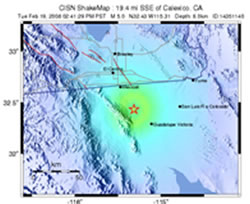

What an exciting week. After years of avoiding it… I finally experienced my first earthquake. Most of you probably didn’t feel the 5.0 magnitude quake located just south of the border, but we sure felt it in El Centro, CA! By the way, thanks to the folks at Rabobank for calming my nerves. Yeah… I’m sure you Cali natives are laughing pretty hard right now. OK, no buildings collapsed and there were no cracks i n the ground, but I have to admit, it was a little scary when the building shook for like 10 minutes (well, probably closer to 10 seconds – but it felt like a lot longer!).

n the ground, but I have to admit, it was a little scary when the building shook for like 10 minutes (well, probably closer to 10 seconds – but it felt like a lot longer!).

While not a life-changing experience, it sure got me thinking. The obvious first thought was never to move to California. But, more relevant, the Gonzonian in me immediately drew a parallel to the shaky ground we’re experiencing in banking. Fourth quarter earnings were downright ugly as write-offs and large provisions continued to hit the bottom line.

Unfortunately, the bad news may be just beginning with fears of recession looming. In fact, we may be in the first of several years during which the pencil sharpening and turnip blood-squeezing are front and center activities. And we all know what happens during earnings crunches – cost cutting gets more top of mind than ever. This was sure evident in 2007 as quotes like, “Isn’t Folgers just as good as Starbucks?” and, “I think we can decorate the admin garage just fine for the Christmas party!” were commonplace.

I felt the pressure first hand by spending countless, mind-numbing hours buried in multi-addendum contracts and mulling over massive spreadsheets looking for ways to save my clients a buck or two. This definitely gave me a new appreciation for Steve Williams’ so called “Diggers.” From Steve’s article, “A clear sign of a digger is someone who treats the bank operating expenses like they were a wad of Franklins stuffed in their own wallet.” You gotta love these folks.

I suppose each of us has a little “digger” blood. Looking back, the digger in me found some fairly low hanging fruit ripe for the picking in technology and services contracts/bills on the vendor side. Granted, some of the savings may not be obvious at first, but there are savings to realize if you dig deep enough.

Opportunities are definitely out there for financial institutions with their vendors. In fact, many costs have declined significantly, especially in the high growth payments area. Identifying the low hanging fruit is sometimes easier said than done. What follows are some tricks of the trade I’ve learned over the years in identifying these opportunities. I have to admit, I’m not the most organized person in this world, and looking around Gonzo HQ… being organized is not the Gonzo persona. However, organization can be the first line of defense against out friends from the vendor community who usually mean well but aren’t always exactly, um, proactive in pointing out how banks can reduce their bills.

I have to admit, I’m not the most organized person in this world, and looking around Gonzo HQ… being organized is not the Gonzo persona. However, organization can be the first line of defense against out friends from the vendor community who usually mean well but aren’t always exactly, um, proactive in pointing out how banks can reduce their bills.

Get Organized

Questions to think about when getting organized include:

Negotiate

Once organized, it’s time to start diggin’. So, where to begin? Start by reviewing those contracts that are due for renewal in the next few years. Also, it’s important to focus on major contracts that represent large expenditures and show a real opportunity to get lower unit prices with a fairly short remaining term (e.g., core, EFT, telecom, item processing/statements, Internet banking/bill pay). Once the prime candidates are selected, there are a few options:

Down and Out

This is the typical vendor renegotiation ploy to lower costs by extending the term. Think back to the last visit from your vendor. You may have heard something like this: “Costs continue to rise; the time to renew is now. We can lock in your costs for another five years.”

What can be tough to know is where costs have gone since the last negotiation. Unfortunately, depending on the product, market prices are all over the board with some staying flat and others decreasing by double digits. Don’t think that just because a vendor pulls out 30% from the current run rate, it’s a good deal.

That’s when knowing the market comes into play. There are a few ways to obtain the knowledge. Of course, hiring an expert that has the experience is probably the fastest and easiest. For those who don’t have the deep pockets to hire consultants, talk with other financial institutions. Most will give you objective feedback. Also, there are some blogs out there with good information. The point is to do your homework before signing on the dotted line.

RFP

Another option is to go through a more formal process. Nothing beats a good old fashioned RFP process to get the vendor’s attention and also get a feel for other products in the marketplace. The challenge can be the amount of time and resources needed to do it right. To limit resources, many of my clients choose an RFP-lite process that can accomplish the same results.

Regardless, an RFP process is time consuming. However, making this investment can yield a high payback in the end. The key is to make sure the vendor knows you’re serious.

Products

Some of the highest vendor costs can be avoided or at least decreased simply by pushing a lower cost alternative or deploying technology in a particular manner.

E-statements

Going down the list, there’s a good chance that one of the higher ticket items is statement processing… mostly related to printing and postage. The idea of eliminating these costs seems to be basic, right? For the life of me, I can’t understand why there isn’t more e-statement penetration out there. It’s funny, there’s all this talk about mobile banking and online account opening, yet we can’t get e-statements right.

The excuse I hear is “customers want a paper record of their transactions,” and I guess there is some merit there. Remember, that was the same excuse we heard for returning checks but it worked itself out, especially when banks started charging for the service. That’s what the mobile phone providers have done with their statements and had great success.

The other piece of the puzzle is the technology. Unfortunately, many vendors limit the motivation for banks to go “green” with pricing barriers. Many are charging on a per statement basis and some even on a per page basis. They want to own the archive and hold the bank hostage. Breaking it down, the needs are not that complicated:

Sounds simple, but everyone seems to want a little piece of the action. If possible, work with your vendors directly and develop an in-house strategy to avoid click charges and stay in control

Bill Pay

Another high ticket item is bill pay. This one is especially important as growth raises these costs higher and higher. Many banks continue to push the service hoping to build a loyal customer base. Yet, the correlation of bill pay to loyalty has never been established and, more importantly, no profitability analysis has ever been run. Let’s face it, bill pay is expensive and without a profit justification, it makes no sense to offer it, especially for free.

For those who want to fit the mold and offer bill pay regardless of profitability, there are a few ways to reduce your costs.

Unlike my experience in California this week, we can see the shaky economic future coming. Preparation will be crucial in dealing with the downturn. For most GonzoBankers some preparation has already begun… recent internal budget cuts make that point crystal clear. Tightening even further will be the key to weathering the upcoming storm. Coach Knight said it the best: “The key is not the ‘will to win’ … everybody has that. It is the will to prepare to win that is important.”

Unlike my experience in California this week, we can see the shaky economic future coming. Preparation will be crucial in dealing with the downturn. For most GonzoBankers some preparation has already begun… recent internal budget cuts make that point crystal clear. Tightening even further will be the key to weathering the upcoming storm. Coach Knight said it the best: “The key is not the ‘will to win’ … everybody has that. It is the will to prepare to win that is important.”