Bloomington, Illinois, is where we find this month’s GonzoBanker honoree. For the past four years, Tim Owen of Heartland Bank and Trust Company has been one of the industry’s loudest evangelists for reinventing the commercial loan process with document imaging. Tim is leading an enterprise content management (imaging and workflow) crusade that is well on its way to transforming Heartland Bank and Trust into a true paperless organization.

Bloomington, Illinois, is where we find this month’s GonzoBanker honoree. For the past four years, Tim Owen of Heartland Bank and Trust Company has been one of the industry’s loudest evangelists for reinventing the commercial loan process with document imaging. Tim is leading an enterprise content management (imaging and workflow) crusade that is well on its way to transforming Heartland Bank and Trust into a true paperless organization.

Name: Tim Owen

Name: Tim Owen

Official Title:

Vice President and Senior Lender, Commercial Lending

Heartland Bank and Trust Company ($921 million)

Bloomington, Illinois

Gonzo Title:

The Crazy-Eyed Evangelist of Enterprise Content Management

Banking gig prior to Heartland Bank:

First State Bank of Pekin, IL

College Alma Matter:

Monmouth College, Monmouth, IL

Gonzo Claim to Fame:

Tim was the lead sponsor in a bank-wide document imaging and workflow initiative. For the most part, document imaging has met a great deal of skepticism from commercial bankers. Lenders are as eager to let go of their loan files as babies are their tippy cups. Many banks have completed document imaging for archival and disaster recovery purposes, but few have taken the more gut-wrenching look at truly changing commercial lending workflow.

Tim was the lead sponsor in a bank-wide document imaging and workflow initiative. For the most part, document imaging has met a great deal of skepticism from commercial bankers. Lenders are as eager to let go of their loan files as babies are their tippy cups. Many banks have completed document imaging for archival and disaster recovery purposes, but few have taken the more gut-wrenching look at truly changing commercial lending workflow.

The bizarre aspect of Heartland Bank’s imaging initiative is that Tim is a lender who didn’t resist this technology. On the contrary, he was the Kool-Aid drinking maniac promoting the technology’s possibilities.

Heartland Bank and Trust began document imaging in April 2003. The bank started with Loans & Trust. However, within two years of great success the project mushroomed to include Deposits, Human Resources, Operations, Customer Information Procedures (CIP), Accounts Payable, Agriculture, Investments, Board and Administration, Policy, Holding Company, COLD, and even Marketing!

Yep, it’s becoming clear – the Holy Grail might actually be found in Bloomington.

Here’s one example. Today, Heartland’s entire deposit process is paperless. Gonzos, good luck finding any paper signature cards, deposit slips or loan documents in this organization. And, since the entire paperless crusade is an enterprise-wide initiative, every line of business and branch personnel within Heartland has access to the electronified documentation.

Using Hyland’s content management platform and workflow software tools from PROFORMANCE’s INFO-ACCESS, Heartland has created a slick bar coding process that automatically indexes all of the documents in a typical loan package. In addition, the bank is using INFO-ACCESS as its collateral and credit exception tracking system, fully integrated with document imaging. So, if a UCC filing has expired, not only will the bank’s system flag this issue, it will also allow an employee to drill down into an image of the UCC on the spot.

The database with the content management is being stretched for many uses at Heartland. Tim reported that he creates a record on the database whenever he has a lending prospect, well before the actual loan documents are ready to populate the system.

Bottom Line for the Bank:

Heartland has been able to reduce the number of storage facilities necessary to house documents, and automation has allowed the bank to continue its growth without substantially adding staff.

Tim swears that the impact of imaging has also been noticeable in customer service levels. “Regardless of where a customer elects to do business with us, i.e. any of our 22 branches, call center, etc.,” he said, “the bank rep has electronic access to all of that customer’s information. Sharing information across the organization and enabling quick and easy access allows us to service customers more effectively and efficiently.”

Key to Project Success:

Total commitment from the bank’s owners/senior management and a commitment to global thinking by team members. It has been stated many times, friends – trying to change an organization from the ground up is… well… difficult. When asked about the “global thinking” concept, Tim just smiles. This undoubtedly conjured up images of bumper-stickers throughout Bloomington that read “HBT: Think globally, act locally.”

If you had to do it all over again, what would you do differently?

Tim’s only change would have been plopping down the bucks for enough hardware to meet the entire project needs from the beginning. Don’t be penny-wise and pound foolish up front in a content management rollout.

In most imaging projects getting lenders and employees to use the new tools is typically the biggest stumbling block. When purchasing more hardware is the only hiccup… you done good, Heartland Bank!

Who on your team would you like to give credit to for helping make this project successful?

Tim, Nancy, Lorri, Marilyn, Brett and Amy comprised a core team that made a huge commitment to the imaging project with no reduction in their primary responsibilities at the bank.

Career Choice if Tim Wasn’t in Banking?

Career Choice if Tim Wasn’t in Banking?

Rent masks, flippers, and sell bottled water in Maui!

The reward after selling bottled water and renting scuba equipment all day (oh, and because Tim helped save so many trees):

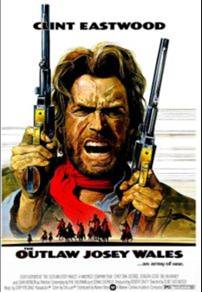

Any Western. Now we understand how Tim was able to get the entire bank to participate in the paperless crusade.

Any Western. Now we understand how Tim was able to get the entire bank to participate in the paperless crusade.

Favorite movie of all time:

As the GonzoBanker of the Month, Cornerstone is proud to donate $250 to Monmouth College in Tim’s name. Great job Tim.

After a decade of fits and starts, document imaging is ready for prime time in the commercial lending arena, and bankers have folks like Tim Owen to thank for bringing some real “proof of concept” to the industry.

-GB

A Technology Assessment from Cornerstone Advisors will provide an objective view of where your organization stands in terms of infrastructure, applications, outsourcing relationships and technology support staff. Our analysis of current technology deployment and spending will specifically address these questions:

* How does technology spending compare to peers in the marketplace?

* How should major future projects (imaging, electronic banking, etc.) be planned?

* What future systems will have the biggest strategic benefit?

As part of our Technology Assessment, Cornerstone reviews every technology initiative under way in the organization and provides recommendations for the most effective implementation.

Visit Cornerstone’s site or contact us for more information.