A striking dynamic has occurred among regional and community banks over the past 10 years: their assets have grown much faster than their maturity.

Amidst frenetic M&A activity and vibrant organic growth, the typical midsize bank has doubled or tripled its size from a decade ago. However, operationally these same banks have merely held things together with hard work and hustle versus truly retooling their organizations for scale.

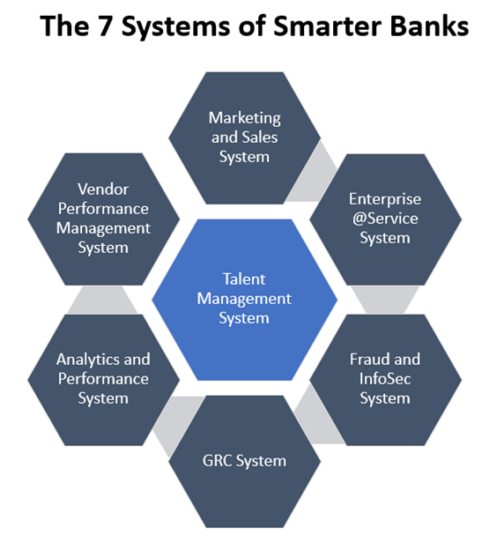

In a previous Gonzo post I wrote how the leaders of Smarter Banks need to replace daily hustle with a focus on building scalable “systems.” Bank boards and executives often confuse “systems” to mean technology, but let’s clarify with broader definitions from the Cambridge Dictionary: A system is “a set of connected things that operate together” and “a way of doing things.”

Through the remainder of this decade, banks that truly distinguish themselves as high performers will get serious about building digitally powered, data-driven and repeatable systems that enable them to scale to more “hyper-efficient” levels. Building great systems requires design thinking, cultural change and a ton of hard work.

As opposed to the stovepipes of a traditional bank organization, the systems of Smarter Banks drive effectiveness horizontally across the organization. They require new standard processes, habits and accountabilities for both lines of business and supporting functions. So, GonzoBankers, imagine a growing bank that has moved past the chaos of daily fire drills, and let’s take a tour of the seven critical systems that Smarter Banks will leverage in the future.

This system will intelligently collect the top-of-funnel marketing automation and social media activity with a data-driven enterprise lead and sales management capabilities. The entire organization will have transparency into the business development pipeline, and various workflows will be triggered by the role to drive leads and cross-sell into closed deals. Additionally, individual and team accountability will be sky-high given the real-time dashboards that make this sales system visible to leadership.

This system may be connected to a bank’s CRM platform or built with service desk tools powered with robotic process automation. The focus here is that every customer service request gets captured as a “service” case that is tracked and fulfilled through a workflow platform. Every team member can see the status of any customer service item, and automation and data integrations help the bank fulfill requests with Amazon-like speed. Importantly, service levels can improve continually because of the learnings that come from the data this system spits out to leaders.

Like the @Service platform, this system ensures that all suspicious fraud and security breach cases are captured in one system that is powered by integrating transactional and behavioral activity across the enterprise and married with external information (e.g., device IP address). The system becomes more robust over time as pattern analytics are employed early to stop the bad guys in their tracks.

Ugh! Every bank leader seems to hate governance, risk and compliance requirements and laments, “Why can’t we run the business without all this red tape?” Well, sorry ladies and gents, we live in the real world, and scaled banking organizations must accept risk/compliance mandates and figure out how to address them effectively. A GRC platform becomes the true north for risk owners across the organization to maintain risk assessments, controls and monitoring in a common accessible format.

The key success factor for GRC systems is to avoid overengineering to the point where business owners reject them as too complicated. A GRC system is more than a pure audit system. It is an active risk program integrated across the bank where owners take charge of their assigned risk management activities.

Smarter Banks will drive daily/weekly/monthly activities and achieve high performance with a standardized “dashboard culture” where managers own benchmarked key performance indicators (KPIs) and key risk indicators (KRIs). In an integrated performance system, all managers leverage a “single version of the truth” via a reliable and constantly cleansed enterprise data warehouse.

Additionally, Smarter Banks deploy a formal cadre of “data stewards” with deep knowledge of various bank data models that provide smart analytics in a consistent, professional fashion across the organization.

While regulatory requirements around third-party vendor management have grown, vendor management systems in banking have been narrowly focused on compliance. Smarter Banks will use integrated vendor performance management to drive vendor business outcomes, lower costs and manage the risk and compliance aspects of the relationship. This system should ensure ongoing vendor service level agreements and road map releases/enhancement requests are rigorously managed and contracts are reviewed and negotiated with lead times that guarantee maximum negotiating leverage.

A robust vendor performance management system also leverages proprietary benchmark data to ensure negotiated costs are competitive and aligned with the bank’s future growth plans. At most banks, vendors act as the “supply chain” that delivers customer experience and operating efficiency. For this reason, Smarter Banks will step up their vendor management game.

One could argue that a strong talent management system will be the critical discipline that guarantees Smarter Banks’ success. Forget the outdated view of the HR department managing payroll and “personnel” issues. A Smarter Bank’s talent management system links HR professionals and business leaders in an integrated approach to recruiting, onboarding, developing, managing performance and creating future leaders within the organization.

Key strategic disciplines like workforce planning, personality profiling, talent analytics, employee engagement and workplace experience help Smarter Banks turn talent and culture into a competitive weapon. Smarter Bank leaders and employees will not look the same as they did at banks over the past 20 years, and a strong talent management system will be needed to drive this transformation of the future workforce.

So, there you have it, GonzoBankers: a suite of systems that can take a bank from today’s chaotic and fragmented operations to a smart, scaled future. How does your bank stack up? Give yourself a grade on each of these systems and then get busy filling the gaps to build a Smarter Bank.

Steve Williams is a founder and chief executive officer of Cornerstone Advisors. Tune in to Steve’s Plugged In podcast and follow him on LinkedIn and X.

What seems to be missing from this list is an engagement platform. Bringing new customers in the door can be key to growth if they become deep and profitable relationships. Banks struggle with this, and Neobanks do, too. Account openers find it difficult to adopt services and give up. A heck of a lot of checking account openers close their accounts within the first year (after banks spent hundreds of dollars to acquire them). That’s why banks bribe people with cash bonus offers. Investing in making it easier for customers to engage is far more efficient.