMS technology to transform consumer cell phones into more than just a gadget to call home.

PayPal

One of the first companies to leverage this technology was PayPal. PayPal Mobile is a text message-based service that allows consumers in the U.S. to send money anytime, from anywhere, using their cell phones. Hmmm…so how does this work?

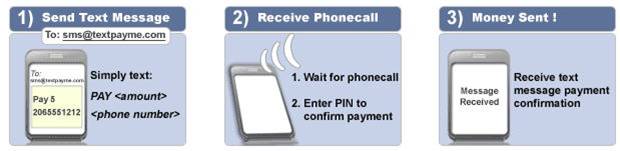

Customers send text via their cell phone requesting to pay bills, transfer funds, purchase magazines and newspapers, etc. After a customer sends a text request, a PayPal computer calls the customer and requests the user to enter the secret PIN determined at account set-up to confirm the transaction. Once the merchant receives the verified payment, the product is shipped and viola!

Just in case that made no sense at all, take a look at the pictorial below.

PayPal’s belief is that it will assist customers in turning their cell phones into the long forgotten promise of an electronic wallet.

TextPayMe

Similar to PayPal’s offering, TextPayMe asserts its service will eliminate verbal IOUs and enable customers to:

• Split restaurant bills

• Pay beer club or other club dues

• Settle a roommate’s rent and utility bills on the spot (Boy, I know I could have used this function in college.)

TextPayMe’s partnership with Craigslist, allows customers to buy and sell items. Once again a picture is worth a thousand words.

BillMonk SMS

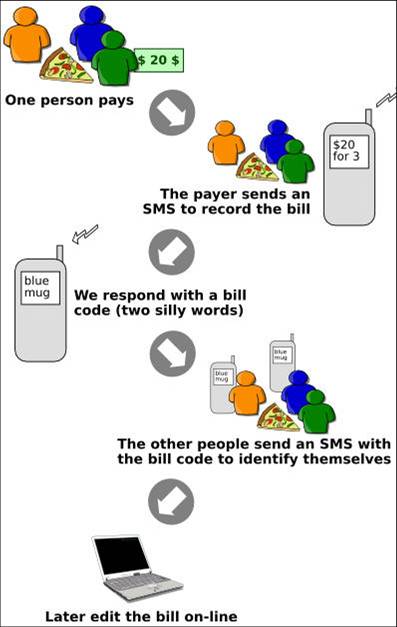

This is one of the newest services to leverage SMS. Launched in January 2006, BillMonk addresses a very important daily issue: splitting bills among cohorts.

BillMonk allows a consumer to record shared bills and loans (IOUs) the moment they happen via a cell phone. Later, the consumer can visit the BillMonk Web site and see who owes what.

To use this service, one must first establish an account with BillMonk. For it to truly work, all the buddies must sign up as well. Having established an account, reporting a dinner bill via BillMonk SMS would go something like this for a typical (yeah right) night out for the Gonzos:

If this aforementioned description somehow eludes your comprehension, once again we GonzoBankers love our pictures.

Other players entering the SMS mobile payments space may be of interest:

MyTango lets customers pre-purchase food and drink orders via their cell phones.

Eko, a company out of Australia, has created an SMS Banking and Finance Solution. Using Eko’s infrastructure and secure architecture methodologies banks can offer customers the following services via SMS:

• Account balance information

• Fund transfers

• Bill payments

• Stock information

• Transaction alerts

• Sell/Buy executions

• Transaction confirmations

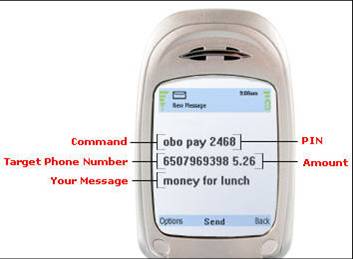

Employing a different approach to some of the aforementioned, Obopay combines a downloaded application that resides on the customer’s cell phone with SMS services. The downloaded application provides additional layers of security and fraud protection. The service works similar to PayPal Mobile and TextPayMe.

SMS services are offered by every major cell phone provider, but consumers might want to check with their providers before they start texting away to determine just how much each text message will cost. Oh yes, friends, there is always a cost.

SMS is available on just about every cell phone, but a new technology has begun to make waves in the mobile payments world.

NFC

Near Field Communication is a standards-based, short-range wireless connectivity technology that enables simple and safe (i.e. secure) two-way interactions among electronic devices, allowing consumers to perform contactless transactions, access digital content and connect devices with a single touch.

To use NFC, a cell phone must first be NFC enabled. ABI Research claims that by 2010, more than 50% of cellular handsets – some 500 million units – will incorporate NFC capabilities. Cell phone companies like Nokia and Motorola and the payment powerhouses of Visa and MasterCard are plowing down the NFC path.

What makes NFC so different from SMS?

SMS deals strictly with a cell phone and simple text messaging, whereas NFC enables devices. Here are some examples of devices and machines that are likely to become NFC enabled:

Most people have probably heard about or even used a “speed pass” card at a gas station or grocery store. Today, the transaction is performed with a card or key fob; tomorrow, an NFC-enabled cell phone replaces both.

Although NFC-enabled devices are not widespread today, some companies are already taking advantage of this new technology.

VIVOtech

Vivotech has developed the VIVOplatform and VIVOwallet based on NFC technology. The platform provides back-end processing, payment and promotions capabilities connected to the billing infrastructure and the VIVOwallet, which is a client- or server-based electronic wallet.

VIVOtech has shipped more than 160,000 NFC readers (platform) since it started selling them 18 short months ago and has key partners like Phillips, MasterCard, American Express, VISA, Symbian and Sprint.

MobileLime

MobileLime has turned the cell phone into a real-time marketing, cardless loyalty, and mobile payment device leveraging NFC technology. The company claims that customers can user their mobile phones to personalize their shopping experiences, take advantage of loyalty programs without carrying a card and use their cell phone to pay for purchases.

NFC and Banking

You knew I couldn’t resist at least mentioning multi-factor authentication. An NFC-enabled cell phone could be used for storing authentication and digital signature credentials, in addition to storing payment credentials for remote payment and financial services. Imagine a world without key fobs, tokens, plastic cards, passwords and pass phrases and envision a world with bank-branded cell phones that grant users access to their offices, login to their PCs, authentication for online banking, and even get money out of ATMs.

Yeah, I know, a little far fetched…at the moment.

Having said that, GonzoBankers, mobile commerce has arrived and it has legs that are moving pretty fast. I encourage bankers to analyze the role mobile devices could play in their contactless payments strategies. At the same time, the use of an NFC-enabled cell phone as an authentication device for online banking may warrant consideration

To really begin to understand the role financial institutions can play in the mobile commerce world, The Mobey Forum has developed an excellent whitepaper: “Mobile Financial Services Business Ecosystem Scenarios & Consequences”.

Now I gotta chase down Hodge and get that money he owes me from dinner.

Until next time,

-tj