The historic deposit runs on several niche regional banks have woken up bankers and their investors, regulators and policymakers to the threats that liquidity flows place on the entire industry. Taking a step back and looking into reported financial data for Q1 2023, a few key insights appear:

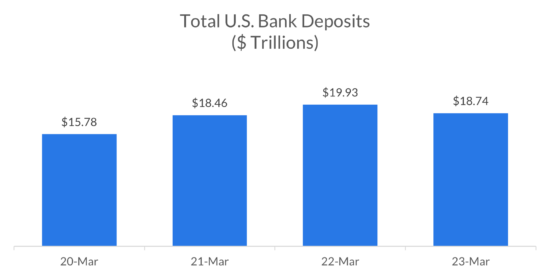

The banking industry lost a remarkable $1.1 trillion or 5.5% of total deposits from March 31, 2022, to March 31, 2023 – obviously, a pace that is dangerous to liquidity if it continues. Where did the money go?

Interestingly, even with these outflows, bank deposits are still markedly higher than they were when the COVID crisis began and liquidity flooded into the industry.

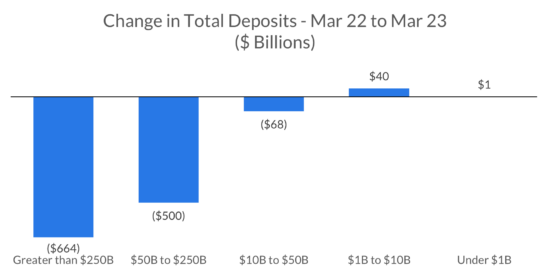

Most of the panicked headlines seem to indicate that funds have been flowing freely from small banks into too-big-to-fail players. However, here are a few counterintuitive data points:

For the regional banks, a combination of major failures coupled with large businesses moving money for risk management and investment purposes remains the major cause of deposit outflows. Retail and small business deposits do not appear to be major sources of outflow.

For the large banks, the factors of reduced personal savings and flows into higher-yielding treasury investment and bank offerings are likely why funds are flowing out.

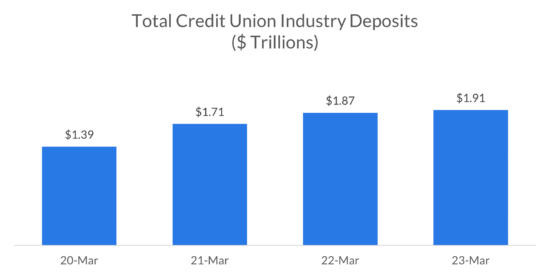

Given that deposit risk has primarily been centered around large accounts and uninsured exposure, it may be no surprise that credit unions have done quite well through this crisis in retaining consumer deposits. Because less than 9% of their deposits are uninsured, members of credit unions are more at risk of moving for yield vs. moving for safety and soundness concerns.

Going forward, Cornerstone sees banks working overtime to preserve their deposits and essentially manage liquidity risk on a daily basis. Key actions leaders should be taking include:

The massive influx of deposits after COVID tended to lull the banking industry into a slumber when it came to liquidity, just in time for a historic shift in rates that shook the walls of all banks. Now liquidity is the lifeblood of banking and leaders are working overtime to defend their performance and relevancy in a new financial world.

Excellent article, Tristan!